Not that it hasn't been anything but good news. All the growth numbers have turned up on a year to year basis (log annual changes):

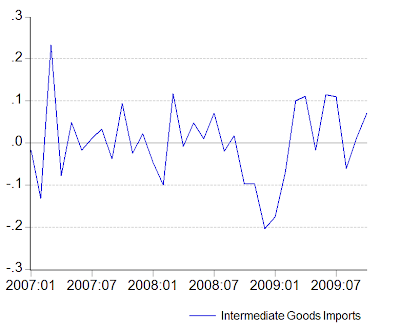

...as well as on a monthly basis, except for electricity output (log monthly changes):

But this data is highly coloured by a pretty strong "base" effect, first from Ramadhan being a month later last year, as well as the after effects of Ramadhan this year. In any case, I'm dubious of assigning too much weight on growth statistics around turning points of a business cycle, much less a sharp recession such as we have just witnessed. It's far more important to focus on the levels, as those will give you a better idea of real changes in activity:

But even on that basis, things are looking good. Mining output has stagnated - but then, it was never a threat to increase anyway. Electricity output has more or less been back on its long term trend since more than six months ago (around Apr-May), which heralded recovery in other indicators by at least a full quarter. Manufacturing is still (just) in the recovery phase, but close to the output levels last seen in 2007-2008.

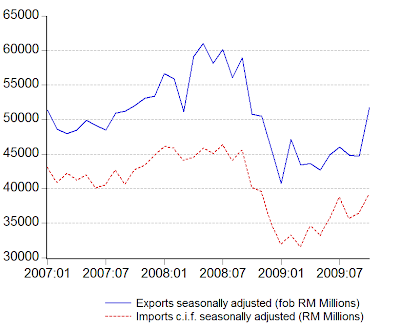

So I'd say industrial production is essentially almost fully recovered from the downturn. The key question here is - are we going to see further growth (in levels, mind, not ratios)? I don't have any answers. The "base" effect means that there's going to be good news in term of growth numbers for some time to come (up to at least Feb-Mar 2010), but that doesn't mean Malaysia is making any real progress. The prognosis depends a great deal on external demand - so far, it's domestic manufacturing output that has been propping up the manufacturing index:

Technical Notes

IPI Report sourced from DOS.