Recall from my last post that there are problems with the measurement of inflation via the CPI, but these problems are solvable and less to do with the construction of the CPI and more of people’s perceptions of price rises and how it effects them.

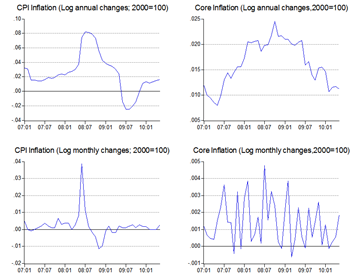

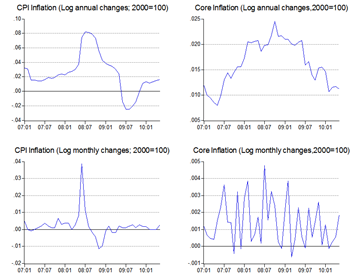

The May CPI report released last week isn’t going to make many people’s doubts and suspicions go away (log annual and monthly changes; 2000=100):

Inflation as measured by the CPI is up 1.6% in annual log terms, but my core inflation measure (CPI ex-food, ex-transport) decelerated to 1.1% from 1.2% from April’s reading. Price’s are up from the month before, but not by much – not so coincidentally, the Ringgit has been falling slightly against major currencies, so some pass through of inflation is to be expected. But the magnitude of price increases is still far below what people seem to feel is happening to their monthly household bills.

Inflation as measured by the CPI is up 1.6% in annual log terms, but my core inflation measure (CPI ex-food, ex-transport) decelerated to 1.1% from 1.2% from April’s reading. Price’s are up from the month before, but not by much – not so coincidentally, the Ringgit has been falling slightly against major currencies, so some pass through of inflation is to be expected. But the magnitude of price increases is still far below what people seem to feel is happening to their monthly household bills.

To get a feel for this, I’m going to invert the components of my core measure – instead of excluding the more volatile components to arrive at a stable long term inflation measure that’s useful for policy analysis, I’m going to exclude the non-volatile components instead i.e. measure inflation based exclusively on food and transport prices, which is more representative of what’s happening to people’s wallets.

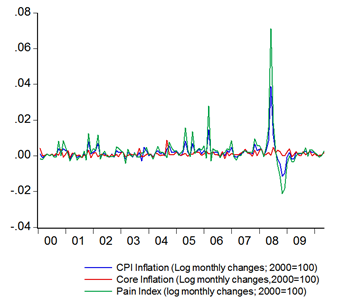

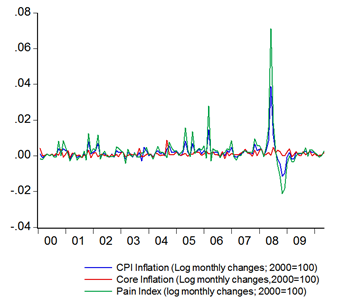

You could call this the “Pain” Index (index numbers; 2000=100):

Note that the price level in these two categories have risen faster and have been persistently higher than either the overall CPI and definitely over the core index.

Note that the price level in these two categories have risen faster and have been persistently higher than either the overall CPI and definitely over the core index.

This is fairly obvious when looking at the growth numbers (log annual and monthly changes; 2000=100):

The average annual increase in the pain index (2000-2009) is around 3.3% p.a., compared to around 1.4% for the rest of the CPI components. If we take just the last five years (2005-2009), then the rate increases to around 4.1% p.a. versus 1.6%. If you compare that against average nominal wage growth of around 4%-5% as suggested by newspaper reports (the average in the manufacturing sector was just 2.7% from 2007-2009), then we have our basis for falling real incomes.

The average annual increase in the pain index (2000-2009) is around 3.3% p.a., compared to around 1.4% for the rest of the CPI components. If we take just the last five years (2005-2009), then the rate increases to around 4.1% p.a. versus 1.6%. If you compare that against average nominal wage growth of around 4%-5% as suggested by newspaper reports (the average in the manufacturing sector was just 2.7% from 2007-2009), then we have our basis for falling real incomes.

Technical Notes:

May 2010 Consumer Price Index Report from the Department of Statistics

No comments:

Post a Comment