I probably shouldn’t bother, but from TMI (excerpt):

When the success of one nation casts shadows on the failures of another

...That Malaysia, with her bounty of natural and human resources, has failed miserably to keep up with Singapore is a sad reflection of the policies we’ve undertaken in the last 50 years. Where one has chosen unwavering pragmatism and a merit-based administrative policy to push its nation forward, the other is still proclaiming the supposed inherent superiority of one race over others.

Singapore is able now to move beyond focusing entirely on economic policy, to addressing problems such as social mobility and a rapidly ageing society to further better the quality of life of its citizens. Malaysia seems to be obsessed with proposing-debating-and-proposing-again the implementation of hudud, instead of fighting the deeply-rooted disease of corruption and inefficiency which leads to the billions of ringgit that slip out of our country’s coffers every year.

I hate repeating myself, but:

The Paradox Of Plenty

There’s this somewhat understandable idea that because Malaysia is rich in natural resources, we are…well, rich. Or at least we should be, if the government had handled things properly....

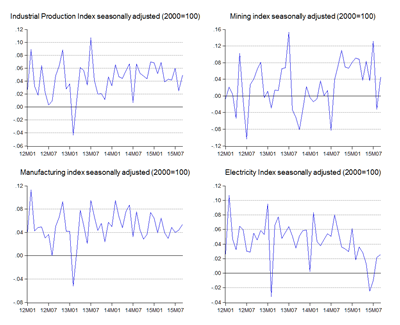

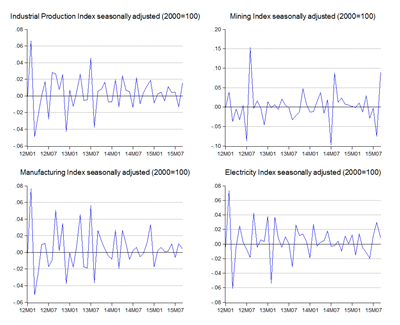

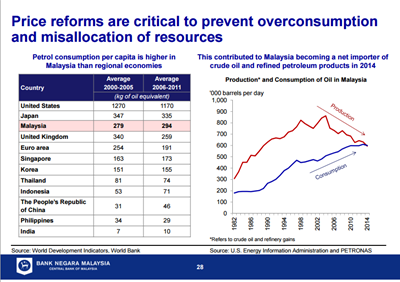

...But there’s a slight problem with this mindset – the empirical evidence suggests that natural resources alone do not beget wealth or prosperity, that focusing on developing such assets actually undermines the foundation of long term growth and prosperity. In fact, in development circles, it’s more common to speak of natural resources as a “curse”, not a blessing....

…In Malaysia’s case, it’s probably more pertinent – and accurate – to wonder not why we aren’t rich when we have abundant natural resources, but rather how Malaysia has managed to grow so far and so fast despite the handicap of having abundant natural resources.

In addition, three links on my series on corruption and growth (here, here and here), or if you want the whole series, you can start from here. From Part III of the series (excerpt):

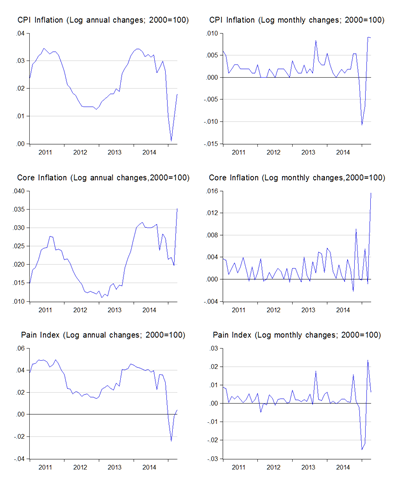

The idea that corruption has a dampening effect on income levels and/or growth is intuitively appealing, yet the data doesn’t appear to support any causal relationship of any kind. In fact, the conclusion appears to be that the relationship is technically spurious – corruption affects neither the level or growth of income, nor does income affect the level or rate of corruption (or should I say, the perception of corruption).

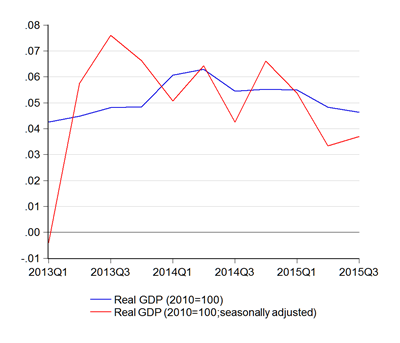

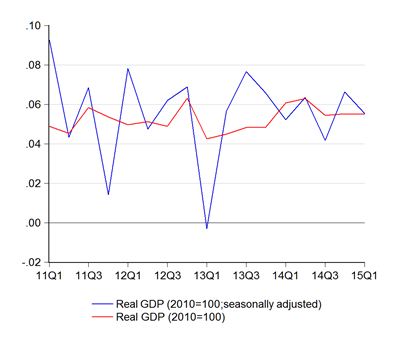

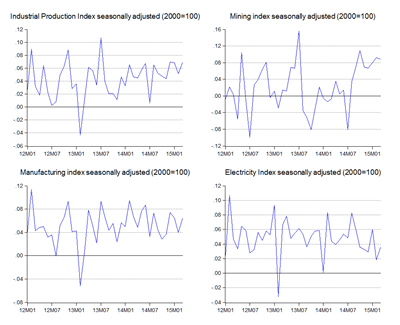

The difference in growth between Singapore and Malaysia really boils down to volatile commodity prices before Malaysia’s economy was fully diversified beginning in the 1990s. There are a few other things, which I won’t get into right now.

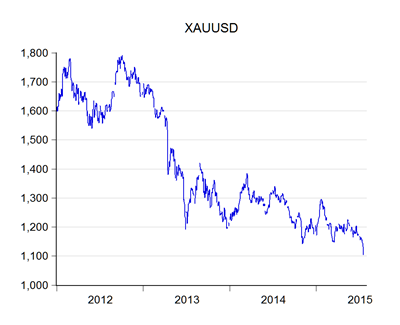

Natural resources are not a blessing. Anybody who watched oil prices plunge last year can certainly attest to that. Long term, any country relying on natural resources is not on a path to prosperity.

The statement that Malaysia is “…staggering behind most of her Asian peers,” is sheer hyperbole. Since 1965, the only countries to have overtaken Malaysia in real GDP per capita in East Asia is Korea and Taiwan – despite the fact that both had had institutionalised corruption during their highest growth phases. This also ignores that we have been making steady gains on both, as well as against developed country standards, in the last decade.

Lastly, on the (de)merits of pure meritocracy, try here, here and here.