One of the key aspects of the NEM, and a vital part of regularising government finance, is reducing and eventually phasing out entirely subsidies, particularly on food and fuel. Some of the figures bandied about, not least by the Prime Minister, are a little too much in la-la land, but the gist of it is clear – the cost of subsidies are too high, they’re not benefiting the target groups as much as they should, and they’re creating perverse economic incentives.

There’s a nice piece on the subject of petrol subsidies in yesterday’s The Star (excerpt):

Malaysians consume more fuel

As Malaysia practises a blanket subsidy on fuel, data made available to the Performance Management and Delivery Unit (Pemandu) subsidy rationalisation lab showed that 71% of fuel subsidy was enjoyed by the middle to high-income level groups.

Some 28% of those enjoying fuel subsidy earn more than RM5,000 per month, while 43% earned between RM2,500 and RM5,000.

Abuse of liquid petroleum gas (LPG), or cooking gas, has also contributed to an inflated subsidy bill. Some RM1.71bil was spent on subsidising LPG, to which only RM397mil or 30% are used by households.

In addition, there’s the rather telling datum that fuel consumption rose 8% in 2008, despite pump prices doubling in that year.

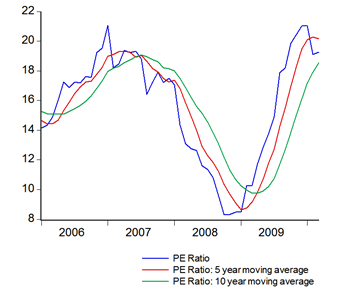

What are the actual subsidy numbers? Officially, based on MOF’s functional classification of expenditure, the government spent RM18.6 billion on subsidies in 2009 and RM35.2 billion in 2008. The historical data is illuminating (RM billions, inflation adjusted; 2000=100):

Subsidies started climbing in the wake of the 2000 recession, and haven’t stopped since. The killer blow was the climb in commodity prices and the concurrent upswing in food prices in 2008 (remember the rice “shortage”?).

Subsidies started climbing in the wake of the 2000 recession, and haven’t stopped since. The killer blow was the climb in commodity prices and the concurrent upswing in food prices in 2008 (remember the rice “shortage”?).

Of course the official figure isn’t the whole story – there’s the hidden gas subsidy at Petronas which ends up as reduced government income from petroleum royalties and corporate taxes; the difference in pricing between what TNB charges against what it has to pay the IPPs; controlled prices on basic food items; as well as whether development spending as a whole can be considered as subsidies, as implied by the PM’s figures. I don’t think any of these are on the table for abolishment just yet.

In any case, the cabinet is meeting tomorrow to discuss the issue, and there will be an open day at KLCC on Thursday to gain public feedback.

The key problem in my view is that the subsidies are directed at consumer prices, rather than targeted at a particular group. This is easier to administer, but from the numbers in the article quoted above, it’s fairly obvious that the actual benefits accrue to everybody, rich and poor alike, corporations as well as individuals. That’s a rather inefficient and expensive way to handle welfare transfers – it’s actually highly regressive i.e. those that benefit the most need it the least.

But getting rid of subsidies isn’t the whole answer, as you still have the negative welfare impact on the poor and lower income groups from higher food and fuel prices. They’d still need some form of support to replace the expenditure lost through higher outlays. Royal Professor Ungku Aziz has suggested a debit card scheme for the hard-core poor, with a monthly token of RM300 for basic food items. Or you can follow some Western practices like food stamps, or outright cash giveaways. Whichever the route we end up following, there’s going to be a call on Government finances and there’s going to have to be some form of administrative framework to manage the scheme i.e. the Government’s going to get bigger.

Now, from the financial perspective funding a social safety net can be derived from savings gained from the abolishment of subsidies. I don’t think that’s going to be a big issue, unless the scheme itself becomes too complex, or the government goes overboard in terms of benefits. You could also argue for an income tax cut, but that would be pretty regressive too as the tax base is so narrow. Alternatively, the reduction in subsidies could be predicated on a lower GST, if and when that comes into play.

However, there’s a hidden aspect particular to petrol and gas that isn’t being addressed – pollution and the concomitant need for healthcare (need I say that the services offered by public hospitals and clinics are also highly subsidised?), known in the economic terminology as negative externalities. Abolishing subsidies on these items would go a long way toward matching supply and demand, but the market price does not address their true economic costs. These become another form of hidden subsidy – increased healthcare costs, pollution cleanup costs, infrastructure delivery costs and more, that are borne not by the users of petroleum products but by everyone.

So I’m firmly of the belief that we ought to tax petrol and gas, not just lift subsidies. That achieves three things – one is to impose the true costs of using petrol and gas on users; secondly, it reduces fuel consumption, the impact on the environment, and encourages conservation; and third the proceeds can be used to help offset the costs of both the social safety net as well as the ancillary costs of the negative externalities arising from the use of petroleum products. It also helps that a Pigovian tax and transfer mechanism of this form will also be far more efficient in terms of raising social welfare and rebalancing incomes. There’s also the secondary effect of increasing pressure to raise pay packets – which is the direction we want to head in anyway.

I’m not blind to the difficulties here. There’s an obvious corollary that the government’s social welfare capabilities needs to be beefed up (it’s awful right now) in terms of manpower, organisation, data collection and funding – which increases the opportunities for waste, mismanagement and corruption. There’s also going to be an outcry from the middle classes, as they have the most to lose (no increase in benefits, but with all the cost).

This isn’t a vote winning proposition, but it is the right and economically correct thing to do.

For Further Reading (from Prof N. Gregory Mankiw):

- The Pigou Club Manifesto

- Alternatives to the Pigou Club

- Smart Taxes: An Open Invitation to Join the Pigou Club (pdf link)