Thursday, October 29, 2009

DOS gets an upgrade

Read here. Data collection for Census 2010 will apparently be internet-based.

Monday, October 26, 2009

September CPI: Raya Blues Again

Almost loss in the shuffle of Friday's budget was the CPI report for September. Not that there were any surprises (index numbers, log annual and monthly changes, 2005=100):

As the impact of the fuel price hikes in July fade, you'll see inflation ticking up again. The faster pace of price increases in September can be squarely blamed on Ramadhan, for obvious reasons. To underscore this, here's the chart for my pseudo-core inflation measure(index numbers, log annual changes, 2005=100):

Note that even as growth in the main index started climbing, growth in the core index has dropped. Reading the numbers from DOS' report shows food, transport and miscellaneous items contributed to the bulk of the increase.

Otherwise, I'd consider September's developments encouraging. Price pressures indicate higher economic activity, which augurs well for a higher consumption reading for 3Q 2009. But again, that's really just the Raya effect, and not necessarily a symptom of a more solid rebound in the economy.

As the impact of the fuel price hikes in July fade, you'll see inflation ticking up again. The faster pace of price increases in September can be squarely blamed on Ramadhan, for obvious reasons. To underscore this, here's the chart for my pseudo-core inflation measure(index numbers, log annual changes, 2005=100):

Note that even as growth in the main index started climbing, growth in the core index has dropped. Reading the numbers from DOS' report shows food, transport and miscellaneous items contributed to the bulk of the increase.

Otherwise, I'd consider September's developments encouraging. Price pressures indicate higher economic activity, which augurs well for a higher consumption reading for 3Q 2009. But again, that's really just the Raya effect, and not necessarily a symptom of a more solid rebound in the economy.

Friday, October 23, 2009

Budget 2010: I'm (Mostly) Happy

…because lots of things on my wish list got ticked. Improve education? Check. More money for vocational schools? Check. Remove fuel subsidies? Mostly check. Do something for the lower-income groups and not just the poor? Check. But I’m getting ahead of myself. The numbers look half-decent to me:

But this is planned expenditure and expected revenue, either of which may change as we go through the year. The forecast is for a budget deficit of 5.6%, which isn’t bad either. As you can see from the charts above, most of the drop from this year’s expected deficit of 7.4% is coming from a rather savage cut in operating expenditure. The savings were garnered from a planned drop in procurement, subsidies and especially from “others”. I can’t imagine that would make many government contractors very happy.

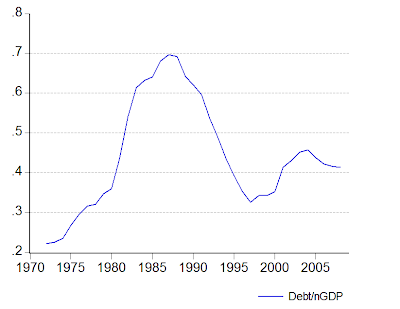

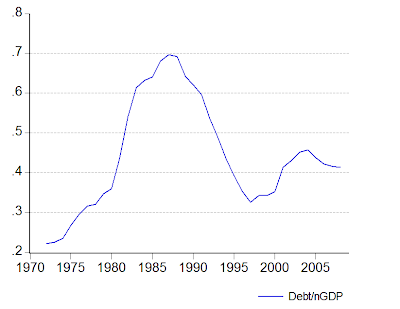

Based on these numbers and a projected outstanding debt of about RM420 billion by the end of 2010, we’re looking at the debt to GDP ratio reaching 58.0%, which ain’t good. It’s not quite the all-time high (69.7% in 1987) but it’s getting a little close for comfort. On the other hand the banking system is still awash in liquidity, which means there’s still plenty of capacity to absorb government borrowing without impacting private sector lending. With any luck, we should have a firmer recovery in place by 2011, and we can start on fiscal consolidation by then – or at least, get the pace of borrowing below the economy’s growth rate.

My notes on some of the things that stood out for me in the budget speech:

1. As expected, the government revised upwards the growth forecast for this year to -3.0% from -4.0%-5.0%. Next year’s forecast is between 2.0% to 3.0% - encouraging but not great, as it implies that there will be little closing of the output gap and because with population growth at the upper end of that figure, real per capita income growth will essentially be flat to slightly negative (the +2.5% increase quoted by the PM is in nominal terms).

2. 48k projects under the stimulus packages completed and another 40k projects going on right now – impressive numbers until you look at the government’s account at BNM. September figures aren’t out yet, but as of August the government was sitting on RM25.6 billion in cash, which means projects aren’t being implemented as fast as the government is ready to finance them.

3. Note the introduction of Public-Private Partnerships, which at least have the benefit of having projects in the pipeline. You may remember that RM20b Private Finance Initiatives (PFIs) were mentioned in 9MP as another method of reducing the need for public development spending. Try as I might, I can find no evidence in the last five years that any PFI initiatives were even begun, much less completed.

4. New privatization program? Does this mean Khazanah will be letting go its holdings? How is Ekuinas affected?

5. Rationalising R&D efforts, establishing National Innovation Centre and integrating R&D with patent, copyright and trademark registration. Don’t think this is enough – how about triple deduction on R&D spending?

6. RM0.9b for the tourism industry and a whole slew of initiatives – thumbs up. Also kudos for PR status equivalence between males and females marrying Malaysians.

7. 10MBit broadband? Where? How much? And will it stay up? And RM500 tax allowance barely covers the cost even if you’re taking the cheapest packages. Does wireless qualify? 3G?

8. Halal industry – too little too late I think. But the effort’s appreciated.

9. RM0.5b for agriculture. I’m still waiting for the shoe to drop and someone discovers that we’re neglecting doing anything about domestic distribution.

10. RM1.0b for incentives and subsidies to farmers and fishermen. Why not just give handouts? It’ll probably be more effective. Some of the “incentives” that used to be offered had some perverse effects.

11. GreenTechnology investment – not unexpected

12. Bringing pre-school education into the national system – about time. I’m wondering what this might mean in terms of employment of pre-school teachers.

13. Prestige schools and recognition of head masters – elitism? Or introducing competition into the school system? Time will tell. This isn't a new idea, but at least the government is listening.

14. For students, 4 measures that are bound to be popular – 30 non-race based national scholarships, converting loans to scholarships for 1st class honours, 50% discount for KTM rides, and best of all, subsidized broadband and netbook purchases. Lucky b****rs.

15. RM1.3b to improve polytechnics and community colleges, RM1.1b for training and vocational institutes. I really like this. Trying to put everyone through university education never struck me as a good strategy – you just get poor quality graduates. At least this way, some of our youth have a fighting chance at getting good jobs that don’t necessarily need an academic education, an education they might not be suited for. And I really like having SKM on the same level as diploma holders. I’m reminded of Germany’s apprenticeship system here, and it’s a potential solution towards upgrading our manufacturing capabilities and breaking reliance on low-wage type jobs.

16. Ar-Rahnu microcredit program – I don’t like this on principle. The whole idea of microcredit as pioneered by Grameen was to provide financing based on need and desire for work, not on the ability to put up collateral. The way this is structured, it just confines the hardcore poor in a poverty trap, surviving on handouts.

17. Still no GST!

18. RPGT is coming back!

19. RM10k for each AP! Woot!

20. Fuel subsidies abolished! Kind of. What the new system will be like and how it will be managed are still unknown. I’d actually go further and slap a tax on petrol for those who don’t qualify for the subsidy. The proceeds could help fund investment in green technologies.

21. Government child care centres! Now if only the private sector would follow suit.

22. Individual income tax cut to 26% and personal allowance raised to RM9k. I didn’t expect this and I’m not sure it’s warranted. It’s definitely a significant boost to consumer spending power, at least for those who pay taxes and especially those who are in the top tax bracket. But with the tax base already so narrow, I’m not sure this is a good move at all. Add the RM1k increase in the allowance for annuities and KWSP contributions, and you’re talking about narrowing the tax base even further.

23. Urban poor to include those earning less than RM3k – but with only RM48 million allocated for urban poverty eradication, that’s like spitting into the wind.

24. More trains for Komuter and LRT – I don’t think these will be enough, based on recent experience. Congestion has been increasing so rapidly, that these will only be stop-gap measures.

Overall, I'm not down on this budget - there were some gaps, but there were also some truly good ideas here. I can just imagine civil servants trying to get to grips with outcome based budgeting! Compared to DAP's alternative budget, this one's way weaker on transport, but much stronger (in my opinion) on education.

But this is planned expenditure and expected revenue, either of which may change as we go through the year. The forecast is for a budget deficit of 5.6%, which isn’t bad either. As you can see from the charts above, most of the drop from this year’s expected deficit of 7.4% is coming from a rather savage cut in operating expenditure. The savings were garnered from a planned drop in procurement, subsidies and especially from “others”. I can’t imagine that would make many government contractors very happy.

Based on these numbers and a projected outstanding debt of about RM420 billion by the end of 2010, we’re looking at the debt to GDP ratio reaching 58.0%, which ain’t good. It’s not quite the all-time high (69.7% in 1987) but it’s getting a little close for comfort. On the other hand the banking system is still awash in liquidity, which means there’s still plenty of capacity to absorb government borrowing without impacting private sector lending. With any luck, we should have a firmer recovery in place by 2011, and we can start on fiscal consolidation by then – or at least, get the pace of borrowing below the economy’s growth rate.

My notes on some of the things that stood out for me in the budget speech:

1. As expected, the government revised upwards the growth forecast for this year to -3.0% from -4.0%-5.0%. Next year’s forecast is between 2.0% to 3.0% - encouraging but not great, as it implies that there will be little closing of the output gap and because with population growth at the upper end of that figure, real per capita income growth will essentially be flat to slightly negative (the +2.5% increase quoted by the PM is in nominal terms).

2. 48k projects under the stimulus packages completed and another 40k projects going on right now – impressive numbers until you look at the government’s account at BNM. September figures aren’t out yet, but as of August the government was sitting on RM25.6 billion in cash, which means projects aren’t being implemented as fast as the government is ready to finance them.

3. Note the introduction of Public-Private Partnerships, which at least have the benefit of having projects in the pipeline. You may remember that RM20b Private Finance Initiatives (PFIs) were mentioned in 9MP as another method of reducing the need for public development spending. Try as I might, I can find no evidence in the last five years that any PFI initiatives were even begun, much less completed.

4. New privatization program? Does this mean Khazanah will be letting go its holdings? How is Ekuinas affected?

5. Rationalising R&D efforts, establishing National Innovation Centre and integrating R&D with patent, copyright and trademark registration. Don’t think this is enough – how about triple deduction on R&D spending?

6. RM0.9b for the tourism industry and a whole slew of initiatives – thumbs up. Also kudos for PR status equivalence between males and females marrying Malaysians.

7. 10MBit broadband? Where? How much? And will it stay up? And RM500 tax allowance barely covers the cost even if you’re taking the cheapest packages. Does wireless qualify? 3G?

8. Halal industry – too little too late I think. But the effort’s appreciated.

9. RM0.5b for agriculture. I’m still waiting for the shoe to drop and someone discovers that we’re neglecting doing anything about domestic distribution.

10. RM1.0b for incentives and subsidies to farmers and fishermen. Why not just give handouts? It’ll probably be more effective. Some of the “incentives” that used to be offered had some perverse effects.

11. GreenTechnology investment – not unexpected

12. Bringing pre-school education into the national system – about time. I’m wondering what this might mean in terms of employment of pre-school teachers.

13. Prestige schools and recognition of head masters – elitism? Or introducing competition into the school system? Time will tell. This isn't a new idea, but at least the government is listening.

14. For students, 4 measures that are bound to be popular – 30 non-race based national scholarships, converting loans to scholarships for 1st class honours, 50% discount for KTM rides, and best of all, subsidized broadband and netbook purchases. Lucky b****rs.

15. RM1.3b to improve polytechnics and community colleges, RM1.1b for training and vocational institutes. I really like this. Trying to put everyone through university education never struck me as a good strategy – you just get poor quality graduates. At least this way, some of our youth have a fighting chance at getting good jobs that don’t necessarily need an academic education, an education they might not be suited for. And I really like having SKM on the same level as diploma holders. I’m reminded of Germany’s apprenticeship system here, and it’s a potential solution towards upgrading our manufacturing capabilities and breaking reliance on low-wage type jobs.

16. Ar-Rahnu microcredit program – I don’t like this on principle. The whole idea of microcredit as pioneered by Grameen was to provide financing based on need and desire for work, not on the ability to put up collateral. The way this is structured, it just confines the hardcore poor in a poverty trap, surviving on handouts.

17. Still no GST!

18. RPGT is coming back!

19. RM10k for each AP! Woot!

20. Fuel subsidies abolished! Kind of. What the new system will be like and how it will be managed are still unknown. I’d actually go further and slap a tax on petrol for those who don’t qualify for the subsidy. The proceeds could help fund investment in green technologies.

21. Government child care centres! Now if only the private sector would follow suit.

22. Individual income tax cut to 26% and personal allowance raised to RM9k. I didn’t expect this and I’m not sure it’s warranted. It’s definitely a significant boost to consumer spending power, at least for those who pay taxes and especially those who are in the top tax bracket. But with the tax base already so narrow, I’m not sure this is a good move at all. Add the RM1k increase in the allowance for annuities and KWSP contributions, and you’re talking about narrowing the tax base even further.

23. Urban poor to include those earning less than RM3k – but with only RM48 million allocated for urban poverty eradication, that’s like spitting into the wind.

24. More trains for Komuter and LRT – I don’t think these will be enough, based on recent experience. Congestion has been increasing so rapidly, that these will only be stop-gap measures.

Overall, I'm not down on this budget - there were some gaps, but there were also some truly good ideas here. I can just imagine civil servants trying to get to grips with outcome based budgeting! Compared to DAP's alternative budget, this one's way weaker on transport, but much stronger (in my opinion) on education.

Labels:

fiscal deficit,

government budget,

income tax,

national debt

Thursday, October 22, 2009

Trade Elasticities and the Ringgit

This post ought to make happy those who think that the Ringgit should appreciate to force Malaysian firms to be more competitive, as well as those who think the currency is being manipulated for export competitiveness.

Some background is called for here. What’s an elasticity? In simple terms, it’s the response of one variable to a change in another. In the present post, I’m calculating the response of exports and imports to a change in demand and supply variables, specifically the exchange rate (both nominal and real trade-weighted indexes), Malaysian GDP, as well as external GDP.

In the literature, for a change in the exchange rate to affect the trade balance, then the sum of the absolute values of the exchange elasticity of exports and imports have to be greater than unity (1). This is known as the Marshall-Lerner condition.

Since my formulation of exchange rates is different (for simplification purposes I use the reciprocal of the normal definition), then for the Marshall-Lerner condition to hold my calculated sum of exchange elasticities should be less than -1.

Some disclaimers before proceeding: I’m not using any lag structure (past values of variables), even though I really ought to – economic variables do not respond instantaneously to changes in other economic variables.

Also by rights, the variables should be used within a vector autoregression model rather than the single equation estimates I’m using here, to capture feedback effects and dynamics – but the models I’ve tried so far were unstable and generated some perverse results (Malaysian GDP granger causing World GDP for instance). I’m going to continue working on that, as using a VAR is the more technically correct approach (you run up straight against the Lucas critique otherwise), but the current estimates will have to do for now.

The demand model specifications are:

Log(exports) = log(exchange rate) + log(World GDP) + monthly seasonal dummies

Log(imports) = log(exchange rate) + log(Malaysian GDP) + log(exports) + monthly seasonal dummies

Data is at monthly frequencies (with interpolated GDP data), and the sample period is 2000:1 to 2007:12. World GDP was proxied by using a trade-weighted geometric average of US, Japan, EU, China and Singapore GDP (Malaysia’s five biggest trading partners). For the import demand functions, I had to use an ARCH model rather than standard OLS.

So what did I get?

For nominal exchange rates:

Exports

A 1% appreciation in the exchange rate results in a 1.55% fall in exports

A 1% rise in world GDP results in a 1.50% rise in exports

Imports

A 1% appreciation in the exchange rate results in a 0.28% rise in imports

A 1% rise in exports results in a 0.97% rise in imports

Changes in Malaysian GDP had no significant effects on imports

For real exchange rates:

Exports

A 1% appreciation in the exchange rate results in a 1.57% fall in exports

A 1% rise in world GDP results in a 1.49% rise in exports

Imports

A 1% appreciation in the exchange rate results in a 0.34% rise in imports

A 1% rise in exports results in a 0.99% rise in imports

Changes in Malaysian GDP had no significant effects on imports

So a depreciation in the exchange rate (“weaker” if you will) does result in an increase in the trade balance, as the Marshall-Lerner condition holds for both nominal and real exchange rates. Adding the export elasticity with the import elasticity yields:

Nominal

-1.55 - 0.28 = -1.83

Real

-1.57 – 0.34 = -1.91

…so both sums are less than -1.

Equally, an appreciation of the exchange rate will result in a deterioration of the trade balance, as exports fall faster than imports. At least, that’s what these figures suggest.

However, because I haven’t modeled feedback effects (except through the inclusion of the export series in the import demand equation), you should probably take these results with a bucket of salt. The fact that exports cause a one-to-one change in imports suggests that adding dynamics might change the picture dramatically, but I haven’t yet come up with a model I’m happy with.

I’m also working on breaking down the components of both exports and imports, which might yield further insights. One preliminary result that seems to be holding up: the exchange rate has no impact on imports of consumption or intermediate goods, which also suggests that the import demand functions I’ve estimated are questionable.

Technical Notes

1. Trade data from DOS

2. GDP data from IMF International Financial Statistics

Some background is called for here. What’s an elasticity? In simple terms, it’s the response of one variable to a change in another. In the present post, I’m calculating the response of exports and imports to a change in demand and supply variables, specifically the exchange rate (both nominal and real trade-weighted indexes), Malaysian GDP, as well as external GDP.

In the literature, for a change in the exchange rate to affect the trade balance, then the sum of the absolute values of the exchange elasticity of exports and imports have to be greater than unity (1). This is known as the Marshall-Lerner condition.

Since my formulation of exchange rates is different (for simplification purposes I use the reciprocal of the normal definition), then for the Marshall-Lerner condition to hold my calculated sum of exchange elasticities should be less than -1.

Some disclaimers before proceeding: I’m not using any lag structure (past values of variables), even though I really ought to – economic variables do not respond instantaneously to changes in other economic variables.

Also by rights, the variables should be used within a vector autoregression model rather than the single equation estimates I’m using here, to capture feedback effects and dynamics – but the models I’ve tried so far were unstable and generated some perverse results (Malaysian GDP granger causing World GDP for instance). I’m going to continue working on that, as using a VAR is the more technically correct approach (you run up straight against the Lucas critique otherwise), but the current estimates will have to do for now.

The demand model specifications are:

Log(exports) = log(exchange rate) + log(World GDP) + monthly seasonal dummies

Log(imports) = log(exchange rate) + log(Malaysian GDP) + log(exports) + monthly seasonal dummies

Data is at monthly frequencies (with interpolated GDP data), and the sample period is 2000:1 to 2007:12. World GDP was proxied by using a trade-weighted geometric average of US, Japan, EU, China and Singapore GDP (Malaysia’s five biggest trading partners). For the import demand functions, I had to use an ARCH model rather than standard OLS.

So what did I get?

For nominal exchange rates:

Exports

A 1% appreciation in the exchange rate results in a 1.55% fall in exports

A 1% rise in world GDP results in a 1.50% rise in exports

Imports

A 1% appreciation in the exchange rate results in a 0.28% rise in imports

A 1% rise in exports results in a 0.97% rise in imports

Changes in Malaysian GDP had no significant effects on imports

For real exchange rates:

Exports

A 1% appreciation in the exchange rate results in a 1.57% fall in exports

A 1% rise in world GDP results in a 1.49% rise in exports

Imports

A 1% appreciation in the exchange rate results in a 0.34% rise in imports

A 1% rise in exports results in a 0.99% rise in imports

Changes in Malaysian GDP had no significant effects on imports

So a depreciation in the exchange rate (“weaker” if you will) does result in an increase in the trade balance, as the Marshall-Lerner condition holds for both nominal and real exchange rates. Adding the export elasticity with the import elasticity yields:

Nominal

-1.55 - 0.28 = -1.83

Real

-1.57 – 0.34 = -1.91

…so both sums are less than -1.

Equally, an appreciation of the exchange rate will result in a deterioration of the trade balance, as exports fall faster than imports. At least, that’s what these figures suggest.

However, because I haven’t modeled feedback effects (except through the inclusion of the export series in the import demand equation), you should probably take these results with a bucket of salt. The fact that exports cause a one-to-one change in imports suggests that adding dynamics might change the picture dramatically, but I haven’t yet come up with a model I’m happy with.

I’m also working on breaking down the components of both exports and imports, which might yield further insights. One preliminary result that seems to be holding up: the exchange rate has no impact on imports of consumption or intermediate goods, which also suggests that the import demand functions I’ve estimated are questionable.

Technical Notes

1. Trade data from DOS

2. GDP data from IMF International Financial Statistics

Labels:

export competitiveness,

exports,

external trade,

imports,

NEER,

REER,

trade elasticities

Direct Investment, the Balance of Payments, and the International Investment Position

It’s no secret that capital has been leaving the country, even as the trade balance generates a continuous surplus. Breaking down the financial account of the balance of payments (BOP), here’s what Malaysia has experienced over the past ten years or so (1999-2008, RM Millions):

While FDI has been increasing, it doesn’t even begin to cover outward investment or the (negative) “other” investment. Portfolio investment has ebbed and flowed depending on the vagaries of the stock market, except for last year with a flight to safety from all emerging markets prompting a sell down of equities and other assets in favour of (paradoxically) USD assets. That spike has partially reversed in 2009.

The cumulative numbers are staggering: negative RM156.6 billion in outward direct investment, RM257.0 billion in other investment, and RM52.8 billion in portfolio investment, for a total outflow as at end of 2008 of RM 466.5 billion.

That’s right, nearly half a trillion Ringgit, or half of current M3.

The question is: is this outward flow occurring because foreigners are abandoning Malaysia as an investment destination, or is this Malaysian companies investing abroad? The former is downright bad for obvious reasons, while the latter is only somewhat good as it can be counterbalanced by subsequent inward income flows. Anecdotal evidence favours the latter, as there’s plenty of news of domestic corporations making big bets on other emerging markets – such as Maybank in Indonesia, and Maxis in India.

However, there is an inherent flaw in using BOP data to figure out where investment is actually going, because it is a flow measurement, not a stock measurement. With BOP data, we’re completely ignoring the possibility of reinvestment of profits and earnings. This doesn’t turn up in financial flows, and it’s difficult to judge private sector investment attitudes towards Malaysia based on BOP data alone.

It is more than possible that the outward flow of investment is due not only to Malaysian firms investing overseas, but also to foreign-owned firms redirecting investment overseas from retained profits generated locally. That in itself is not great news, but it’s certainly more palatable than foreign firms pulling up stakes and leaving. What we need is to get a view of foreign and domestic holdings of investment stock, not just flows as in the BOP, to get a better idea of what’s going on.

Luckily, we do actually have such a report – the International Investment Position. This is a relatively new set of statistical information (as such things go), and data availability is still very patchy for many countries. Malaysia’s for instance, only goes back to 2001 and was first published in 2005. Prior to the IIP, figuring out a country’s investment stock position (more commonly known as the net foreign asset position) was a matter of guesstimation and to be honest it still is, even with the IIP – you’re depending on accurate reporting to compile the statistics and there are many offshore money centers, some with dubious legal enforcement.

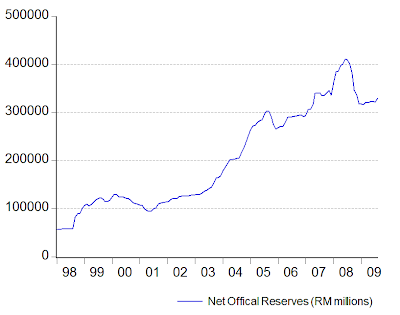

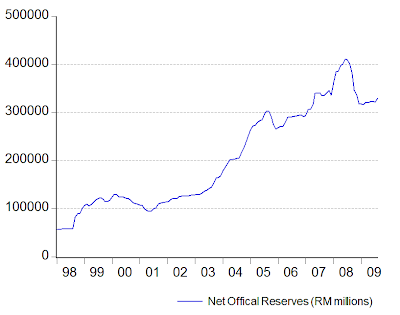

Be that as it may, the IIP makes for interesting reading. I’ve posted on Malaysia’s net foreign asset position, and the IIP (with some discrepancies) confirms the notion that Malaysia is now a net creditor nation (RM Millions):

Since we’re at the moment interested in the direct investment position, here’s both the asset and liabilities side (RM millions):

External Direct Investment Assets

External Direct Investment Liabilities

So we are primarily looking at Malaysians investing abroad, with a very small pullback in foreign inward investment in 2008, which is understandable given economic conditions over the past two years. The numbers don’t quite reconcile with the BOP data, mainly due to slightly different categorization as well as the element of reinvested earnings involved.

And of course, the net portfolio position is still sharply negative (RM millions):

But on the whole, we’re in a better than decent position here (assuming the positive IIP holds). Even though investment and capital are leaving the country, this is counterbalanced by an increase in future potential earnings from abroad, as well as less pressure to keep reserves high. This also puts upward pressure on the exchange rate.

Technical Notes

1. BOP data from BNM's Monthly Statistical Bulletin

2. The International Investment Position Reports available from DOS

While FDI has been increasing, it doesn’t even begin to cover outward investment or the (negative) “other” investment. Portfolio investment has ebbed and flowed depending on the vagaries of the stock market, except for last year with a flight to safety from all emerging markets prompting a sell down of equities and other assets in favour of (paradoxically) USD assets. That spike has partially reversed in 2009.

The cumulative numbers are staggering: negative RM156.6 billion in outward direct investment, RM257.0 billion in other investment, and RM52.8 billion in portfolio investment, for a total outflow as at end of 2008 of RM 466.5 billion.

That’s right, nearly half a trillion Ringgit, or half of current M3.

The question is: is this outward flow occurring because foreigners are abandoning Malaysia as an investment destination, or is this Malaysian companies investing abroad? The former is downright bad for obvious reasons, while the latter is only somewhat good as it can be counterbalanced by subsequent inward income flows. Anecdotal evidence favours the latter, as there’s plenty of news of domestic corporations making big bets on other emerging markets – such as Maybank in Indonesia, and Maxis in India.

However, there is an inherent flaw in using BOP data to figure out where investment is actually going, because it is a flow measurement, not a stock measurement. With BOP data, we’re completely ignoring the possibility of reinvestment of profits and earnings. This doesn’t turn up in financial flows, and it’s difficult to judge private sector investment attitudes towards Malaysia based on BOP data alone.

It is more than possible that the outward flow of investment is due not only to Malaysian firms investing overseas, but also to foreign-owned firms redirecting investment overseas from retained profits generated locally. That in itself is not great news, but it’s certainly more palatable than foreign firms pulling up stakes and leaving. What we need is to get a view of foreign and domestic holdings of investment stock, not just flows as in the BOP, to get a better idea of what’s going on.

Luckily, we do actually have such a report – the International Investment Position. This is a relatively new set of statistical information (as such things go), and data availability is still very patchy for many countries. Malaysia’s for instance, only goes back to 2001 and was first published in 2005. Prior to the IIP, figuring out a country’s investment stock position (more commonly known as the net foreign asset position) was a matter of guesstimation and to be honest it still is, even with the IIP – you’re depending on accurate reporting to compile the statistics and there are many offshore money centers, some with dubious legal enforcement.

Be that as it may, the IIP makes for interesting reading. I’ve posted on Malaysia’s net foreign asset position, and the IIP (with some discrepancies) confirms the notion that Malaysia is now a net creditor nation (RM Millions):

Since we’re at the moment interested in the direct investment position, here’s both the asset and liabilities side (RM millions):

External Direct Investment Assets

External Direct Investment Liabilities

So we are primarily looking at Malaysians investing abroad, with a very small pullback in foreign inward investment in 2008, which is understandable given economic conditions over the past two years. The numbers don’t quite reconcile with the BOP data, mainly due to slightly different categorization as well as the element of reinvested earnings involved.

And of course, the net portfolio position is still sharply negative (RM millions):

But on the whole, we’re in a better than decent position here (assuming the positive IIP holds). Even though investment and capital are leaving the country, this is counterbalanced by an increase in future potential earnings from abroad, as well as less pressure to keep reserves high. This also puts upward pressure on the exchange rate.

Technical Notes

1. BOP data from BNM's Monthly Statistical Bulletin

2. The International Investment Position Reports available from DOS

Wednesday, October 21, 2009

Strong Vs Weak Ringgit Again

Izwan Idris asks if we should have a stronger Ringgit:

"One theory why the ringgit is limping behind its regional peers is that the ringgit basket is US dollar-heavy.

This explains why the currency continues to track the US dollar movement closely under the current 'managed float' system, rather than reflecting Malaysia’s own economic health.

Typically, a weak ringgit, in a way, works as a subsidy for local exporters by way of keeping export prices “competitive” against manufacturers based in other countries. This strategy helps local manufacturers earn more ringgit for every dollar sold but, on the flip side, Malaysians will have to pay more in ringgit for imported goods and services."

There are so many problems with this post I don't even know where to begin (and I'm not even going to comment on the grammar and tense usage mistakes).

So from the top (my comments in blue for legibility):

1. "The ringgit was officially de-pegged against the US dollar from a fixed rate of 3.80 on July 21, 2005 and, like the Singapore dollar, is currently under a float system tied to a basket of currencies."

Plain wrong. MAS follow an explicit exchange rate policy with interest rates and money supply free to vary (within limits), so that part is correct. BNM focuses on short term interest rates (the Official Policy Rate or OPR), with the exchange rate and money supply free to vary within limits in terms of volatility - so that part is false.

Fail.

2. "Economists estimate that the United States accounts for about 20% of Malaysia’s total trade, but as much of 80% of the country’s foreign transactions are denominated in US dollar."

I'll concede the latter statement (in the absence of firm evidence), but the former needs to be substantiated. Malaysia's direct trade with the US was last at 20% of total trade 10 years ago (the peak was 20.9% in 1998). As of last year, the US trade share has fallen to 11.8% - behind Singapore and approximately on par with Japan and China.

Big fail.

3. "One theory why the ringgit is limping behind its regional peers is that the ringgit basket is US dollar-heavy.

This explains why the currency continues to track the US dollar movement closely under the current “managed float” system, rather than reflecting Malaysia’s own economic health."

This is not a theory - it's a hypothesis, and an easily disproved one at that. First, as I pointed out in point 1. above, officially the Ringgit is in a free-float system, with the policy focus on interest rates rather than the exchange rate.

Second, if the Ringgit is truly tracking the USD then from a statistical perspective the MYRUSD rate should have a smaller standard deviation compared to other MYR cross rates. Out of the currencies of our major trading partners (sample 2005:6 to 2009:9, daily frequencies), the USD only ranks a distant third behind EUR and SGD, and only very marginally in front of CAD, GBP and SWF. Hardly conclusive evidence that we have a de facto peg to a USD-heavy basket.

Looking at the period when BNM was actively managing the exchange rate back in the 1980s bears this result out. For the sample 1980:1 to 1989:12 (again, daily frequencies), the USDMYR standard deviation was far and away the lowest by a couple of orders of magnitude, followed distantly by CAD and GBP, and even more distantly by the SGD, AUD, and ECU.

[Edit]: I should also point out that current MYRUSD volatility (as measured by the standard deviation) is 5x greater than it was in the 1980s.

Given relative movements and volatility in currencies against MYR over the past four years, if BNM is using a currency basket to "manage" the Ringgit, it's a very, very strange one.

Again, fail.

4. "The US dollar had fallen 15% against a basket of six major currencies since March, based on the performance of the US dollar index traded in New York. During this period, the won shot up 34% against the US dollar, followed by the rupiah’s 27% appreciation over the same period. The rupee gained 12%, while the Singapore dollar strengthened by 11%.

The ringgit lagged behind with a 10% rise, which was slightly better than the baht’s 9% advance."

This appears to imply (rather disingenuously) that MYR is being deliberately kept weak as regional currencies have advanced more than the MYR. In academic economic circles, this is an example of "data-mining" - selecting the data or the model that best supports your hypothesis or preconceptions, and hang the bigger picture.

To show what I mean, here are the percentage movements in the 2008:9 to 2009:2 timeframe (i.e. from the beginning of the financial meltdown to approximately the lowest point):

a. USD Major Currencies Index = +13.1%

b. KRW = -40.8%

c. IDR = -30.8%

d. INR = -17.6%

e. SGD = -9.1%

f. MYR = -9.2%

g. THB = -5.6%

We have an almost mirror image from the statistics quoted in the article. MYR hasn't gained much in the last six months or so, for the simple reason that it didn't fall as much during the worse of the crisis.

As Benjamin Disraeli was once purported to have said, "There are three kinds of lies: lies, damned lies, and statistics."

Fail.

5. "At near-0% interest, the US dollar is a cheap currency to borrow, but yields almost nothing to keep. Savvy international investors lend money in the United States and use the cash to buy assets elsewhere."

Let's be charitable - I can only think of this (emphasis mine) as a typo. It should be borrow not lend.

6. "Commodities and Asian equities are the big winners. Gold, which is the traditional hedge, is now trading at record high of US$1,065 an ounce.

Indonesian stocks have the highest return in US dollar terms year-to-date. The Jakarta Composite Index rose 84% in its local currency, but shot up 122% if the gains are reflected in US dollar.

At 1,265 points yesterday, the FBM KL Composite’s 48% rise year-to-date was the least among other regional stock indices."

Same as point 4 above - we haven't risen as much, because we didn't lose so much during the depths of the crisis either. Using the same sample period as my currency example (Oct 2008-Feb 2009), the JKSE fell 40.6% during that period and was 54.6% off its all time high. The KLCI by comparison fell just 19.1%, and was 41.3% off its all time high. A more regional comparison also holds - the KLCI was among the better performers in terms of holding its value in the past two years.

Do I sense a pattern here? Fail.

7. "High income equals to high purchasing power. To achieve this, it will require shifting the whole economy away from its current low-cost manufacturing base to a more service-oriented one, which is more or less what Singaporeans had done."

Finally a sensible statement - which unfortunately completely missed the connection between a stronger exchange value and having a services-based, high income economy. The latter begets the former, not the other way around. Singapore has an appreciating currency vis-à-vis Malaysia, because they have a stronger services (non-tradables) sector. There's also the demographic angle: countries with higher youth dependency ratios tend to have "weaker" currencies, and Singapore is "aging" faster than Malaysia is.

Going for a strong currency policy without improvement in the non-tradables sector is a triumph of form over substance.

8. "Keeping the ringgit undervalue against its regional counterpart may be counter-productive in the longer run, as it will only fuel our addiction to cheap exports industries that only attract unskilled foreign labour."

What's truly ironic is that having a "cheap" currency is not necessarily an advantage when you have low-value added export industries (i.e. with high import content), and especially not when a portion of your exports is commodity based. I'll touch on this when I get around to posting on trade elasticities. He made the point earlier when talking about the effect of exchange rates on exports and imports (see quote at the top of this post), but again missed the connection.

But as I've extensively written on before (for instance here, here, and here), I do not believe the Ringgit is substantially undervalued based on Malaysia's economic structure and current fundamentals (like terms of trade, services/exports shares, trade barriers, capital and financial stocks and flows etc). Nor do I believe that there is an implicit policy to keep the MYR undervalued relative to any currency. As far as I'm concerned, MYR is close to its trade-weighted fair value with a bias towards appreciation as the country increasingly shifts towards services as the growth sector.

Technical Notes:

1. MYRUSD exchange rates and MYR cross rates against other currencies derived from the Federal Reserve's Report H.10, except for IDR, where data was sourced from Pacific Exchange Rate Service.

2. Stock market index data from Yahoo! Finance.

"One theory why the ringgit is limping behind its regional peers is that the ringgit basket is US dollar-heavy.

This explains why the currency continues to track the US dollar movement closely under the current 'managed float' system, rather than reflecting Malaysia’s own economic health.

Typically, a weak ringgit, in a way, works as a subsidy for local exporters by way of keeping export prices “competitive” against manufacturers based in other countries. This strategy helps local manufacturers earn more ringgit for every dollar sold but, on the flip side, Malaysians will have to pay more in ringgit for imported goods and services."

There are so many problems with this post I don't even know where to begin (and I'm not even going to comment on the grammar and tense usage mistakes).

So from the top (my comments in blue for legibility):

1. "The ringgit was officially de-pegged against the US dollar from a fixed rate of 3.80 on July 21, 2005 and, like the Singapore dollar, is currently under a float system tied to a basket of currencies."

Plain wrong. MAS follow an explicit exchange rate policy with interest rates and money supply free to vary (within limits), so that part is correct. BNM focuses on short term interest rates (the Official Policy Rate or OPR), with the exchange rate and money supply free to vary within limits in terms of volatility - so that part is false.

Fail.

2. "Economists estimate that the United States accounts for about 20% of Malaysia’s total trade, but as much of 80% of the country’s foreign transactions are denominated in US dollar."

I'll concede the latter statement (in the absence of firm evidence), but the former needs to be substantiated. Malaysia's direct trade with the US was last at 20% of total trade 10 years ago (the peak was 20.9% in 1998). As of last year, the US trade share has fallen to 11.8% - behind Singapore and approximately on par with Japan and China.

Big fail.

3. "One theory why the ringgit is limping behind its regional peers is that the ringgit basket is US dollar-heavy.

This explains why the currency continues to track the US dollar movement closely under the current “managed float” system, rather than reflecting Malaysia’s own economic health."

This is not a theory - it's a hypothesis, and an easily disproved one at that. First, as I pointed out in point 1. above, officially the Ringgit is in a free-float system, with the policy focus on interest rates rather than the exchange rate.

Second, if the Ringgit is truly tracking the USD then from a statistical perspective the MYRUSD rate should have a smaller standard deviation compared to other MYR cross rates. Out of the currencies of our major trading partners (sample 2005:6 to 2009:9, daily frequencies), the USD only ranks a distant third behind EUR and SGD, and only very marginally in front of CAD, GBP and SWF. Hardly conclusive evidence that we have a de facto peg to a USD-heavy basket.

Looking at the period when BNM was actively managing the exchange rate back in the 1980s bears this result out. For the sample 1980:1 to 1989:12 (again, daily frequencies), the USDMYR standard deviation was far and away the lowest by a couple of orders of magnitude, followed distantly by CAD and GBP, and even more distantly by the SGD, AUD, and ECU.

[Edit]: I should also point out that current MYRUSD volatility (as measured by the standard deviation) is 5x greater than it was in the 1980s.

Given relative movements and volatility in currencies against MYR over the past four years, if BNM is using a currency basket to "manage" the Ringgit, it's a very, very strange one.

Again, fail.

4. "The US dollar had fallen 15% against a basket of six major currencies since March, based on the performance of the US dollar index traded in New York. During this period, the won shot up 34% against the US dollar, followed by the rupiah’s 27% appreciation over the same period. The rupee gained 12%, while the Singapore dollar strengthened by 11%.

The ringgit lagged behind with a 10% rise, which was slightly better than the baht’s 9% advance."

This appears to imply (rather disingenuously) that MYR is being deliberately kept weak as regional currencies have advanced more than the MYR. In academic economic circles, this is an example of "data-mining" - selecting the data or the model that best supports your hypothesis or preconceptions, and hang the bigger picture.

To show what I mean, here are the percentage movements in the 2008:9 to 2009:2 timeframe (i.e. from the beginning of the financial meltdown to approximately the lowest point):

a. USD Major Currencies Index = +13.1%

b. KRW = -40.8%

c. IDR = -30.8%

d. INR = -17.6%

e. SGD = -9.1%

f. MYR = -9.2%

g. THB = -5.6%

We have an almost mirror image from the statistics quoted in the article. MYR hasn't gained much in the last six months or so, for the simple reason that it didn't fall as much during the worse of the crisis.

As Benjamin Disraeli was once purported to have said, "There are three kinds of lies: lies, damned lies, and statistics."

Fail.

5. "At near-0% interest, the US dollar is a cheap currency to borrow, but yields almost nothing to keep. Savvy international investors lend money in the United States and use the cash to buy assets elsewhere."

Let's be charitable - I can only think of this (emphasis mine) as a typo. It should be borrow not lend.

6. "Commodities and Asian equities are the big winners. Gold, which is the traditional hedge, is now trading at record high of US$1,065 an ounce.

Indonesian stocks have the highest return in US dollar terms year-to-date. The Jakarta Composite Index rose 84% in its local currency, but shot up 122% if the gains are reflected in US dollar.

At 1,265 points yesterday, the FBM KL Composite’s 48% rise year-to-date was the least among other regional stock indices."

Same as point 4 above - we haven't risen as much, because we didn't lose so much during the depths of the crisis either. Using the same sample period as my currency example (Oct 2008-Feb 2009), the JKSE fell 40.6% during that period and was 54.6% off its all time high. The KLCI by comparison fell just 19.1%, and was 41.3% off its all time high. A more regional comparison also holds - the KLCI was among the better performers in terms of holding its value in the past two years.

Do I sense a pattern here? Fail.

7. "High income equals to high purchasing power. To achieve this, it will require shifting the whole economy away from its current low-cost manufacturing base to a more service-oriented one, which is more or less what Singaporeans had done."

Finally a sensible statement - which unfortunately completely missed the connection between a stronger exchange value and having a services-based, high income economy. The latter begets the former, not the other way around. Singapore has an appreciating currency vis-à-vis Malaysia, because they have a stronger services (non-tradables) sector. There's also the demographic angle: countries with higher youth dependency ratios tend to have "weaker" currencies, and Singapore is "aging" faster than Malaysia is.

Going for a strong currency policy without improvement in the non-tradables sector is a triumph of form over substance.

8. "Keeping the ringgit undervalue against its regional counterpart may be counter-productive in the longer run, as it will only fuel our addiction to cheap exports industries that only attract unskilled foreign labour."

What's truly ironic is that having a "cheap" currency is not necessarily an advantage when you have low-value added export industries (i.e. with high import content), and especially not when a portion of your exports is commodity based. I'll touch on this when I get around to posting on trade elasticities. He made the point earlier when talking about the effect of exchange rates on exports and imports (see quote at the top of this post), but again missed the connection.

But as I've extensively written on before (for instance here, here, and here), I do not believe the Ringgit is substantially undervalued based on Malaysia's economic structure and current fundamentals (like terms of trade, services/exports shares, trade barriers, capital and financial stocks and flows etc). Nor do I believe that there is an implicit policy to keep the MYR undervalued relative to any currency. As far as I'm concerned, MYR is close to its trade-weighted fair value with a bias towards appreciation as the country increasingly shifts towards services as the growth sector.

Technical Notes:

1. MYRUSD exchange rates and MYR cross rates against other currencies derived from the Federal Reserve's Report H.10, except for IDR, where data was sourced from Pacific Exchange Rate Service.

2. Stock market index data from Yahoo! Finance.

Tuesday, October 20, 2009

Tan Sri Governor's Thoughts On MYR...

...are the same as mine:

"Asked if the ringgit should not be allowed to appreciate too much as economic growth could be affected, she said the current level of the currency actually reflected the country's economic fundamentals.

'I want to emphasise that our export sector has been resilient despite the appreciation of the ringgit,' she said."

Read the rest of her comments here. Regardless of this consistently given message (I've heard this same comment from her quite a few times in the past four years), I don't think any diehards are going to change their position that the Ringgit is undervalued.

I'm still working on the promised post on trade elasticities - or rather, trying to find the time to work on it - but my first impressions were correct.

Yup, my initial work-ups were wrong.

I was looking primarily at the time series properties of exports and imports as they relate to the exchange rate. After a quick run through of the literature, turns out that you should actually do fully-specified export and import demand models. Since that's beyond the scope of this blog, I'm working on reduced-form models (only essential variables, not too many lags). At the moment I'm getting some unexpected results, even by my stubbornly contrarian standards.

What's this to do with exchange rates? It has to do with the second part of her comment, on trade. Stay tuned.

"Asked if the ringgit should not be allowed to appreciate too much as economic growth could be affected, she said the current level of the currency actually reflected the country's economic fundamentals.

'I want to emphasise that our export sector has been resilient despite the appreciation of the ringgit,' she said."

Read the rest of her comments here. Regardless of this consistently given message (I've heard this same comment from her quite a few times in the past four years), I don't think any diehards are going to change their position that the Ringgit is undervalued.

I'm still working on the promised post on trade elasticities - or rather, trying to find the time to work on it - but my first impressions were correct.

Yup, my initial work-ups were wrong.

I was looking primarily at the time series properties of exports and imports as they relate to the exchange rate. After a quick run through of the literature, turns out that you should actually do fully-specified export and import demand models. Since that's beyond the scope of this blog, I'm working on reduced-form models (only essential variables, not too many lags). At the moment I'm getting some unexpected results, even by my stubbornly contrarian standards.

What's this to do with exchange rates? It has to do with the second part of her comment, on trade. Stay tuned.

Monday, October 19, 2009

Random Thoughts on Budget 2010

I'll be honest - I've never been good at reading the tea leaves when it comes to the budget, except in aggregate. Micro-level policy has never been my strong suit, and I'm far more comfortable diagnosing monetary policy and real indicators. Having said that, given the crossroads that Malaysia is at, it's such an interesting period to be an economics observer (or voyeur if you prefer), that I really can't pass this up. Be warned, this is going to somewhat of a stream-of-conciousness post, with no real point to make!

My macro-view of the economy has evolved, but not changed significantly in the last six months. I think the stimulus packages were on balance necessary and useful, if only to turn around consumer and business confidence rather than any real effects they may have on the economy. I suppose it'd be nice to have the morale boost without the financial outlay, but I'm not sure people (including politicians themselves) would accept that, especially in the heat of the crisis. The national debt is climbing rapidly, but not to any serious level as yet, and certainly well below any point where borrowing costs or domestic liquidity becomes a problem.

Real indicators are generally all creeping up, Aug/Sept slowdowns notwithstanding. As I've talked about before, this is a factor of Ramadhan/Eid el Fitri artificially crimping output. I've already recorded that the economy has already passed the recession stage and (because of the eccentricities of Malaysian statistical computations) we should see official confirmation next month when the 3Q figures are scheduled to be released. I'm still concerned that this recovery may turn out to be inventory-driven which may see us slowing again in the next couple of quarters, but I'd say a "W"-shaped recovery isn't a high probability at this stage.

So it's time to deal with the structural headwinds besetting the Malaysian economy, where fiscal policy is best effective (or least damaging, depending on your philosophical viewpoint). What are the key problems? In no particular order...

1. Caught in a middle income trap

2. Youth unemployment

3. Poor R&D spending

4. Quality education

5. Affordable healthcare and housing

6. Ineffective transport (and auto) policy

7. Subsidy mentality

8. Income inequality

9. Low-value added manufacturing

10. Declining oil reserves (and thus future oil revenues)

11. Narrow tax base

...and the list goes on. I'm sure I've left quite a few biggies off.

There's no way the government (or any government) will make headway in all these areas in one year, or even during the 5-year period of our development plans.

One key thing I am happy with is the shift to a services-based growth strategy. I've been talking about this as the way to go since around 2005, when it became obvious that export-led manufacturing had reached a dead-end - despite a global trade boom, Malaysian electronics exports flat-lined from that point on. A services-based strategy would be the logical evolution of the economy, one which other high income countries have already undergone. Because the labour market would be less affected by international arbitrage, incomes should rise independently of productivity as labour demand in the services sector rises. This shift should also help to resolve some of the problems in the list above, and incidentally put upward pressure on the exchange rate.

I remember reading Morgan Stanley's Global Economic Forum (good for a quick, intelligent view of economic happenings around the world - Stephen Roach was the Guru for me) back in 2005-2006, that Malaysia should explicitly follow a dual-track, hybrid strategy - both export-led manufacturing as well as export commodities-based. Thailand was put up as a good example to follow. I think that's a step sideways more than anything - you're depending on a lack of correlation between the two sectors to maintain domestic economic activity.

Still, that was a few years lost in getting a leg up the income ladder. One of the problems (of many) with a centrally directed strategy is that bureaucrats will tend to stick with a particular solution, even when it's obviously not working (like investment quotas). In this case, I'm wondering if we've left it too late. The increasing adoption of the internet as a business tool means that costs of communications has dropped rapidly, which reduces some of the barriers that hitherto have isolated domestic services sectors from foreign competition.

Oh, there certainly continues to be high barriers to labour mobility, especially in high-income professional services (lawyers) and in low-income services (think fast food), but for some things like shopping, the market is truly international. That complicates and makes more difficult gains from a services-based growth strategy, which depends in large part on restricted market access and labour market immobility.

Having said that, the alternatives are unpalatable - commodities are inherently volatile, even if it has supplemented export incomes in the last four years. High value-added domestic manufacturing isn't likely to take hold, unless we do something really drastic with our truly pathetic private and public R&D spending and poor corporate-academic cooperation.

So what do I expect from the 2010 Budget? Forget any bones for the consumer - adult unemployment has barely ticked up, real wages have continued to rise (except in manufacturing), and consumer spending is up. I don't think we will see any progress in implementing GST either, especially with the political bugbear of potentially higher prices. Civil service wages should continue to go up, although Cuepacs is whistling in the wind if they think they can get two months bonus. The boost in wages is necessary, to push up incomes especially for some of the lower paid civil servants as well as reduce the temptation towards venal corruption.

While I think the government will try to keep operational expenditure below expected revenue, that's a tough job in the present state of the economy. I don't think revenues will drop as much as people expect, but the operational budget should still be in the red. Which means after tacking on the development budget, we're still looking at a substantial fiscal deficit, I'm thinking in the range of 4%-5% of GDP. Whatever the planned figure however, I do expect actual 2010 expenditure to come in at a more palatable ratio, if revenues come in higher as I expect.

My macro-view of the economy has evolved, but not changed significantly in the last six months. I think the stimulus packages were on balance necessary and useful, if only to turn around consumer and business confidence rather than any real effects they may have on the economy. I suppose it'd be nice to have the morale boost without the financial outlay, but I'm not sure people (including politicians themselves) would accept that, especially in the heat of the crisis. The national debt is climbing rapidly, but not to any serious level as yet, and certainly well below any point where borrowing costs or domestic liquidity becomes a problem.

Real indicators are generally all creeping up, Aug/Sept slowdowns notwithstanding. As I've talked about before, this is a factor of Ramadhan/Eid el Fitri artificially crimping output. I've already recorded that the economy has already passed the recession stage and (because of the eccentricities of Malaysian statistical computations) we should see official confirmation next month when the 3Q figures are scheduled to be released. I'm still concerned that this recovery may turn out to be inventory-driven which may see us slowing again in the next couple of quarters, but I'd say a "W"-shaped recovery isn't a high probability at this stage.

So it's time to deal with the structural headwinds besetting the Malaysian economy, where fiscal policy is best effective (or least damaging, depending on your philosophical viewpoint). What are the key problems? In no particular order...

1. Caught in a middle income trap

2. Youth unemployment

3. Poor R&D spending

4. Quality education

5. Affordable healthcare and housing

6. Ineffective transport (and auto) policy

7. Subsidy mentality

8. Income inequality

9. Low-value added manufacturing

10. Declining oil reserves (and thus future oil revenues)

11. Narrow tax base

...and the list goes on. I'm sure I've left quite a few biggies off.

There's no way the government (or any government) will make headway in all these areas in one year, or even during the 5-year period of our development plans.

One key thing I am happy with is the shift to a services-based growth strategy. I've been talking about this as the way to go since around 2005, when it became obvious that export-led manufacturing had reached a dead-end - despite a global trade boom, Malaysian electronics exports flat-lined from that point on. A services-based strategy would be the logical evolution of the economy, one which other high income countries have already undergone. Because the labour market would be less affected by international arbitrage, incomes should rise independently of productivity as labour demand in the services sector rises. This shift should also help to resolve some of the problems in the list above, and incidentally put upward pressure on the exchange rate.

I remember reading Morgan Stanley's Global Economic Forum (good for a quick, intelligent view of economic happenings around the world - Stephen Roach was the Guru for me) back in 2005-2006, that Malaysia should explicitly follow a dual-track, hybrid strategy - both export-led manufacturing as well as export commodities-based. Thailand was put up as a good example to follow. I think that's a step sideways more than anything - you're depending on a lack of correlation between the two sectors to maintain domestic economic activity.

Still, that was a few years lost in getting a leg up the income ladder. One of the problems (of many) with a centrally directed strategy is that bureaucrats will tend to stick with a particular solution, even when it's obviously not working (like investment quotas). In this case, I'm wondering if we've left it too late. The increasing adoption of the internet as a business tool means that costs of communications has dropped rapidly, which reduces some of the barriers that hitherto have isolated domestic services sectors from foreign competition.

Oh, there certainly continues to be high barriers to labour mobility, especially in high-income professional services (lawyers) and in low-income services (think fast food), but for some things like shopping, the market is truly international. That complicates and makes more difficult gains from a services-based growth strategy, which depends in large part on restricted market access and labour market immobility.

Having said that, the alternatives are unpalatable - commodities are inherently volatile, even if it has supplemented export incomes in the last four years. High value-added domestic manufacturing isn't likely to take hold, unless we do something really drastic with our truly pathetic private and public R&D spending and poor corporate-academic cooperation.

So what do I expect from the 2010 Budget? Forget any bones for the consumer - adult unemployment has barely ticked up, real wages have continued to rise (except in manufacturing), and consumer spending is up. I don't think we will see any progress in implementing GST either, especially with the political bugbear of potentially higher prices. Civil service wages should continue to go up, although Cuepacs is whistling in the wind if they think they can get two months bonus. The boost in wages is necessary, to push up incomes especially for some of the lower paid civil servants as well as reduce the temptation towards venal corruption.

While I think the government will try to keep operational expenditure below expected revenue, that's a tough job in the present state of the economy. I don't think revenues will drop as much as people expect, but the operational budget should still be in the red. Which means after tacking on the development budget, we're still looking at a substantial fiscal deficit, I'm thinking in the range of 4%-5% of GDP. Whatever the planned figure however, I do expect actual 2010 expenditure to come in at a more palatable ratio, if revenues come in higher as I expect.

Labels:

fiscal deficit,

fiscal policy,

government budget,

services

Friday, October 16, 2009

Why The IMF Thinks MYR Is Undervalued

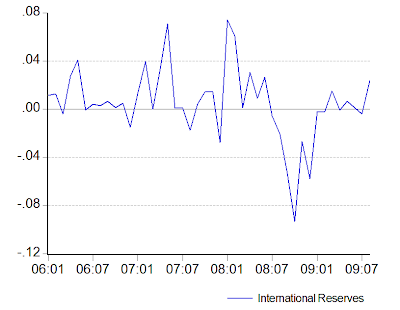

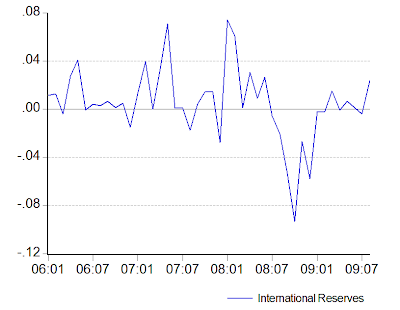

In keeping with the forex theme this week, in my last post I pointed out that Singapore is accumulating international reserves at a faster pace than Malaysia, but yet is considered to have a "strong" currency. Later I linked to research that suggested that SGD was as undervalued as the MYR, while the IMF suggested SGD was only slightly undervalued. Why the divergence in opinion?

There is of course the difference in methodologies used to determine currency misalignments (which I talked about here, here and here). But what I'd like to point out today are two potential issues that may be affecting MYR currency misalignment analysis.

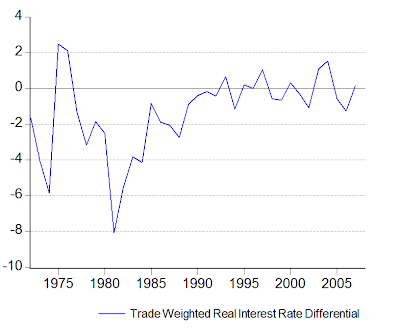

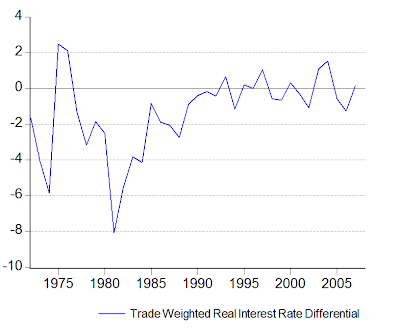

The first issue lies with differences in calculating the real effective exchange rate index (REER) itself which may be to blame. To illustrate, here are my calculated nominal and real indexes, compared with the published IMF calculated indexes:

Notice that the nominal indexes are more or less equivalent, with any differences attributable to the currencies included in the basket as well as changes in the weighting scheme. I calculate my indexes with weights changing on a quarterly basis, while the IMF changes once every five-ten years or so - but doesn't appear to make a significant difference here.

There is however a substantial divergence in the REER indexes, with the IMF REER much higher in 2008 - and thus indicating that the nominal rate is too low, and the exchange rate is undervalued. The main difference between the real and nominal indexes is the application of price deflators in the real index, which are used to adjust currency values based on inflation. For the IMF index, CPI inflation is generally used for most countries except for OECD members, where unit labour costs are substituted.

Since CPI inflation can more readily go negative than unit labour costs (as we've seen this past year), that puts an upward bias into the IMF's REER index in periods of disinflation or deflation, especially with OECD countries taking more than a third of the total weight in the MYR index.

Another issue is one of export structure. Most analysis, including the one I linked to in the last post, use aggregate exports when running regressions (heck, so do I). The problem here is that when there is a commodity bubble, prices might go up without output necessarily increasing to the same degree. For example, palm oil and rubber (log annual changes, export volumes and values):

If the increase represents a transitory change, then the degree of currency adjustment required to rebalance the current account will be inflated - hence current account approaches to exchange rate determination, such as used in the aforementioned paper and in two of the three methodologies used by the IMF, would tend to overstate the equilibrium level of the exchange rate.

As an aside, I made the point in my last post that positive terms of trade shocks would see the income effect dominate, and would not reduce volumes very much. The behaviour of agricultural commodity exports over the past few years is certainly suggestive that my conjecture is worth considering.

There is of course the difference in methodologies used to determine currency misalignments (which I talked about here, here and here). But what I'd like to point out today are two potential issues that may be affecting MYR currency misalignment analysis.

The first issue lies with differences in calculating the real effective exchange rate index (REER) itself which may be to blame. To illustrate, here are my calculated nominal and real indexes, compared with the published IMF calculated indexes:

Notice that the nominal indexes are more or less equivalent, with any differences attributable to the currencies included in the basket as well as changes in the weighting scheme. I calculate my indexes with weights changing on a quarterly basis, while the IMF changes once every five-ten years or so - but doesn't appear to make a significant difference here.

There is however a substantial divergence in the REER indexes, with the IMF REER much higher in 2008 - and thus indicating that the nominal rate is too low, and the exchange rate is undervalued. The main difference between the real and nominal indexes is the application of price deflators in the real index, which are used to adjust currency values based on inflation. For the IMF index, CPI inflation is generally used for most countries except for OECD members, where unit labour costs are substituted.

Since CPI inflation can more readily go negative than unit labour costs (as we've seen this past year), that puts an upward bias into the IMF's REER index in periods of disinflation or deflation, especially with OECD countries taking more than a third of the total weight in the MYR index.

Another issue is one of export structure. Most analysis, including the one I linked to in the last post, use aggregate exports when running regressions (heck, so do I). The problem here is that when there is a commodity bubble, prices might go up without output necessarily increasing to the same degree. For example, palm oil and rubber (log annual changes, export volumes and values):

If the increase represents a transitory change, then the degree of currency adjustment required to rebalance the current account will be inflated - hence current account approaches to exchange rate determination, such as used in the aforementioned paper and in two of the three methodologies used by the IMF, would tend to overstate the equilibrium level of the exchange rate.

As an aside, I made the point in my last post that positive terms of trade shocks would see the income effect dominate, and would not reduce volumes very much. The behaviour of agricultural commodity exports over the past few years is certainly suggestive that my conjecture is worth considering.

Labels:

commodities,

equilibrium exchange rates,

inflation,

NEER,

REER

Thursday, October 15, 2009

Stronger Exchange Rate ≠ Strong Exchange Rate Policy

Jagdev Singh Sidhu over at The Star thinks we should pursue a strong currency policy because:

"A stronger ringgit will force Malaysians, both employees and employers, to be more efficient and that is something the economy needs to do as I feel it is somewhat in an economic mid-life crisis."

He also makes the statement that:

"The current preference of using interest rates to drive economic growth may be due for a re-think in favour of the currency as the lower-than-normal rates in Malaysia since the Asian financial crisis haven’t really worked."

And third:

"A stronger ringgit is no guarantee that the country will be able to make that transition to a high-income economy but there are a couple of examples nearby which we should look at.

Singapore and Taiwan endured short-term pains when they allowed their currencies to appreciate but they did make the adjustment to incorporate more skills and capital in manufacturing processes. The stronger currency was also a boost for the service sector in those countries."

As you can imagine, I’m going to pick a few holes in this argument.

The first statement assumes that the substitution effect dominates the income effect in the terms of trade (the purchasing power of money we receive from exports, relative to what we can buy of imports). In other words, a stronger exhange rate reduces our competitiveness and we have to become more efficient to continue to sell to external markets.

The general consensus and the empirical evidence in the research literature finds just the opposite. In other words, higher terms of trade (which is what you get with a stronger exchange rate) actually increases export revenues more than the loss coming from reduced demand. So there won’t be much impact in terms of forcing Malaysians to “be more efficient”. In fact, given the relative share of primary resources in exports, there’s probably going to be even less incentive to improve productivity.

A second point is that because of our low value-added industries and with multi-nationals involved in exports, strengthening the exchange rate should in fact have only marginal effects on incomes and trade volume because there’s little local currency pass-through. A higher exchange rate not only reduces the local currency value of exports, but at the same time reduces the local currency value of imported inputs. Assuming the exchange rate elasticities are equivalent, then there will be roughly no change in returns to local content.

Third, given the two effects above, it’s not obvious or automatic that a stronger exchange rate would raise labour incomes in the export sector. Because the income effect dominates, trade volumes will change very little in the manufactured sector, so demand for labour will not change much or at all – which means whatever excess returns are generated from a higher exchange rate will benefit owners of capital, not labour. This also true to a lesser degree for the primary resources sector, where the ratio of imported inputs (e.g. in CPO) is actually quite high. This is not a recipe for raising domestic income levels.

The second statement is really about the conduct of monetary policy in pursuing price stability and economic growth, with the priority on the former as it is also a precondition for the latter. The choices a central bank can make here are setting the monetary base (money supply targeting), setting the price of money (interest rate targeting), and setting the relative price of money (exchange rate targeting). More recently, some central banks have experimented with direct inflation targeting with some success, but our statistical capabilities have to be upgraded for that to happen here.

The first option is a proven failure after experimentation in the early 1980s in the US and UK, and gave rise to Goodhart’s Law. The second has had relative success in maintaining price stability over the past twenty years.

The third is only advisable for relatively small economies with high external exposure or for countries with no external credibility, because in essence it means abdication of any influence over domestic monetary conditions. That’s fairly obvious from the experience of both Singapore and Hong Kong, the two countries in East Asia that use exchange-rate targeting – interest rates and monetary aggregates are subject to far more volatility than countries that use interest rate targeting. It’s also interesting to note that Malaysia’s aggregate economic record in the last decade is marginally better than Singapore’s and much better than Hong Kong’s.

Given this weakness, I don’t see any advantages for Malaysia, with its much more diversified economy, to follow this route. Since the first option is also out, that leaves only interest rate, and potentially, inflation targeting as the basis for monetary policy.