I’m playing catch up again, so I’m skipping some update posts this month (monetary conditions for one). The February IPI report came out two days ago, and while the headline numbers aren’t too impressive we have to factor in the short month and the impact of CNY (log annual and monthly changes; seasonally adjusted; 2000=100):

The only real disappointment is in electricity production, which was essentially flat – the rest look fairly supportive of growth.

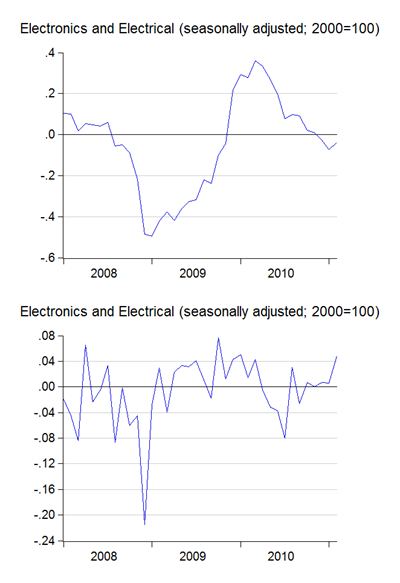

Production of E&E products, and manufacturing generally, picked up in February (log annual and monthly changes; seasonally adjusted; 2000=100):

So I’m thinking that real GDP growth might exceed my initial forecast of around 5.4% in 1Q.

Certainly the index levels lend some credence to this view, as well as providing some rationale for the increase in capital goods imports last year (index numbers, 2000=100):

Better times? Maybe – just remember the Japan earthquake and tsunami hit in the second week of March, and while Malaysia was not directly affected there will be an impact on trade.

Technical Notes:

February 2011 Industrial Production Report from the Department of Statistics

welcome back from korea....what is your prediction for the march cpi which will be released on 20th? and do you believe that negara will hike rates in may mpc considering the last cpi print of 2.9% and the hawkishness expressed by them in their annual reports especially with regard to real yields drifting in to negative territory? or do you believe that the next meeting will also be a SRR hike only. Thanks and as always appreciate your thoughts.

ReplyDeleteMy current estimate is a little over 3.0% yoy, 0.25% mom.

ReplyDeleteI think there's grounds for a policy move this May - growth is stronger than people think and inflationary expectations are getting higher. We ought to be seeing a spread of 2.0% over core inflation, but it's barely 1.2% now.

I think whatever they do, an SRR hike is a given, and they won't stop at 4% either. The cost of keeping KLIBOR on the OPR target is beginning to become more prohibitive.