I’m not going to spend much time on this post, as I’m still looking at yesterday’s GDP release.

Suffice to say that there’s not been much movement in the price level this year – in fact, the CPI level has been absolutely flat for the last four months (index numbers; 2010=100):

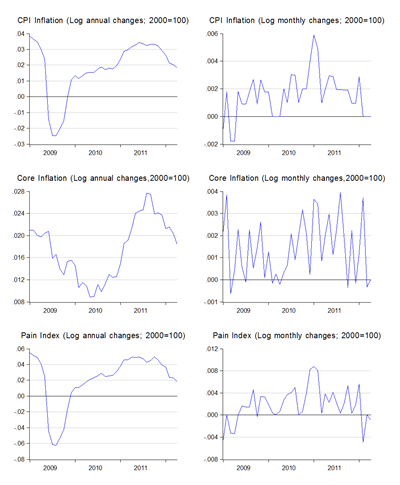

As a result, the inflation metrics have all continued slowing (log annual and monthly changes; 2000=100):

Even the Pain index shows prices increasing at a rate below 2% – this is the first time that all three indexes are showing price increases below 2% since mid-2010. What’s interesting is that while transport costs have gone up (no idea where that came from), food prices came down to almost the same degree.

Of more immediate import is that the core numbers have been flat for the last couple of months, indicating little demand side price pressure. That undercuts somewhat the idea of a tightening bias for monetary policy going into the end of the year, especially with the heightened uncertainty surrounding global markets at the moment. Commodity prices have come off in recent weeks, which means little supply side pressure as well.

I don’t think on the whole though, that there’s a strong argument for monetary easing. Even with the prudential lending measures in place since the beginning of the year, credit growth is still fairly elevated at over 11%. GDP growth for 1Q 2o12 was still much better than our regional peers, and we still have all those big infra projects coming on stream in 2H2012.

Technical Notes:

April 2012 Consumer Price Index report from the Department of Statistics

No comments:

Post a Comment