It’s rare that I can be unequivocal about interpreting the data, whether it’s GDP, inflation or anything else. But yesterday’s industrial production report from DOS doesn’t pull punches.

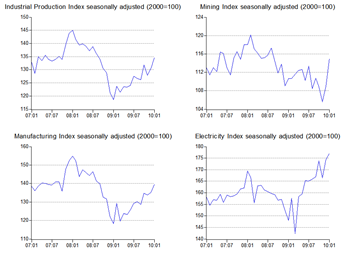

Whichever way you look at it, growth has been positive and high (log annual and monthly changes;seasonally adjusted; 2000=100):

About the only sour note, if you can call it that, is that apart from electricity generation index levels are still below 2007/2008 peaks:

But since I’d consider 2007/2008 as a bit of a bubble period anyway, that’s no real cause for not considering the economy to have fully recovered, at least in terms of industrial production.

Now, what does this say about 1Q2010 GDP growth? My point estimate based on IPI alone as an explanatory variable suggests 11.0% in y-o-y percentage terms and 10.4% in log terms – the consensus estimate is 9.4% in percentage terms. The risk is all on the upside, as IPI does not incorporate services output.

The picture is slightly less rosy if we use the internationally accepted methodology of annualised, seasonally adjusted quarter on quarter growth, which yields just 6.7% in percentage terms and 6.6% in log terms. This is a factor of the rip-roaring growth of 14.6% in 4Q 2009, which obviously increases the base of the calculation.

Technical Notes:

March 2010 Industrial Production report from the Department of Statistics

No comments:

Post a Comment