Today’s report on Malaysia’s industrial production in April underscores the weak start to the second quarter from slowing external trade (log annual and monthly changes; seasonally adjusted):

On a seasonally adjusted basis, annual growth was a little better than March, mainly from higher manufacturing output. Monthly growth is however showing lower real output.

What’s driving growth is very much domestic-oriented production (log annual and monthly changes; seasonally adjusted; data up to March):

Along with the surprising strength of construction related activities last quarter, it’s been construction related industrial output that’s helped boost output, particularly fabricated metals (log annual and monthly changes; seasonally adjusted; data up to March):

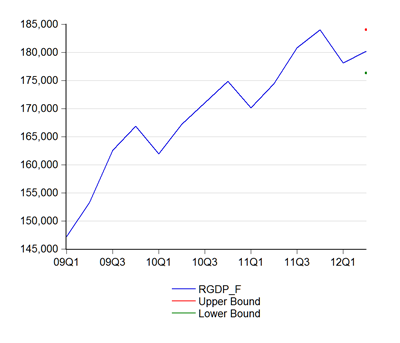

Nevertheless, a IPI based forecast of 2Q GDP suggests momentum will slow (RM billions; 2005=100):

The point forecast is at RM180.1 billion, or a year-on-year increase of about 3.3%. The quarterly SAAR on the other hand suggests the economy will shrink by 1.3%, so the signal’s kinda mixed right now. Better results for May would improve the prognosis, but the news flow over May has been mostly discouraging. On the other hand, the domestic economy is still pretty robust, so you can’t really discount a growth surprise.

Technical Notes:

April 2012 Industrial Production Report from the Department of Statistics (warning: pdf link)

MRT will kick in soon...wats the impact?The project uses lots of steel bars,cement,sand n aggregates...possibly 30% of cost.Only problem is project too over inflated with huge margins thus actual cost is only 70% of awards For undergrnd only 50%.Still its RM11 bil of works in 4 years n RM3.5 bil demand for basic material.Is it big enuff to offset exports downturn?

ReplyDeleteIt's not just MRT, it's the LRT extension, Warisan, KLFID, and Iskandar, not to mention all the housing projects kicking off. First thing I'd look for is an acceleration in the building materials cost index and the PPI - those huge margins are likely to disappear pretty fast. Whether that will turn up in consumer inflation, I don't know, though I suspect it will.

ReplyDeleteAs far as GDP growth is concerned, yes, it should more than offset slowing trade growth.

How did you get the export/import oriented production?

ReplyDeleteHafiz, DOS doesn't appear to have them, but BNM does include them in the MSB.

ReplyDeleteThe BNM MSB lags by 2 or 3 weeks.

ReplyDeleteDoes that mean you manually filled in the necessary components into MSB version of the IPI to get?

I've looked into the MSB IPI and the differentiation between exports and imports isn't so clean. For instance, electronics is classed as export-oriented but I don't know how much is exported for instance. Would this be a problem?

Nah, didn't do that. If you look at the preamble to the chart, I specifically put in "data up to March".

ReplyDeleteAnd yeah, the demarcation is probably problematical.