Money supply growth was fairly steady over the course of the last half of 2010, but as we get into the Year of the Rabbit, things have changed (log annual and monthly changes; seasonally adjusted):

Seasonally adjusted M1 rose RM9.9 billion (RM 15.6 billion unadjusted) mainly from higher demand deposits and an unseasonally high cash injection. M2 growth accelerated as well from much the same factors, with the rest of the components rising marginally or not at all.

The higher liquidity helped to marginally lower yields on short term debt instruments:

Longer dated yields however are going the other way:

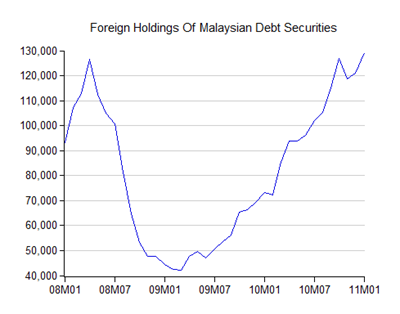

The government borrowed RM6.5 billion in January, the first time since November. But while that might have been a factor in yields rising, but the broad based trade down argues against it. Foreign holdings of Malaysian debt securities rose RM8.3 billion in January while private sector funding by the capital markets fell, so demand isn’t obviously lacking (RM millions):

Putting it all together, it’s one of two stories or both – risk premiums (uncertainty) are rising, or expectations of inflation (and growth) have been reassessed higher. You’ll see the yield curve steepening even further over February – 3yr MGS is nearly 20bp higher today than in January. Maybe its a reflection of the turmoil in the Middle East, but definitely a reaction to rising oil prices and the inflation outlook.

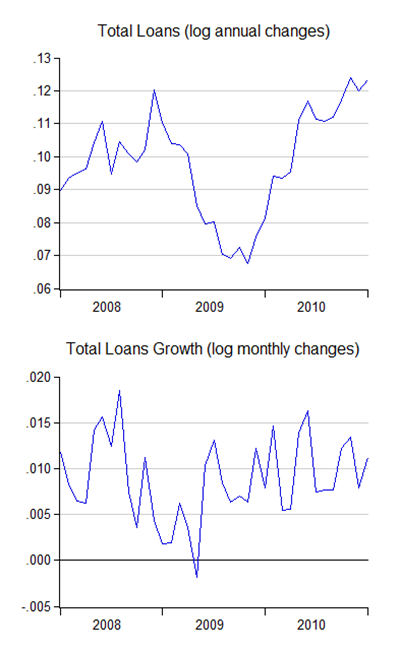

Also on the rise: loans and loan margins (log annual and monthly changes):

About a third of the increase in loans came from mortgages, and another third in working capital loans. Rising private investment is driving private sector borrowing, which I suppose is a good sign. Banks are making a mint however, even with these low margins e.g. record profits at CIMB. Possibly there is a CNY factor at play here, in which case loan numbers should slow in February.

But the arguments for a further hike in the OPR are mounting now, even if growth is expected to slow.

Technical Notes:

All data from BNM’s January 2011 Monthly Statistical Bulletin

No comments:

Post a Comment