Interesting video on BBC magazine:

Author David Wolman says cash is dirty, expensive and should just be pushed off the cliff.

He describes his new book, "The End of Money: Counterfeiters, Preachers, Techies, Dreamers- And The Coming Cashless Society," as a eulogy to these rectangular slips of paper and little metal disks.

But while writing the book, and going without cash for a year, Wolman found that the future of money is about much more than just dollars and cents.

The link goes to a short video (the Beeb makes it hard for others to embed their video). It’s not exactly world breaking news – Japan has had a mobile payment system based on phones for something like a decade now, and cashless payments are popular in Africa (Kenya alone has 20 million users). But it looks like the movement is gaining critical mass.

Central banks and legitimate businesses generally dislike cash because it’s bulky, requires security, and is expensive to produce (coins for instance cost more than paper notes).

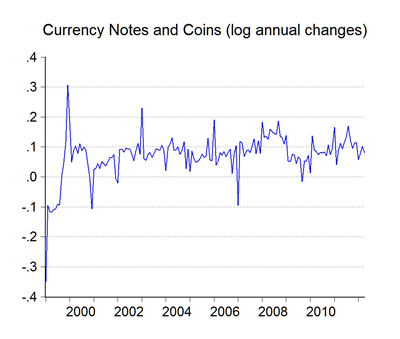

How much cash is there in Malaysia? As of April, the figure stands at about RM54.3 billion, and BNM grows the amount by on average about 8.0% per annum (log annual changes):

More interesting is that the ratio to the money stock has fallen steadily over the years:

Since 2007, the ratio to M2 has averaged just 4.5%; by comparison cash amounted to around 25% of the money stock in 1969 and 12% as late as 1990. You can already use Touch’n’Go for many small payments; MEPS cash is another channel, though I don’t know how popular that is. In any case, slowly but surely, we’re already heading towards becoming a cashless society.

If cashless society is something possible, direct use of gold as currency might be rejuvenated. What's you take on that.

ReplyDeleteZaki, I don't see the point. Going cashless doesn't resolve the fundamental problem of a gold-based monetary system, which is that the supply of gold is completely divorced from the level and pace of economic activity.

ReplyDeleteIf anything, if I may interject, a completely cashless society will lead to a stronger fiat arrangement.

ReplyDeleteWith paper/coin-currency, there is a cost to printing and minting however negligible it is these days.

With complete cashless system and hence fully electronic system, what is the cost of money/credit creation?

The only limit is the bit size of the system, which is large enough right now that it is essentially limitless. The closest thing to a limit to money supply is the demand for money in the economy.

So, that'a a complete opposite of gold with its problem of severe scarcity, regardless of money demand.