However, on a year to year basis, the rate of decline is at best stabilising:

We're not out of the woods just yet, not by any means. On the other hand external demand is just one part of a larger picture, and with bank lending increasing at a good clip and borrowing costs trending down, there's some hope that at the very least we'll see a bottom form for the economy in the second quarter.

Moving on to my ongoing saga in determining a good forecasting model for exports, recall in my last external trade post I constructed 5 different models and used them to predict March exports. Model selection procedures suggested the best choices were to either seasonally adjust the trade data prior to running the regression, or directly modelling the seasonal effect within the regression.

How did these models do? The predictions:

1. Baseline: RM33832; Range: RM40.0-27.6b

2. ARMA: RM44618; Range: RM51.5-37.7b

3. Structural ARMA: RM33712; Range: RM39.9-27.5b

4. Seasonally adjusted: RM39792*; Range: RM44.7*-34.9*b

5. Seasonal Effect: RM43861; Range: RM49.4-38.3b

And actual March exports were RM43645 (RM42778 seasonally adjusted).

Models 1 and 3 are completely off the reservation - in retrospect, not accounting for seasonal effects means these models will always have large errors in months when the seasonal effect is strong. Models 2 is very close and 4 is close enough, so I'll keep evaluating those.

Model 5 however is a spectacular RM200 million within the preliminary figure (trade data is always revised the next month), so that's the obvious winner this month.

Here's the April forecast:

2. ARMA: RM44555; Range: RM51.3-37.8b

4. Seasonally adjusted: RM37561*; Range: RM42.2*-32.9*b

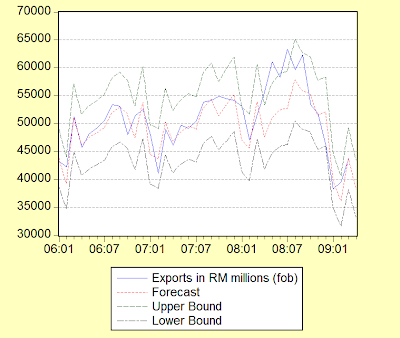

5. Seasonal Effect: RM38293; Range: RM43.4-33.2b (shown below)

Note that Models 4 and 5 are predicting a further downturn in external trade, while Model 2 suggests exports will remain flat from March. If this does happen, I'd think that we might have turned the corner, at least as far as external demand was concerned. An April disappointment on the other hand suggests that the bounce in exports and potentially IPI would be due to inventory rebuilding within the global supply chain, rather than a more sustainable increase in global final demand.

No comments:

Post a Comment