I’ve done this exercise once before (see here), but this way is probably a lot more intuitive for most people. The TL:DR version – the Ringgit is undervalued, but not by much:

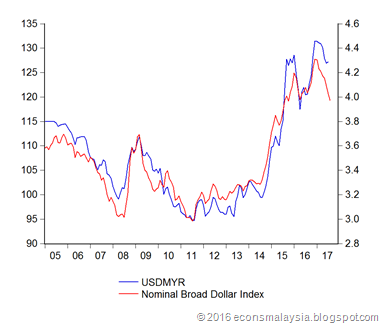

The chart above has the USDMYR exchange rate on the right, and the Fed’s USD broad nominal effective exchange rate on the left, from 2005 to the present. The correlation is very close – better than 95%. In other words, almost all the variation in the MYR exchange rate has come from movements in the USD rather than factors idiosyncratic to the MYR.

I won’t say that the gaps between the lines are good measures of the MYR’s over- or under-valuation, but they are indicative. In the MYR’s recent history, there’s been two episodes of obvious misalignment, roughly from mid-2015 to early-2016, and from the end of 2016 to the present.

The first you can probably call the 1MDB effect, and just like in my previous exercise, you can say it was indeed a factor in pushing down the MYR. However, the effect was short-lived, again roughly coinciding with the sale of Edra Energy.So to the idea that 1MDB, and Malaysian governance generally, has any bearing on the Ringgit exchange rate: please go away. You’re not relevant anymore.

The second coincided with the US elections and probably more pertinently, BNM’s reaction to the change in global capital flows it triggered. I’d call this the fear-of-capital-controls effect. It’s still persisting, and I’d call it a roughly 5% deviation from where the MYR should be (around RM4.00 to the USD).

The bottom line is: Yes, the Ringgit is undervalued, but probably not as much as people think.