This actually came out last week, but I’ve been too bum lazy to touch on it. But the results, as preliminary as they are, yield some pretty interesting information – and not just for the population numbers:

Thursday, December 30, 2010

Tuesday, December 28, 2010

Department of “Duh”: Corruption Not Good For Growth

Believe it or not, the empirical evidence on the effect of corruption on economic growth isn't clear. The same can also be said for democracy and democratic institutions. In a new article on VoxEU, Campos and Dimova review the literature (excerpts):

Corruption does sand the wheels of growth

Does corruption sand or grease the wheels of economic growth? This column reviews recent research that uses meta-analysis techniques to try to provide more concrete answers to this old-age question. From a unique, comprehensive data base of 460 estimates of the impact of corruption on growth from 41 studies, the main conclusion that emerges is that there is little support for the “greasing the wheels” hypothesis…

Monday, December 27, 2010

The Dark Side Of Gold

Bloomberg/Businessweek has been running a series of articles over the past couple of weeks looking at the human costs of gold’s popularity. They’ve now brought together these articles and some associated graphics and videos on a single portal.

I’m not going to comment on this, but worth a look if you’re interested in the gold market.

Thursday, December 23, 2010

Measuring Inflation Revisited

A little over six months ago, there was quite a bit of debate on the adequacy of Malaysia’s inflation measures (see here and here). For many people, the official estimates of inflation didn’t seem to jive with their on-the-street experiences. I contended (and still believe) that its partly a perception issue, partly a factor of slow income growth (relative to inflation and productivity) and partly a problem of income inequality.

But before going further, what prompted this post was an article in Slate (excerpts):

Do We Need Google To Measure Inflation?

…Each month, the Bureau of Labor Statistics goes through all that hassle because knowing the rate of inflation is such an important measure of economic health—and it's important to the government's own budget…

But just because the government expends so much energy determining the rate of inflation does not mean it is tallying it in the smartest or most accurate way. The reigning methodology is, well, clunky…[and] archaic, given that we live in the Internet age. Prices are easily available online and a lot of shopping happens on the Web rather than in stores.

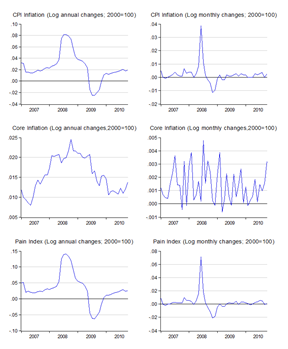

November 2010 CPI

After last month’s “exciting” little excursion due to the hike in tobacco excise duty, things have settled down on the inflation front. Even with that, increases in the price level have steadied at just under an annualised 2.0% since the middle of the year (log annual and monthly changes):

Wednesday, December 22, 2010

October 2010 Economic Indicators

No question that things are looking up. Today’s economic indicators report from the Department of Statistics underscores the argument that 3Q 2010 was at worse a pause in growth:

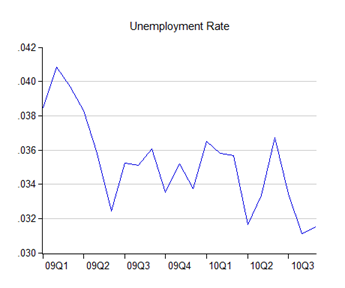

October 2010 Employment Report

After the pause in 3Q 2010, it looks as if the Malaysian economy is accelerating again. So much for labour supply constraints…employment has hit an all time high in absolute terms (‘000):

The Typology Of Capital Controls

Menzie Chinn at Econbrowser sends us to the World Economic Forum’s Financial Development Report 2010, which has a nice broad summary of capital control tools and their strengths and weaknesses. I won’t reproduce the graphic (that’s a breach of netiquette), so head on over to Econbrowser if you’re interested in the subject.

Worth a glance, since capital controls are the flavour of the day, and likely to remain so for some while.

3Q 2010 Government Revenue and Expenditure

Well, I’m back from my break, and catching up on events. In the meantime I’ll be getting rid of the backlog of posts that I’ve been meaning to do.

First up is 3Q numbers on the Federal Government’s expenditure and revenue. As intimated by the 3Q GDP numbers, there’s been further consolidation in government spending (sample: 2000:1 to 2010:3):

Friday, December 10, 2010

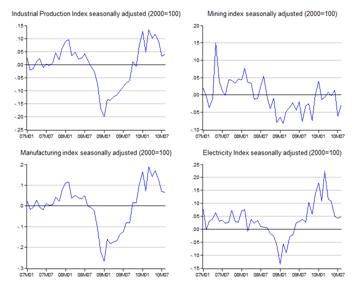

Oct 2010 Industrial Production: Better Days

The report for this October’s industrial production indexes gives grounds for some optimism. You’re not going to see it from the annual growth percentages though (log annual changes; seasonally adjusted):

Thursday, December 9, 2010

Posting In December

I’ll be on leave and travelling for a couple of weeks, so posts this week and next will be pretty sporadic (as you’ve probably already noticed). There’s a few things that need covering – government 3Q numbers for example – but these posts will probably be late, and queued up, rather than real time.

I’m hoping to resume posting regularly after the 20th. In the meantime, Happy New Year to all Muslims.

Monday, December 6, 2010

Scott Sumner On Gold

This is the first commentary on the gold market that actually made sense to me:

...As far as I know there is really only one respectable argument that inflation expectations are approaching dangerous levels in the US. We know that 5 year TIPS spreads are low, and we know that the near to medium term consensus inflation forecast is low. We know actual inflation is low and falling. But then there are those gold prices.

I’ve never been convinced that the high gold prices were signaling US inflation fears…

...I seem to recall someone pointing out that Asian gold demand couldn’t be the problem, because the totals were fairly stable. But that confuses shifts in demand with movements along a demand curve. When world output is falling, it is necessarily true that total quantity demand will also fall. If you confuse demand and quantity demanded, it will never look like higher demand is pushing up prices when output is declining...

Sunday, December 5, 2010

New Economic Model Part 2

I haven’t had the time to read it yet (watch for an analysis later this week), but the NEM Part 2 Document was launched on Friday, and can be downloaded here.

Round 2 Subsidy Rationalisation

I almost missed this one (been out of town the whole day):

New subsidy cuts to save RM1.2bil

PUTRAJAYA: The prices of Ron95 and diesel have increased by 5sen per litre while liquefied petroleum gas (LPG) and sugar will go up by 5 sen per kg and 20sen per kg respectively.

Minister in the Prime Minister’s Department Datuk Seri Idris Jala said that the price hikes, effective midnight yesterday, were expected to result in a total savings of RM1.18bil.

He said the savings would be channelled towards the Government Transformation Programme including improving the urban transportation network, rural basic infrastructure and roads, education and efforts to combat crime.

Saturday, December 4, 2010

Oct 2010 External Trade

I expected a bounce, but not quite as good as this. October’s seasonally adjusted export numbers showed a monthly increase for the first time in six months (log annual and monthly changes; seasonally adjusted):

Friday, December 3, 2010

IMF: No Real Estate Bubbles In China and Hong Kong

Just a quickie note, for those who are interested. Two new IMF working papers investigate China’s and Hong Kong’s property markets. Their conclusion is that there are and will continue to be a structural and fundamental basis for the rapid price increases seen in both countries, though some parts of China’s high end property market appear overvalued (abstracts):

Are House Prices Rising Too Fast in China?

Ahuja, Ashvin, and Lillian Cheung, Han Gaofeng, Nathaniel John Porter, & Zhang WenlangSharp increase in house prices combined with the extraordinary Chinese lending growth during 2009 has led to concerns of an emerging real estate bubble. We find that, for China as a whole, the current levels of house prices do not seem significantly higher than would be justified by underlying fundamentals. However, there are signs of overvaluation in some cities’ mass-market and luxury segments. Unlike advanced economies before 2007-8, prices have tended to correct frequently in China. Given persistently low real interest rates, lack of alternative investment and mortgage-to-GDP trend, rapid property price growth in China has, and will continue to have, a structural driver.

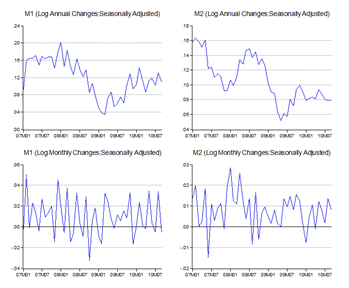

Oct 2010 Monetary Conditions Update

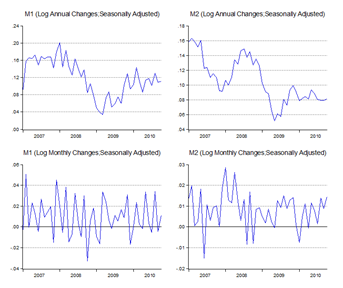

Fascinating things going on in the monetary side of the economy, though you won’t know it from the money supply data (log annual and monthly changes; seasonally adjusted):

Thursday, December 2, 2010

Ranking Kuala Lumpur: Pre- and Post-Recession

Via the Economist’s Free Exchange blog, The Brookings Institution’s Global MetroMonitor tracks performance in major cities around the world:

In the current table of rankings(2009-2010), KL ranks 23rd out of 150, up from 37th during the recession period (2007-2009), but down from 17th before the recession (1993-2007).

Get the KL page here (warning: pdf link), or the full report here.

Just When You Thought You’d Seen Everything…

This is so funny, I had to share (click the pic for a larger version):

In case you’re wondering, that’s not the title page…that’s the whole paper! And read the reviewer’s comments at the bottom for an extra laugh!

[H/T Brad DeLong]

Wednesday, December 1, 2010

2009 State GDP

Just a quick note – I’m a little under the weather from a cold, so I’m taking it easy for the next few days.

This report was actually released last week, and almost brings us up to date on state level GDP. If you recall, DOS started releasing state GDP data about this time last year, starting with 2005-2006 data. The latest numbers report 2009 GDP figures by state.

I haven’t gone so far as to analyse any of the numbers (the October MSB release has priority), but there don’t appear to be too many surprises here – Penang was the worst hit by the recession, due to its high exposure to export manufacturing, while KL continued growing because of its high concentration of service industries.

Technical Notes:

GDP Report By State from the Department of Statistics

Monday, November 29, 2010

Revisiting Vision 2020 (Updated)

This morning I attended a speech by Tun Mahathir on the Vision 2020 that he introduced way back in 1991. The event was organised by the Institute of Marketing Malaysia (freebie plug here) on the subject of Vision 2020 and what progress we’ve made in achieving its goals.

The grand old man of Malaysian politics was in fine fettle, cracking jokes, most of which were at his own expense (like, having to reread the Vision 2020 document because he couldn’t remember what was in it, and making constant references to mega projects).

I want to touch on a few things he mentioned in his speech, some good, some not so much.

October 2010 CPI: The Price Of Sin

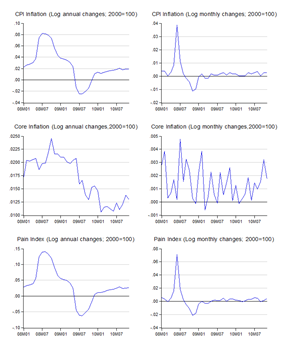

Last week’s report on consumer prices showed inflation jumping 1.9% in log terms (log annual and monthly changes; 2000=100):

In a reversal of the usual case, core prices (ex. food and transport) rose faster than the pain index (food and transport prices).

Sunday, November 28, 2010

Malaysian Property: Bubbles AND Gluts?

Via the Malaysian Insider, Dr Dzulkefly Ahmad of opposition PAS talks about the property bubble (emphasis added):

Of Property Overhang and Mounting Household Debt

Property Overhang as reported by Napic (National Property Informational Centre) for the third quarter of last year was supposedly a cause for alarm. Then there was an overhang of 20,286 residential, 5,450 shop and 619 industrial units worth a whopping RM5.3 billion.

Of the 6,401 new residential units launched during the third quarter, which was a far cry from the 14,588 units launched in the previous corresponding quarter, only 20.2% found buyers…

Wednesday, November 24, 2010

Monetary Policy Explained For The Layman

Capital Controls For Malaysia? Not Yet

Charles Santiago of the DAP is calling for capital controls:

Govt urged to consider capital controls

KUALA LUMPUR: An Opposition MP has urged the Government to view capital controls as a protective policy to insulate the local economy from destabilisation.

Charles Santiago (DAP-Klang) said China, Indonesia, Thailand, Brazil, South Korea and other developing countries had recently adopted such a policy.

"Capital controls should be viewed as a policy response to regulate speculative capital, in order to protect the domestic economy from volatile capital flows.

Tuesday, November 23, 2010

3Q 2010 GDP: Disappointing

So much for optimism. Yesterday’s report from DOS had 3Q real GDP (RM141.9b) right on the number predicted by the IPI (RM141.8b), which means the economy actually shrank. Not as bad as Singapore’s, but still…

The growth numbers weren’t quite as bad as I forecasted (though still way below the consensus estimate of 5.7%) with the GDP up 5.3% on the year and –2.6% on the quarter, but that’s because of something negative not positive, as 2Q 2010 real GDP was also revised downwards by RM30 million.

So, what happened? Softening external demand is of course part of the story, but believe it or not, on the demand side the second biggest marginal contributor to the drop in GDP is…public spending!

Monday, November 22, 2010

Can You Borrow Your Way Out Of A Recession?

As a matter of fact, it’s the economic orthodoxy. The insight that eludes critics of debt-financed government spending as a policy tool, is that they fall into the trap of the fallacy of composition – just because saving is good for an individual in times of uncertainty, doesn’t mean it’s good for society in aggregate.

Similarly, if individuals and companies are averse to spending, doesn’t mean it’s good for the economy if the government doesn’t do it too. Of course, making sure that government spending is effective and supports nominal spending and economic recovery remains a thorny issue, as is the level of sustainable debt that a country can bear over the long term. On that basis, a reliance on monetary policy is generally preferred – but that’s hard to do near the zero interest rate boundary.

But often, the debate shouldn’t even have to go that far – I’ve always been of the opinion that it’s relative debt (relative to income and wealth), and not absolute debt that matters. And you really shouldn’t talk about debt without talking about its inverse, wealth and income.

So this article just about pushes all the wrong buttons for me:

All those IOUs stashed under America’s carpet

Andy MukherjeeNOV 22 — The most accurate depiction of the way United States policy makers have dealt with the unsustainable, unserviceable debt that caused the financial crisis of 2008 has to be this: “Bury that putrid stuff under a carpet of cash and hope that no one notices.” …

Sept 2010 Economic Indicators

I’m still waiting on the GDP announcement that’s supposed to be due today, but the economic indicators report from DOS this morning underlines the case that economic growth will be marginal (at least on a q-o-q basis):

Sept 2010 Employment Report

Just as I thought might happen, the Census’ effect on employment (from temporary employment caused by Census 2010) has finally died away in September, though you won’t really see it in the unemployment rate:

Friday, November 19, 2010

3Q GDP Estimates: All Over The Place

Apparently the consensus is that there is no consensus:

Economists’ M'sia Q3 GDP growth estimates vary widely

KUALA LUMPUR: Uncertainty over how the economy performed in the third quarter has resulted in a wide disparity in economists' estimates ahead of the official announcement on Monday.

Economists have projected that the gross domestic product (GDP) for the third quarter could come in at between 3.5% and 7.8%, while the forecast in a poll of 11 economists by Bloomberg averaged 5.7%…

The announcement is due on Monday.

I did a simple regression model to forecast 3Q 2010 GDP based on the Aug-Sept IPI, which yielded a point forecast of RM141.7 billion, which amounts to 5.2% growth y-o-y and –3.1% growth q-o-q (saar). Note that anything under about 5.7% (ironically, the average forecast) implies that the economy actually shrank in 3Q 2010 on a seasonally adjusted basis.

I’m thinking (hoping rather), that BNM’s confidence that domestic demand is holding up might push growth beyond that implied by manufacturing alone. If that’s the case, I’ll need a better specified forecast model – but that would be a nice problem to have.

Wednesday, November 17, 2010

Selamat Hari Raya Eid-al Adha

Wishing all a safe and happy day, and a prayer for the safe return of pilgrims from the Holy land.

Monday, November 15, 2010

Currency Wars Part VIII: The Currency Rap

Ryan Avent sends us to Next Media Animation, to explain global trade and currency imbalances:

If you didn’t understand the Econbrowser post, this is the hip-hop version!

Econbrowser On The G20 Meeting

Menzie Chinn explains, in theoretical terms, about QE2, currency wars and capital controls:

Losing the Battle, Winning the War?

…I have also been thinking about the anger with which the policymakers and economists in the rest-of-the-world (as well as certain US politicians [5]) have greeted QE2 with. In some ways, the fact that they are angry speaks volumes about the effectiveness or ineffectiveness of QE2. (In other words, to criticize QE2 as having no effect, and then to be angry that it is being undertaken, are internally inconsistent views.)

My view is that anger at the US position is currently being driven by an understanding that QE2 has been surprisingly effective at depreciating the dollar, and that the rest-of-the-world has limited scope in countering that depreciation. In a game theoretic context, we usually think of competitive devaluation as a form of the prisoner’s dilemma, where the devalue option dominates the no-devalue option, and both parties end up with a devalued currency, but no net improvement because countries cannot all devalue against each other…

…However, because of the radically different post-recession economic conditions facing the US and China, the payoff matrix has changed. The US gains by allowing the currency to depreciate against the rest-of-the-world, but the Chinese (and to a lesser extent the other BRICs) have competing goals of maintaining rapid growth, high exports, and stable inflation. This point has become apparent as inflation has surged in China. [6] The conflicting goals Chinese policymakers face can be illustrated by reference to the Mundell-Fleming model. (See this post for detail)…

If you want to suss out the policy options that are facing the major economies right now, you could do worse than to read this.

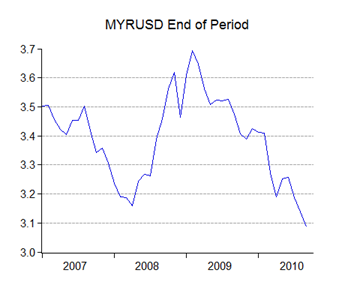

3Q 2010 Exchange Rates Review

This is about a week late but as they say, better late than never.

One of the funny things about the commentary about the Ringgit’s movements is that the focus is almost exclusively on the USD exchange rate. But with total trade with the US averaging just 10% of Malaysia’s total trade over the past year, that gives an incomplete and highly misleading picture of the Malaysia’s trade competitiveness.

Friday, November 12, 2010

BNM Stays On Hold

As expected, BNM stayed pat on the OPR at 2.75% for another meeting. The language of the press statement is about as unenlightening as…well, as a typical economist’s statement (excerpt; hit the link for the full statement):

…The MPC considers the current level of OPR as appropriate and consistent with the latest assessment of the economic growth and inflation prospects. The stance of monetary policy continues to remain accommodative and supportive of economic growth. While domestic financial conditions remain orderly, greater vigilance will be accorded to the potential risks arising from large and volatile capital flows.

Malaysia To World Bank: Help!

As far as I know, this hasn’t been reported locally:

Malaysia Seeks World Bank Help to Cut Spending, Trim Deficit

Nov. 12 (Bloomberg) -- Malaysia will ask the World Bank to help in the country’s efforts to cut government spending as Prime Minister Najib Razak seeks to reduce the budget deficit from a 22-year high.

The nation is asking the Washington-based lender to review all areas of government expenditure, including how state contracts are awarded, to prevent waste from inefficiency, Second Finance Minister Ahmad Husni Hanadzlah said in an interview in Kuala Lumpur yesterday. Malaysia hopes the study will bolster the government’s credibility, he said.

“We just want a third party as a check and balance,” said Ahmad Husni, 58. An annual audit of spending at state agencies has shown “some negative findings and we hope that with the involvement of the World Bank, in the future we can see a clean sheet,” he said.

Waiting On The MPC Meeting? Don’t Bother.

Today marks the last meeting for the Monetary Policy Committee in 2010 (the announcement is due at 6.00pm local, about 10.00am GMT)). Virtually nobody is expecting a further interest rate hike at this juncture as there’s simply no call for it.

Monetary conditions over the past few months have been pretty stable, with maybe a slight concern over heightened loan growth – and even that’s not too far off the reservation. The external outlook continues remains uncertain, even as the Fed prepares for another QE blitz that may result in further cash heading to emerging markets. I’m expecting growth in 3Q GDP to flatline, so further monetary tightening (pace loan growth) isn’t warranted.

So I think this meeting will really be a non-event in terms of the current stance of monetary policy. The only thing of interest this evening is BNM’s take on the future trajectory of monetary policy, particularly what BNM plans to do if portfolio inflows exceeds the bounds BNM is prepared to accept.

As the pace of Ringgit appreciation has slowed down over the past two months, helped along by some judicious intervention, there are less worries that the Ringgit will outrun Malaysia’s economic fundamentals. But it would be interesting to see if there will be any mention of currency intervention or alternative measures that BNM might take, in the event that the Ringgit and Malaysian asset prices continue to rise at an accelerated pace.

Just don’t expect an interest rate increase to be on the menu just yet.

Stiglitz Calling For Capital Controls

As a Nobel prize winner, Joseph Stiglitz’s views have some weight. Now he considers capital controls a legitimate policy option for emerging markets:

Stiglitz Sees Bubble Risk in Emerging Markets as Fed Expands U.S. Stimulus

The U.S. Federal Reserve’s plan to expand stimulus will fuel potential asset bubbles in emerging countries with strong growth that don’t have capital control measures, Nobel Prize laureate Joseph Stiglitz said.

“I do have worries on countries like India,” Stiglitz, a Columbia University economics professor, said today at a conference in Hong Kong. “The strong economies that don’t yet have capital control become the focal point for all this money.”

Corruption: Real or Perceived?

Corruption remains a sore point among Malaysians, to the point where it was actually included as a national KRA under the Government’s GTP program. PEMANDU is claiming that progress on this issue is on track:

TRANSPARENCY International's corruption perception index on MalayÂsia may have shown a slight reduction from 4.5 in 2009 to 4.4 this year but some of the component surveys of the CPI have been indicating improvements in 2010…

…While Pemandu acknowledges that if one were to look only at Transparency International's Corruption Perception Index, there is a slight reduction, it means that "a lot more work has to be done".

Wednesday, November 10, 2010

Sept 2010 Industrial Production: Up By A Whisker

Today’s industrial production report was a mixed bag. On the month, the unadjusted series fell 0.8% in log terms (up 5.4% y-o-y), but taking into account the Ramadhan effect, the IPI rose – just barely – for the first time in four months (log annual and monthly changes; seasonally adjusted):

Perak Catches The Gold Disease

I didn’t catch the original announcement, but here’s the follow-up:

IPOH: The gold dinar and silver dirham currency to be introduced by the Perak state government is not meant to be used for trading but only for investment purposes, said Mentri Besar Datuk Seri Dr Zambry Abdul Kadir.

“The plan to introduce the dinar and dirham was made because many people prefer to keep the currency as they feel the value will increase.

“That is the basis of introducing the dinar and dirham,” he told reporters after chairing the state exco meeting here yesterday.

He added that Perak would have no problem cooperating with Kelantan, which was attempting to use the gold dinar and silver dirham in all its transactions, including for paying civil servants’ salaries.

At least they have the sense not to try to use it as a medium of exchange.

Tuesday, November 9, 2010

The World Bank’s Malaysia Economic Monitor: Talking About Income Inequality

From the World Bank’s blog (emphasis added):

Why Updating Malaysia’s Inclusiveness Strategies is Key

Compare South Korea and Malaysia in 1970 and compare them again in 2009. South Korea was a third poorer back then and is now three times richer. Even more remarkable has been South Korea’s ability to widely share the benefits of this spectacular feat across broad segments of society. South Korea’s strong focus on broad-based human capital development allowed the country to transform itself into a high-income economy, while at the same time reducing income inequality and improving social outcomes.

Malaysia’s inclusiveness strategies have produced some remarkable successes as well. Malaysia dramatically reduced poverty and has all but eliminated hardcore poverty. But the country has been far less than successful in reducing income inequality which, since 1970, steadily fell for two decades but has stagnated at high levels ever since…For Malaysia to remain competitive, it became clear that it needs to compete on value, not cost, and this requires a refocusing on getting the incentives right for innovation, creativity and entrepreneurship.

World Bank President Calling For A New Gold Standard? Say It Ain’t So!

Oh, to be a fly on the wall in the World Bank’s press office:

Call to bring back gold standard

World Bank says it can serve as an anchor to guide global currency movements

SINGAPORE: World Bank president Robert Zoellick has called on bickering G-20 nations to bring gold back into the global monetary system as an anchor to guide currency movements.

Ahead of a G-20 summit this week in Seoul, Zoellick wrote in yesterday’s Financial Times that an updated gold standard could contribute to retooling the world economy at a time of tensions over currencies and US monetary policy.

Monday, November 8, 2010

QE2: Confusion And Chaos Reigns

I’m struck by the extent of the divisiveness of opinions that the Fed’s announcement last week about a further US$600 billion in asset purchases has raised. And then there’s the fact that the FOMC’s vote on the matter was not unanimous.

But to illustrate the chasm between opinions on the Fed’s “quantitative easing” (aka printing money) program, have a look at these two articles in Bloomberg:

Bernanke Can’t Use ‘Poison as the Cure,’ Burry Says

Nov. 5 (Bloomberg) -- Michael Burry, the former hedge-fund manager who predicted the housing market’s plunge, said Federal Reserve Chairman Ben S. Bernanke is trying to use “poison as the cure” by pumping more cash into the economy to spur growth.

Bernanke’s Fed pledged this week to use $600 billion in additional Treasury purchases to help lower a 9.6 percent unemployment rate, close to a 26-year high, and to avert deflation.

The attempt to bolster growth is reminiscent of Alan Greenspan’s actions to revive the economy after 2001, Burry said in a telephone interview from Cupertino, California. The former Fed chairman helped create an unsustainable boom in U.S. property prices with his policies, leading to the worst global financial crisis since the Great Depression, he said.

Boosting the economy “was the point of inflating the housing bubble,” Burry said yesterday. “It was the intent that the house would become the ATM machine, and help us through those rough times, post-dot-com, -Enron, -WorldCom, -Iraq and - 9/11. That’s why I say they’re using the poison as the cure.” …

Sunday, November 7, 2010

Currency Wars Part VII: Jim Rogers Gets It Wrong Again

Well-known economist, academician, theorist, investor and author Jim Rogers says Ben Bernanke doesn’t know what he’s doing:

Bernanke ‘Doesn’t Understand’ Economics, Rogers Says

Nov. 5 (Bloomberg) -- Federal Reserve Chairman Ben S. Bernanke’s decision to pump a further $600 billion into the economy shows his grasp of economics is weak, said investor Jim Rogers, chairman of Rogers Holdings.

“Dr. Bernanke unfortunately does not understand economics, he does not understand currencies, he does not understand finance,” Rogers, 68, said in a lecture at Oxford University’s Balliol College yesterday. “All he understands is printing money.”

“His whole intellectual career has been based on the study of printing money,” said Rogers, who predicted the start of the global commodities rally in 1999. “Give the guy a printing press, he’s going to run it as fast as he can.”

Friday, November 5, 2010

October 2010 International Reserves

The latest reserves position shows a RM2 billion increase over the last two weeks, indicating the pace of intervention has slowed compared to the first half of October:

As you can see from the MYR-USD exchange rate, there’s no obvious correlation between changes in reserves and the USD exchange rate after the capital flight episode in late 2008:

Bottom-line: BNM has a soft line in the sand at about 3.08 which says “do not cross…for now”. I’d expect that line to be crossed by the end of the year.

Happy Hari Deepavali

To all my Hindu readers, Happy Deepavali!

Please remember to drive safely if you’re travelling.

Thursday, November 4, 2010

Thank You

When I first started this blog a year and a half ago, I never expected much to come out of it. My goal was just to have a forum for airing my views and a way to formalise and discipline my thoughts on the economy. I never expected to get the readership that I have now, or to be involved as I am in the online Malaysian community.

Just a few minutes ago, Histats.com reports that since 1 April 2009, Economics Malaysia has hit the 100,000 page views milestone. That’s a heck of a lot of traffic for a specialist blog like this.

So for all my visitors and followers, thank you. I hope you’ve derived some benefit from my doodlings – I’ve certainly enjoyed the process.

I’m especially grateful for those who have put my blog on their blogroll, particularly Rocky, Dato’ Sak, Dali, de Minimis, etheorist and SatD. Couldn’t have done it without you.

And to my wife, thanks for the encouragement and for not complaining too much about the time I spend on line. Love you, babe.

September 2010 External Trade

It’s hard to find anything positive to say about yesterday’s release of September trade numbers. There’s no longer the excuse of a short working month due to Ramadhan (log annual and monthly changes):

BNM Announces 70% LTV For 3rd Mortgages

I’ve been travelling this morning, so posts will be running late today.

As rumoured last week, BNM has announced curbs on property lending, but only for people carrying more than two mortgages:

Bank Negara Malaysia wishes to announce with immediate effect the implementation of a maximum loan-to-value (LTV) ratio of 70%, which will be applicable to the third house financing facility taken out by a borrower. Financing facilities for purchase of the first and second homes are not affected and borrowers will continue to be able to obtain financing for these purchases at the present prevailing LTV level applied by individual banks based on their internal credit policies…

Wednesday, November 3, 2010

Warisan Merdeka, KLFID, And The Demand For Office Space In Kuala Lumpur

Although announced as part of the government’s 2011 budget proposals, neither the RM5 billion Warisan Merdeka (to be developed by Permodalan Nasional Berhad) nor the RM26 billion Kuala Lumpur International Financial District (to be jointly developed by 1Malaysia Development Berhad and Abu Dhabi’s Mubadala Group) are strictly speaking government projects, although the latter skirts a very fine line on that issue.

There’s a lot of opposition to both projects, but funnily enough, it’s Warisan Merdeka that has attracted the most vitriol despite being less in scope and risk, and despite PNB not being directly owned by the government. I guess its the inclusion of a 100 story office tower that has raised people’s hackles, and the prospect of a 5-10 year development in one of the worst traffic areas of the city.

But the real issue here is the viability and feasibility of both projects – will there be enough demand to absorb the inclusion of so much additional office and commercial space?

Tuesday, November 2, 2010

There He Goes Again…

Tun Dr Mahathir on free markets, regulation and gold:

Dr M: Banking, finance need to be regulated

…Former prime minister Tun Dr Mahathir Mohamad said governments must continue to oversee the regulation of banks and financial institutions.

“Unless the Government oversees and limits the ability for the market to abuse (the banking systems) then, of course, we are going to have this kind of (global economic) crisis…

…“This idea of a free market has become almost like a religion. You cannot question it, even when it fails,” he said…

…“And the abuses became rampant because of the idea that governments must not interfere with the financial market. (That) the market it seems would regulate itself,” he explained.

He urged for the gold dinar to be institutionalised as the standard against which all currencies were measured for the sake of stability.

“It’s something tangible and something that has value anywhere in the world,” he said.

However, he said the gold dinar system, if implemented, should only be used for settlements of international trade…

…“The US dollar has got no value whatsoever. It’s got no backing, no reserve. But we accept it as if it has some value and because we accept it, it has value,” he said.

RON97 Petrol Up 5 sen From Today

Unlike the subsidised price of RON95 petrol, RON97 is apparently priced according to a “automatic pricing mechanism”:

RON 97 price up 5 sen and reflects global petrol market price

KUALA LUMPUR: The price of RON 97 is up 5 sen to RM2.15 per litre from Tuesday and reflects the price of petrol in the global market, said Deputy Domestic Trade, Co-operative and Consumerim Minister Datuk Rohani Abdul Karim.

The price of the more widely used RON 95 remains at RM1.85 per litre.

"It was announced on July 16 that the price of Ron 97 will be subjected to a managed float,'' she said this in her reply to Dr Dzulkefly Ahmad (PAS - Kuala Selangor) during Question Time.

A market oriented mechanism is superior to price controls. But even this isn’t sufficient to offset the negative externalities (pollution, congestion, etc) arising from the use of fossil fuels.

Please, tax the stuff.

Sept 2010 Monetary Conditions Update

Monetary conditions were more or less stable over the past few months, but with narrow money falling as BNM took in old notes and coins in the aftermath of Ramadhan (log annual and monthly changes; seasonally adjusted):

Monday, November 1, 2010

Wealth, Income and Education

I’m swamped with work today, so this will be a filler post to tide you guys over until I can get into meatier things.

I’ve been advocating more attention be paid to the early years of education, rather than focusing primarily on tertiary education, as I believe its a more effective way to create a more productive Malaysian workforce.

Here’s some supporting evidence (abstract):

How Does Your Kindergarten Classroom Affect Your Earnings? Evidence From Project STAR

Raj Chetty, John N. Friedman, Nathaniel Hilger, Emmanuel Saez, Diane Whitmore Schanzenbach, Danny Yagan

Saturday, October 30, 2010

There Is No Such Thing As A Theory of The Invisible Hand

Myth making at its finest. From a book review of “How Markets Fail” by John Cassidy:

ALAN Greenspan has a dangerous weakness for Adam Smith – he believes firmly that untrammelled capitalism provides a uniquely productive method of organising markets.

Paying homage to Smith’s Theory of Invisible Hand, Greenspan wrote, shortly before the explosion of subprime crisis, “People must be free to act in their self-interest, unencumbered by external shocks or economic policy ... Yet, even in crises, economies seem inevitably to right themselves.”

Friday, October 29, 2010

Curbing Household Debt

BNM will apparently be making an announcement next week on limits to housing loans:

Bank Negara likely to announce property curbs next week

KUALA LUMPUR: Bank Negara is expected to announce next week measures to curb property speculation and a programme to create financial awareness for the youth, said sources.

The introduction of a loan to value requirement for people buying their third house or more has been talked about, but central bank governor Tan Sri Dr Zeti Akhtar Aziz said any new rules regarding property loans would not be a blanket clamp. ..

The Efficiency of Taxation: Save The Environment, Tax Petrol

Part of the new budget proposals was a tax break for “hybrid” cars, which use both petrol and electrical-driven engines to achieve heretofore unheard of fuel economy. But is this a good idea? Not so much in terms of encouraging the adoption of “green” vehicles, but rather in terms of whether this is actually the best deployment of the government’s financial resources.

In any case, others are talking about further measures along the same vein:

Rich Dad, Poor Dad: Or How To Get Rich Without Really Trying

And the answer is: Write a book on how to get rich.

It’s a bit off-topic I know, but I consider this a public service. If you’ve read the book, or any other that Robert Kiyosaki has written, do yourself a favour and read this.

Thursday, October 28, 2010

What’s The Impact Of The 2011 Mega Projects?

There’s a raging controversy in the aftermath of the budget regarding the spate of big mega-projects that were announced – the yet-to-be awarded Mass Rapid Transport system for Greater KL, the Dubai-based Mubadala Group and 1MDB hook-up for the development of a KL Financial District (I still have no idea where this will be located), and of course PNB’s 100-story Warisan Merdeka project. The last has especially attracted an uncommon amount of vitriol from Malaysians. The least troublesome of these projects would be EPF’s Sg Buloh development project, as there won’t be any “special” needs involved.

I’m going to forbear commenting on the feasibility of the projects as I’m not really qualified to comment on them. What I will do is speak to the possible macroeconomic effects of these projects, insofar as that’s possible with virtually no information beyond their projected development value.

Wednesday, October 27, 2010

ETP Roadmap: PM’s Speech

In case you missed it, the videos are on Youtube. Sorry, they’re in Bahasa Malaysia only:

Zeti Says: No Sudden Moves

On Bloomberg today:

Malaysia’s Zeti Doesn’t Want ‘Sudden’ Currency Moves

Oct. 27 (Bloomberg) -- Malaysian central bank Governor Zeti Akhtar Aziz said she doesn’t want to see sudden currency moves and expressed concern that global policy makers may rely too much on exchange-rate changes to deliver sustainable growth…

…Bank Negara Malaysia should watch the ringgit’s “underlying trend” and wants gradual moves, Zeti said. Malaysia’s currency reached a 13-year high this month.

Tuesday, October 26, 2010

Tun Dr Mahathir Points Out The Elephant In The Room

So much for staying away from blogging.

It was a little over a year ago that I wrote a post on what the Malaysian economy would look like in the run up to becoming a high income economy.

Now our ex-PM points out the same problem that I worried about:

Book Plug: Fixing Global Finance

I’ve an awful lot of research papers that I want to highlight, in addition to going through the ETP proposals in detail. As such there won’t be any posts for the next couple of days, so in the interim, I’d just like to showcase a book and a working paper that supports it.

Back in July, I highlighted an article on VoxEU regarding the imposition of capital controls in East Asia. The author got in touch with me, and has now published a book on the subject:

Fixing Global Finance

A Developing Country Perspective on Global Financial Reforms

Kavaljit SinghThe financial crisis which erupted in mid-2007 has been widely viewed as the most serious financial crisis since the Great Depression of the 1930s. The crisis which originated in developed countries quickly spread to developing countries and the rest of the world. The turbulence in financial systems was followed by a significant reduction in real economic activity throughout the world. The crisis has highlighted that financial markets are inherently unstable and market failures have huge economic and social costs. The crisis has renewed debate on the role of global finance and how it should be regulated.

The aim of this book is to encourage and stimulate a more informed debate on reforming the global finance. It examines recent developments and problems afflicting the global financial system. From a developing country perspective, it enunciates guiding principles and offers concrete policy measures to create a more stable, equitable and sustainable global financial system. Several innovative measures have been proposed to reform the global finance and to ensure that it serves the real economy.

Monday, October 25, 2010

ETP Roadmap Download

Hot off the press. If you still want a hard copy, MPH will be carrying it nationwide from tomorrow.

ETP Roadmap Launch: We Are Live At PWTC (Updated)

Well so much for well-laid plans. After enduring an hour long jam just to get in the place, and going round in circles trying to find parking, I find that the auditorium is full. There’s still at least a few hundred people milling around outside as well, Right now, I’m sitting in a hall on the 2nd floor which has a live feed.

The World Has Turned On Its Axis: Didn’t Notice, Did You?

From this weekend’s G20 meeting comes the news of a realignment in the IMF’s governance structure:

G-20 Ministers Agree ‘Historic’ Reforms in IMF Governance

Ministers of the Group of Twenty (G-20) industrialized and emerging market economies agreed on a proposed raft of reforms of the IMF that will shift country representation at the IMF toward large, dynamic emerging market and developing countries.

Currency Wars Part VI

From the Forex Blog:

Currency War Devalues all Currencies…Except for Gold

Then there are those that believe all currencies will suffer, and that even the currencies that are still rising are actually depreciating in real terms (due to inflation). Those who harbor such beliefs will often try to short the entire currency market, usually by betting on commodities or heavy metals, of which Gold is probably the most prominent.

The price of Gold has risen more than 20% this year (in USD terms). Its backers claim that it is the ultimate store of value (where this derives from is unclear), and defend its lack of utility and inability to accrue interest by arguing that its appreciation is more than enough of a reason to own it. When you look at the performance of gold over the last five years, you begin to wonder if maybe they have a point.

I’m kinda busy this morning so I’ll forbear commenting on this issue…again. But I will add that the best academic guess for when the gold market will reverse is when interest rates start rising again in the developed world. Since the Fed is committed to keeping rates low “…for an extended period”, that might be 2-3 years down the road.

In the meantime, gold is likely to continue to increase in USD terms - $2000? $3000? Your guess is as good as mine. There’s certainly no other fundamental reason for buying gold.

LiveBlogging The ETP Roadmap Launch

I’ve got an invite to the ETP Roadmap launch this afternoon, which is due to start around 3.00pm. So I’m going to try an experiment – if my modem line holds up, I’m going to try live-blogging the event. Pics will be uploaded later tonight, if I can manage it.

Stay tuned.

Saturday, October 23, 2010

September 2010 CPI: Eat And Be Merry

Yesterday’s Consumer Price Index report from DOS was interesting, in a nice kind of way. I would have expected that over the Ramadhan-Syawal period, we’d see some increases in food prices at least – apparently not (log annual and monthly changes; 2000=100; click on pic for larger version):

Currency Wars Part V

Seems I spoke too soon, though whether this is a blip or something more permanent remains to be seen. BNM’s latest biweekly statement of international reserves shows an RM12 billion increase up to October 15, which puts total intervention to weaken the Ringgit over the past 2 ½ months at a revaluation adjusted RM22.5 billion.

The Ringgit touched a little above 3.08 to the USD on Oct 14 and 15 then bounced back up to 3.12 on Wednesday (Oct 20), which suggests to me anyway, that BNM isn’t that keen for the Ringgit to breach below the RM3.00 level – at least not yet. My sense is that BNM is looking at limiting the Ringgit’s movement against the USD to about 1%-2% a month at most, though the pattern of intervention over the past couple of years suggests that they’re agnostic to the level.

Friday, October 22, 2010

Currency Wars Part IV

Tun Dr Mahathir fires a shot, with his usual candour:

1. Malaysians, including Malaysian monetary authorities seem quite happy over the appreciation of the Ringgit against the US Dollar. We think that when our currency strengthens it must be because our economy is strong. Therefore we are doing well.

2. But are we doing well? Is it the Ringgit which is appreciating or is it the US Dollar which is devaluing?

3. Actually it is the US Dollar which is devaluing. It is devaluing against most other currencies, especially against China's currency.

August 2010 Employment Report

The August 2010 report on labour force statistics shows unemployment falling to the lowest level so far in this series:

But I’d take this with a grain of salt, as I’m expecting the jump in employment due to the Census to fall back in September. There are already some signs of that occurring, with August showing a loss of 113k jobs:

Currency Wars Part III: How Much Is BNM Intervening In The Ringgit?

It finally occurred to me that there absolutely has to be some forex intervention going on in Malaysia, if only because the level of reserves is not dropping as fast as the Ringgit is rising. But the degree to which BNM is intervening is so small, that I’m not sure whether its worth talking about.

To understand the relationship between Malaysia’s international reserves and the Ringgit, you have to understand the mechanics of intervention, as well as BNM’s policy on revaluation of reserves. The level of international reserves can only change from one or the other, or both. If there is no intervention – and this is important to understand – there will be no change in the level of reserves except on revaluation (added 22/10/2010 for clarity).

Thursday, October 21, 2010

August 2010 Economic Indicators

The latest Economic Indicators report from the Department of Statistics brings some short relief to the economic outlook – but we’re still not out of the woods yet:

Wednesday, October 20, 2010

Financial Crises: Who’s Next?

I’m leaving Malaysia for a short sojourn offshore – figuratively speaking.

East Asia and others gained a salutary lesson 10 years ago during the 1997-98 financial crisis about the dangers of short-term capital flows. We’ve generally applied that lesson today, in the aftermath of the recession and the subsequent flood of liquidity aimed at emerging markets.

Some countries have responded with controls on short term capital flows, of which Thailand’s 15% withholding tax on government bond purchases last week was just the latest. Others, like Malaysia and Singapore, have generally refrained from administrative measures, instead allowing a sharper appreciation of their currencies to limit incentives for portfolio capital inflows and keep a lid on inflation.

Yet others don’t appear to have gained anything from East Asia’s experience:

When China Moves, Countries Tremble

The Peoples Bank Of China has finally given up on reserve ratios as their preferred monetary tool, and have raised interest rates by 25bp:

Asian Stocks Fall to Two-Week Low After China’s Rate Increase

Oct. 20 (Bloomberg) -- Asian stocks dropped, dragging the MSCI Asia Pacific Index to a two-week low, after China unexpectedly raised lending and deposit rates to curb inflation in the world’s fastest-growing major economy...

..."The perceived problem with China raising rates is it limits economic growth from one of the higher growth economies," said Tim Schroeders, who helps manage about $1 billion at Pengana Capital Ltd. in Melbourne. "Markets in Asia have adopted a very cautious approach to today’s trading in light of this news."

It’s The Little Things That Matter

One of the funny things about the debate over Malaysian educational reform is that it’s distinctly lopsided (at least, from my perspective). A lot of the focus is on the structural graduate unemployment that Malaysia faces, which naturally leads to the feeling that it’s the universities that are in dire need of change. (There’s also the issue of vernacular schools, but there’s better commentary on that in the blogosphere than I could ever give).

But the empirical evidence suggests that life outcomes are highly correlated with the quantity and quality of primary education, and somewhat less so with secondary education. Tertiary education doesn’t even get a look in, though on an individual level it helps to be at a good college. The implication is that early education is far more important than many people realise, and the earlier the better.

Tuesday, October 19, 2010

MIER Forecasts 50bp Rise In The OPR For 2011

The Malaysian Institute of Economic Research (MIER) is one of the oldest independent think tanks in Malaysia, and publishes a quarterly economic outlook as well as Business Conditions and Consumer Sentiment Surveys. Their latest economic outlook forecasts one or more interest rate hikes next year (summary):

...MIER maintains 2010 and 2011 economic growth of 6.5% and 5.2%, respectively. Importantly, these forecasts are also supported by recent in-house surveys. The Business Conditions Index (BCI) fell sharply to 104.9 pts in 3Q10, which more than offsets the surge in the Consumer Sentiment Index (CSI) to 115.8 pts. Other indices also painted a similar gloomy environment ahead.

In terms of interest rates, MIER anticipates the OPR to be kept at 2.75% until end-2010. This is useful in order to assess the effects of previous rate hikes and the possible impact from economic fallout in the Eurozone. The OPR will trend higher to 3.25% in 2011, in tandem with a higher overall CPI forecast of 2.5% yoy (2.2% in 2010).

I’m not sure I’d be brave enough to stick my neck out for this one, as BNM is notoriously unmoved by supply-side driven inflation. The last time BNM hiked rates, in 2005-2006, it was in response to capital inflows arising from the abolishment of the USD peg. With growth expected to slow, we’re obviously not talking about a demand-side driven increase in the price level, nor is the economy yet showing any signs of fully closing the output gap.

The only real argument for further monetary tightening would be due to the continuing influx of foreign portfolio capital, but that I think is more likely to attract administrative measures (aka capital controls) rather than a broad-based increase in the price of borrowing.

Currency Wars Part II

William Pesek of Bloomberg weighs in (emphasis added):

Currency War Is Solved With One Trip to Bangkok

Oct. 15 (Bloomberg) -- Those finance bigwigs blabbing away in Washington last weekend should visit Bangkok instead.

That’s where the “currency war,” which they naively believe they can avoid with their handiwork, is on display. Just as Thailand was on the front lines of Asia’s 1997 crisis, it’s being flooded by liquidity from Washington, Tokyo and Frankfurt.

On Oct. 12, Thailand removed a 15 percent tax exemption for foreigners on income from domestic bonds, joining South Korea and Brazil in curbing hot-money flows and currency gains. The former risks overheating, the latter threatens exports…

…Think of markets as a giant game of Whac-A-Mole. Officials from Beijing to Brasilia stand at the ready, hammers in hand, to whack down any spike in exchange rates. The trouble is, everyone is whacking at once. When everyone tries to tame currencies simultaneously, there will be few, if any, winners.

Monday, October 18, 2010

Budget 2011: By The Numbers (Updated)

I’m not going to regurgitate the analysis and feedback available through the papers since, well, it’s available through the papers (here’s the Star’s reporting).

But I do want to give some perspective to the government’s spending plans and forecasts for this year and next, which are of greater interest. Quite frankly, apart from the front-loaded news on the infrastructure projects, this year’s budget presentation is about as anticlimactic as they come.

But let’s see the government’s spending plans and revenue projections in historical perspective (RM millions; sample: 1976-2011f; includes development spending):

Saturday, October 16, 2010

Federal Government Budget 2011: First Impressions

At first reading (and hearing), this budget seems determinedly populist, especially if you heard the last ten minutes live:

- Big infrastructure projects, like the Warisan Merdeka development and EPF’s Sungai Buloh development;

- The establishment of the National Wage Consultation Council (which will set the minimum wage);

- The increase in civil service maternity leave;

- The continuance of the electricity bill rebate;

- Subsidised low cost Housing loans for estate workers;

- Government guarantees for the 10% deposit for first time homebuyers, for those earning less than RM3000;

- Increase in monthly allowances for community leaders including Imams (almost double the previous level); and

- No toll rate increase for highways under PLUS for the next five years.

Friday, October 15, 2010

Waiting For The Budget: GNI Per Capita

While I’m hanging around waiting for the budget broadcast to begin, here’s a quick note on the New Economic Model target.

You may recall that the NEM target is a minimum of USD15,000 per capita GNI by 2020. I’ve gone on the record to say that I think we’ll reach that target pretty easily, because of:

- The Ringgit’s appreciation, which is a by-product of going up the development scale; as well as

- Through the demographic transition that Malaysia is going through.

That doesn’t detract from the necessity of some of the NEM/ETP objectives however – I still believe that a restructuring of the economy is necessary to spread the wealth around, as well as to put the economy in a less vulnerable position relative to external demand.

GST Postponed

Of all the news that’s come out over the last couple of days, the news over the postponement of GST (Goods and Services Tax) implementation has got to be the most disappointing (read the original press release here, reasonable English translation via The Star).

The reaction (and underlying explanations) to the postponement are more disappointing still (emphasis added):

GST acceptance easier if reductions known upfront

PETALING JAYA: The goods and services tax (GST) may have found easier acceptance if the Government had made known a reduction in corporate and personal tax rates upfront.

Observers said due to the politically sensitive nature of imposing new taxes, even indirect ones, the move to implement the GST necessitated a more transparent communication over how and when personal and corporate taxes would be restructured...

Tuesday, October 12, 2010

Budget 2011 Thoughts

I’ll be teaching a bunch of unemployed graduates over the next two days, so don’t expect much in the way of posts until after then. Having said that it’s budget time again, with next year’s fiscal plans due to be tabled in Parliament on Friday.

I really don’t have much to add to the speculation over what particular measures will be included – there’s a consensus that preliminary funding for the MRT system for KL will at least be included, but apart from that everybody’s really guessing on which of the ETP projects will come up front and centre.

In any case as a macro guy, I’ve always been more interested in the aggregate effect of fiscal policy rather than the particulars, where the impact is often hard to discern – I think governments too often get the credit when the going is good, and too much of the criticism when the going is bad.

But one thing I’m fairly certain of is that the fiscal deficit for this year will be less than expected, assuming the government maintains fiscal discipline – I expect revenue to be at least 10% higher than the government’s forecast, and GDP will also come in higher. That of course leaves expenditure, which is discretionary. They’ve already increased spending plans by RM10 billion RM12 billion over and above the original allocation, which will cut into the revenue increase, but I don’t expect it to be so much as to fully lose the gains from higher revenue.

The 2010 Riksbank Prize in Economics Sciences Goes To…

Peter A. Diamond of MIT, Dale T. Mortensen of NWU, and Christopher A. Pissarides of LSE “for their analysis of markets with search frictions."

From the press release:

Why are so many people unemployed at the same time that there are a large number of job openings? How can economic policy affect unemployment? This year's Laureates have developed a theory which can be used to answer these questions. This theory is also applicable to markets other than the labor market.

On many markets, buyers and sellers do not always make contact with one another immediately. This concerns, for example, employers who are looking for employees and workers who are trying to find jobs. Since the search process requires time and resources, it creates frictions in the market. On such search markets, the demands of some buyers will not be met, while some sellers cannot sell as much as they would wish. Simultaneously, there are both job vacancies and unemployment on the labor market.

Say What? Redux

One of my aims with this blog is to approach the question of economic policy from the “wrong” side of the bed – in a manner of speaking. Instead of using the more usual way of applying theory to try to explain what’s happening in Malaysia and the world, I prefer to follow the opposite route which is to look at the stats and then see which theory really fits the numbers.

To be honest, you really need to use both approaches to arrive at appropriate policy decisions, but I think you make less egregious mistakes by looking at reality first.

Case in point: in an article today at the Malaysian Insider, Datuk Jema Khan is calling for a repeg of the Ringgit to preserve “economic competitiveness” (emphasis added):

…Our ringgit is the best performing currency in Asia for 2010, having risen by more than nine per cent whereas China’s yuan has only appreciated by two per cent as a result of its central bank’s intervention.…

…The major economies of the US, Japan and the UK are flooding the world with liquidity and that liquidity is coming to Asia. For Asia, that is not necessarily a bad thing as it means more inward FDI inflows, but unfortunately it appears that Malaysia is not benefitting from it.

Monday, October 11, 2010

August 2010 Industrial Production

The August IPI report was released today, and like last week’s trade numbers, have been infected by the “holiday” spirit. Annual and monthly growth ticked up ever so slightly, driven mainly by higher electricity output (log annual and monthly changes; seasonally adjusted):

Say What?

There was this article over the weekend on the Ringgit, for which I have very little comment, except for one stupefying line and one irrelevant one (emphasis added):

OVER the past few months, one topic has been in the limelight and it shows no sign of tapering off. Over the week, the ringgit hovers at 3.05-3.08 against the greenback or US dollar, and about 4.80 against the British pound...

...So why has the ringgit been appreciating? There are many arguments brought about from different schools of thoughts, but few are worth mentioning here. First, is the fact that the United States has recently undergone a recession (or still is?) and therefore, in order for it to recover, the greenback is taking a “back-seat”.

Another explanation will be the balance of payments methodology, whereby foreign exchange rate must be at its equilibrium level, which is the rate that produces a stable current account balance.

Malaysia, having a trade surplus, will experience an increase in its foreign exchange reserves, which ultimately appreciate the value of the ringgit.

Sunday, October 10, 2010

August 2010 External Trade:

Friday’s release of August trade data showed, quite frankly, some pretty awful numbers. But as I talked about last month the Ramadhan effect was likely to take a toll on the numbers anyway, so it’s not panic stations just yet, especially since there’s no breakout from last month’s forecast range (log annual and monthly changes; seasonally adjusted):

Taking away a slight uptick in June, we’re now in the fifth month of consecutive declines in exports (seasonally adjusted), and the third in imports. Given the structure of Malaysia’s trade, where much of imports are used as inputs into exports, there’s more than enough evidence here of falling external demand – it’s certainly not coming from lower commodity prices:

Friday, October 8, 2010

The US Dollar And The US Trade Deficit

Marty Feldstein thinks the US Dollar will weaken…and that’s a good thing:

Feldstein Says Dollar to Weaken, Boosting Exports

Oct. 7 (Bloomberg) -- Martin Feldstein, a Harvard University professor who was chief economic adviser to President Ronald Reagan, predicted the dollar will weaken, boosting exports and strengthening the U.S. economy.

“Dollar weakness will be one of the few things that will improve our trade balance, and that will strengthen our exports,” Feldstein said in a Bloomberg Television interview today on “Surveillance Midday” with Tom Keene. “It will cause Americans to shift from imported goods into domestic services. All of that will strengthen the economy.”

Fund managers with large pools of dollars were converting the currency into euros before “all hell broke loose” during the European debt crisis, Feldstein said. As they resume trading dollars for euros, and the U.S. trade deficit remains high, the dollar will depreciate, he said…

Kenneth Rogoff On Gold

Via Greg Mankiw’s blog (excerpts):

$10,000 Gold?

Kenneth RogoffSAN FRANCISCO – It has never been easy to have a rational conversation about the value of gold. Lately, with gold prices up more than 300% over the last decade, it is harder than ever. Just last December, fellow economists Martin Feldstein and Nouriel Roubini each penned op-eds bravely questioning bullish market sentiment, sensibly pointing out gold’s risks...

...Admittedly, getting to a much higher price for gold is not quite the leap of imagination that it seems. After adjusting for inflation, today’s price is nowhere near the all-time high of January 1980…At $1,300, today’s price is probably more than double very long-term, inflation-adjusted, average gold prices. So what could justify another huge increase in gold prices from here?

“Soaring” International Reserves

One of the reasons I’ve always had my charts showing several years worth of data is that I’ve always thought a historical perspective was useful, and in fact necessary, when looking at economic data.

A picture can mislead, but it won’t lie outright.

Case in point is The Star’s otherwise unremarkable article on BNM’s September international reserves position:

Malaysia's foreign reserves soars to RM310.8b

Rreserves [sic] position is sufficient to finance 8.5 months of retained imports and is 4.3 times the short-term external debt

KUALA LUMPUR: Bank Negara’s international reserves amounted to RM310.8bil as at Sept 30.

Thursday, October 7, 2010

Currency Wars

Over the last two weeks, rhetoric has been building up over currency “manipulation” among major trading nations. The biggest target is of course China, with the turtle-slow adjustment of the CNY-USD exchange rate, but their far from the only ones. The Bank of Japan intervened in the Yen market in a big way last month, and Brazil, South Korea and Indonesia have instituted capital controls to a greater or lesser degree. Nor is currency intervention limited to emerging or Asian markets, as Adam Kritzer talks about in this blog post:

Currency War: Who are the Winners and Losers?

It’s still too early too early to say how far the currency war will go. The G7/G20 has announced that it will address the issue at its next summit, though it probably won’t lead to much in the way of action. Ultimately, politicians can’t do much more than shake their fingers at countries that try to hold down their currencies....

…That brings me to my final point, which is that all currency intervention is futile in the long term, because most Central Banks have limited capacity to intervene. If they print too much money to hold down their currencies, they risk stoking inflation…For Central Banks to successfully manipulate their currencies on the spot market, they must fight against the Trillions of Dollars in daily forex turnover. Eventually, every Central Bank must reckon with this truism.

Wednesday, October 6, 2010

PEMANDU Acting Fast And Loose With The Numbers…Again

Once is an accident, two a coincidence, three times…well.

I first remember seeing this particular stat at the ETP Open Day, but didn’t think much of it at the time…maybe I should have looked closer. But this article shows that others are picking up on the “fact” that loan growth has moderated in the last five years compared to the early part of the decade (excerpts; emphasis added):

ETP to help revitalise financing sector

High loans growth seen in construction, real estate and transport sectors

PETALING JAYA: Loans growth from banks’ domestic operations which had shown signs of moderation over the past five years is expected to be boosted by increased activities under the Economic Transformation Programme (ETP).

Based on statistics released under the ETP, loans growth from banks’ domestic operations had moderated to a compounded annual growth rate of 10% in the five-year period of 2005 to 2009 versus 13% between 2001 and 2005…

ETF’s, Index Tracking Investment, And Irrational Markets

One of the seminal contributions to the macroeconomic literature of the last fifty years was the Lucas Critique, which in short states that changes in policy affects individual behaviour, which in turn means that you can’t reasonably expect that policies implemented would have the intended effects based on historical macro relationships. More generally, everything affects everything else, and you can’t take things in isolation.

While this is part and parcel of the now controversial doctrine of rational expectations (for which Robert Lucas won the Nobel Prize in 1995), the fundamental point that Lucas was driving at is still valid – you can’t assume that interrelationships will always stay the same, if you change something within a system. The mania over structured finance products that helped drive this past global financial crisis is a case in point, but it applies to virtually any financial product or government policy.

Which brings me to this article in The Star today:

What are ETFs and why is it beneficial to buy them?

Personal Investing - By Ooi Kok HwaLATELY, the number of ETFs that get listed on Bursa Malaysia has been increasing.

At present, we have a total of five ETFs listed in Malaysia. Unfortunately, we have noticed that not many investors are aware of these instruments and there is also a lack of understanding on the true value of these ETFs.

The Purchasing Power Of Gold Part II

A couple of months back, when the contretemps over the Kelantan Gold Dinar was at its height, I did a post on testing the stability of gold’s purchasing power. But in the last couple of weeks, gold on the international markets has been breaching new highs, virtually on a daily basis:

Gold price rises to yet another high, other commodities too rise

PETALING JAYA: Gold rose to a new all-time high yesterday, while other major raw materials – from copper to cotton – continued to head north as some investors see commodities as safer bets against inflation.

Spot gold price hit US$1,328 an ounce following a surprise pledge by the Bank of Japan yesterday to keep interest rate at virtually zero and to step up purchases of assets.

This had sparked fresh worries that central banks in developed countries may have to further their so-called quantitative easing policy to bolster their ailing economies...

Tuesday, October 5, 2010

If You’re Taking Academic Research Too Seriously…

…you have to read this. My favourite:

ENGINEERING PRIZE: Karina Acevedo-Whitehouse and Agnes Rocha-Gosselin of the Zoological Society of London, UK, and Diane Gendron of Instituto Politecnico Nacional, Baja California Sur, Mexico, for perfecting a method to collect whale snot, using a remote-control helicopter.

REFERENCE: "A Novel Non-Invasive Tool for Disease Surveillance of Free-Ranging Whales and Its Relevance to Conservation Programs," Karina Acevedo-Whitehouse, Agnes Rocha-Gosselin and Diane Gendron, Animal Conservation, vol. 13, no. 2, April 2010, pp. 217-25.

(H/T Dan Hirschman)

iPhone 4 Winners and Losers

This article had me grinning – the last line is sooo full of irony:

iPhone 4 launched by Maxis, DiGi; but which has better plans for subscribers?

PETALING JAYA: Hundreds of buyers queued for hours to get their hands on the newly launched iPhone 4 when it was up for grabs last week. Both Maxis Bhd and DiGi.Com Bhd launched Apple’s latest iPhone 4 last week…

…Teo, a first-time iPhone user, said she had been waiting for the phone ever since it was launched in the United States in the middle of the year.

Teo said she was attracted more by the “cool” aura that iPhones conveyed than the technology itself.

Economics As A Religion

Andrew Sheng turns into a satirist:

Economics is a religion, not a science

…But let us come back to the big debate: Should governments cut deficits or increase them to get jobs going?

My personal view is that if the United States suffers from fundamentally excessive consumption financed by excessive leverage, then simply increasing public debt to substitute for Wall Street losses does not make sense.

De-leveraging has to happen some time, either in the private or public sector and de-leveraging means cutback in consumption…

…The Keynesian argument that if the private sector lacks confidence to spend, the government should spend is not wrong. But Keynes did not spell out where the government should spend. Nor did he envisage that lobbyists can influence government spending to be wasteful. Hence, every prophet can be used by his or her successors to prove their own points of view. This is religion, not science.