Hoisted from comments:

Wenger J Khairy said... Dear Hisham H,

I for one have not a clue what the NEM is neither is worthwhile even spending an iota even discussing it. Actually what business activity can the Government directly influence without incurring additional debt. That itself is going to be a self defeating point of view.

Lets put some facts on the table.

Nos 1 the myth that the Government somehow is responsible for some huge subsidy. 1MPM6 mentioned that the "subsidy" is RM 70 billion budgeted for 2010.

RM 70 billion subsidy? Who is he kidding. The actual subsidy to consumeres [sic] was 2 major items, the subsidy for fuel - RM 10 billion, to be shared with the glorious IPPs,allocation for MARA RM 2 billion and the subsidy for interest on the PTPN fund - about RM 1 billion.

The big ticket items lumped together in this transfer payments mistaken by the PM for subsidy was RM 15 billion - interest on debt

RM 10 billion - Pensions

RM 6 billion - to the Unis (wonder why our students need to pay fees on top of this, and this is only the Op Budget)

RM 1 billion – KLIAB

The balance RM 15 billion was a hodge podge of various accounts with corpratization being a chief culprit.

So essentially the domestic economy is like a merry go round. Spend today like theres no tomorrow.

Unfortunately for the gomen, is that short term rates are now starting to spike up. Our debt duration which used to be very much in the long term during DSAI is now 50% in the short - medium term with massive refinancing of debt over the next 3 yes. The gomens weighted interest rate is 3.4ish %, imagine what the "subsidy" for Gomen debt will be in 2012 if interest rates were to spike to 5%, (of course triggered by some currency crisis / short term money flow out.)

Key thing is BNM's forex reserves. Thanks to the wisdom of Pak Lah we have a sizable cushion. However, for all our supposed current account surplus, the end inc in BNM foreign reserve position has been 0 for the last couple of months owing to the massive "reinvestment in overseas" phenomenon.

So where JPM fears to tread let I Wenger J Khairy put it succinctly.

A massive public deficit will reduce the cost of capital which means more and more of bank loanable funds will be used to prop up MGS and GII. 0 credit growth in all sectors except the household sector.

Any decision by Uncle Sam to start to raise interest rates would put a pressure on BNM to do the same or else pummel the Ringgit.

Option A- Raise Interest rates

Public deficit continues to swell touching past RM 500 billion in 2012. This puts the soverign rating of the country at risk, not that local banks have a choice. In the end banks prop up the gomen and no new investment in the industry, which means declining international trade which means a potential decline in the BNM reserves which mean a downward bias on the ringgit (PPP fanboys be forewarned).

Option B- BNM continues to keep rates low, which means Ringgit gets pummelled on the forex market

So either way long term I see Soros prediction of 5 to the dollar becoming a reality and a massive inflation spike to hit the country in 2012.

SO says I Wenger J Khairy

Wenger paints a nightmare scenario, one I think has a low probability of happening, but he does have some highly pertinent points that bear examination.What he’s talking about is what’s called in economic terminology the “crowding out” of the private sector, as public sector demand on financial resources or the concomitant increase in the cost of capital reduces private consumption and investment. I don’t think that’s likely in Malaysia over the short term, though a failure to generate GDP growth over the next two years would certainly bring this factor potentially into play, as the government tries to pick up the slack in terms of deficient demand. It’s also a potential factor as we go through the latter half of the decade unless growth picks up, and the implementation of the NEM successfully shifts the burden of growth to the private sector.

In any case, my comments on Wenger’s post are as follows:

- Subsidies – the breakdown of government operating and development expenditure by function is available in BNM’s Monthly Statistical Bulletin. Operating expenditure classified as subsidies were RM35.2 billion in 2008 and RM18.6 billion in 2009, nowhere near the RM70 billion quoted for 2010, so Wenger has a point – as far as it goes. It depends on whether you classify development expenditure as subsidies. If you do (and I’ll grant you it’s a bit of a stretch), then the RM70 billion figure is suddenly very plausible. Development expenditure was RM42.8 billion in 2008 and RM49.5 billion in 2009. (Technical Note: for those who are curious, the Malaysia Plans effectively lay out the government’s development expenditure over each 5yr Plan period).

- Debt duration and interest burden – this is something I’ve noticed myself, as the bulk of issuance over the past couple of years has been in 3-year and 5-year maturities, rather than the 5-year and 10-year maturities that the Treasury usually favours. Effectively, that means the Treasury might have some trouble rolling over maturing debt in 2012-2014 when the bills come due, on top of the additional borrowing requirement for deficit financing over the next couple of years (Wenger’s estimate of RM500b sounds plausible to me, though I think it’s probably about 10% too high and one year too early).

I honestly don’t think this will lead to crowding out of private investment or household financing over the medium term however, because Wenger missed one thing – the financial system is just sloshing with liquidity. Commercial bank holdings of MGS and GII are just 3.7% of their total assets, while loans comprise just 58.7%. As of February, commercial banks have RM187 billion on tap at the central bank – or nearly double the borrowing needs of the government for the next two years.

But the spike in short term rates is real enough:

I think this is a combination of a couple of things: BNM’s “normalisation” of interest rates which puts a floor under MGS yields, and (paradoxically) a reduction of investor uncertainty.

The recession drove a big increase in demand for short term, risk-free securities against a relatively static supply in MGS maturing in less than one year, which drove down yields at the short end while widening the spread between maturities. Now that the recovery is well entrenched, the return of risk appetite should shift demand towards the longer end of the yield curve, while also converging yields across the maturity spectrum i.e. the yield curve is going to flatten.

Note that under the current monetary regime which uses an interest rate target as the policy instrument, interest rate volatility should be relatively low compared to the volatility of the exchange rate or money supply (see the difference in MGS yield behaviour pre- and post-July 2005 in the chart above). If this thinking holds true then spreads over the past year or so were an aberration, and convergence should see spreads tightening again. In other words – don’t read too much into the spike in short term yields. - Forex reserves – I think you’re off base with this one, Wenger. If BNM is allowing the Ringgit to float and only intervening during periods of high volatility, as I believe they are, then changes in reserves will not reflect flows of capital at all. I suggest you use this instead:

(Change in Reserves) + (Change in commercial bank net foreign assets) - (Change in trade balance) = (Estimated Capital Flows)

This doesn’t capture reinvestment, but yields a more realistic estimate of inflows or outflows of capital:

But I agree with Wenger’s assessment that money is leaving (or staying) outside of the country. - A massive public deficit will reduce the cost of capital - I think this is a typo - shouldn't it be "raise" instead?

- Any decision by Uncle Sam to start to raise interest rates would put a pressure on BNM to do the same or else pummel the Ringgit – I don’t think this will happen. US rate hikes might slow or halt the appreciation of the Ringgit, but on balance the fundamental story for the Ringgit will still be up. Even with the uncertainty over the trajectories of the two economies, this isn’t a tough call to make. It’s useful to think of it this way – what matters is the real interest rate differential, not just the interest rate difference (click on the pic for the larger version; shaded areas mark Ringgit appreciation relative to the USD):

It’s not a perfect match (note the initial drop in the real interest rate differential during the appreciation of the Ringgit post 2005), because the joker in the pack is the perceived risk premium, which is (i) unobservable, and (ii) time varying. In any case, we have a pretty long head start on tightening, and any US moves in that direction will have to cover a pretty significant gap in Malaysia’s favour. I find myself at odds with Soros – I think a sub RM3.00 to the USD rate a more likely outcome by 2012.

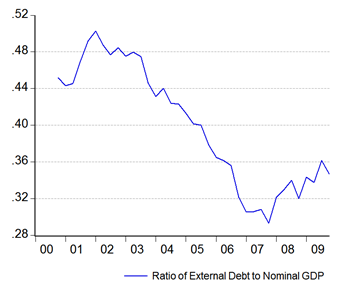

Statistical Note: technically, because the exchange rate (I(1)) and the real interest rate (I(0)) are of different orders of integration, the relationship cannot be long term. Specifically, the real interest rate can only effect the rate of change in the exchange rate, but not its level. - This puts the soverign [sic] rating of the country at risk… – This is an interesting and valid point, and related to the risk premium I referred to in my previous point. Actual external debt is fairly low and dropping:

But the real sensitivity of government debt to the sovereign risk rating, which on surface only directly affects non-Ringgit denominated government debt, is quite a bit higher than that. You have to add in foreign holders of domestic debt to the external debt numbers:

…and probably take into account the external debt of NFPEs and the private sector as well, as these will also be affected by a rerating. On the other hand, I don’t think this will matter much at least over the near future because (i) the ratings agencies didn’t exactly get covered in glory the past couple of years, and (ii) the universe of alternative investments isn’t exactly that great. The thing is, while deficits matter for short term interest rates, long term it’s the debt to GDP ratio that investors look at. And on that score I think we’ll be fine:

We’re still below the 60% level where investors start getting worried, and far below the 90% level where government borrowing starts impacting growth. Other countries in the region are on par or worse, and the advanced economics are far more at risk of seeing crowding out over the near term (many have damaged financial sectors as well). Malaysia’s total external debt position (public + private) isn’t all too bad either:

Going forward, as long as the pace of government borrowing (i.e. the deficit) lags nominal GDP growth, as I expect it will this year, then the debt to GDP ratio should stabilise or retreat. Traditionally there are three ways for governments to reduce their debt burden. Higher taxation (works) or equivalently, reduced expenditure (which works even better – see this post) is what most people think of. The other two are inflation through monetary expansion or other means, and boosting economic growth directly which changes the denominator.

I suspect all three are in play for Malaysia – the actual government debt level at the end of 2009 was a full RM18 billion below my estimate, suggesting that cuts in expenditure may have reduced the borrowing requirement below the projected range defined by the two stimulus packages and the original budget for 2009. In essence, the government traded off public consumption in favour of public investment.

Second, inflation should return to its long term average later this year of around 2.5%-3.0%, which will have a small but measurable impact on the real debt burden (5% MGS yields notwithstanding – yes I think that’s distinctly possible as well, but primarily through higher inflation driven by faster growth).

Third, trade growth is being driven by changes in the terms of trade through rising commodity prices, and not in volume of manufactured goods. The mining and agricultural sectors have never been big borrowers relative to the manufacturing industry, so would be less sensitive to crowding out by public borrowing (of course, their output and income are also more volatile). Another factor is that the manufacturing sector is suffering from massive over-capacity, so there is plenty of slack (and less financing required) to pick up output even in the absence of long term financing.

In short I don’t think the crowding out scenario is credible just yet, though a double-dip in the world economy will guarantee we’ll have trouble. Also there’s no doubt that higher interest rates will eventually impact the private sector, but given we’re starting from a below-optimum point, I’m uncertain how much that effect will be or at what point it will kick in. On the other hand, I don’t think at this stage government borrowing will exhaust or impinge the capability of banks to finance business, given the existing excess liquidity situation we’re in.

In passing, I actually like the NEM, less because I think it will have much of an impact on Malaysia reaching high-income status (I think demographic factors and the exchange rate will take care of that), but because it sets the foundation for sustaining higher income growth in the future - as in 20-30 years from now. But one effect that the NEM will have right now is it’s market-orientation. If the government holds to this principle, then there’s a good chance private investment will flow again. More pragmatically, the sale of government owned companies and assets will help offset the need to borrow.

Dear Mr. Hisham H,

ReplyDeleteWhat a great reply. I have to reread your post maybe a couple of times to fully digest your quite thorough reading of the sitatuion.

But from a simpleton like me, I feel honoured that you have dedicated a posting to agree and disagree with my observations.

Just a quick note, development budget is used to subsidize the cronies like friends of certain leaders whose dad was an ex PM and who contested in an UMNO election but got trounced royally and not the poor humble rakyat like myself :-)

Anyhow, contrary to the image of public prudence, all the Government did for Operational Budget 2010 vs 2009 was to

a) Cut the fuel subsidy from 22 billion to 10 billion

b) Cut the 1-off RM 2 billion given to the rakyat by Pak Lah for the high fuel cost

c) Some minor cuts in supplies and asset

As such we should consider this wealth transfer to the rich, which may not have the same ring as a "subsidy" per se