Last week, DOS released 2010 estimates of Malaysia’s International Investment Position (IIP). For those unfamiliar with the term, if the balance of payments reports on the flow of funds, the IIP reports the stock. In corporate terms the BOP is your cash flow, while the IIP is your balance sheet…sort of.

What the IIP does is show the stock of capital, equity and other investments that Malaysians hold abroad, versus what foreigners own of Malaysian assets.

And unlike many developing countries, Malaysia’s position is that of a net creditor, though just barely at the moment (RM millions):

…and scaled to nominal GDP:

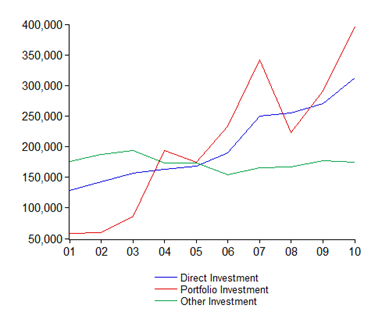

The change between 2009 and 2010 is almost entirely due to a massive increase in portfolio investment into Malaysia, which nearly doubled between the end of 2008 (during the depths of the crisis) through to 2010 (RM millions):

The increase in portfolio investment is about equally shared between equity and debt instruments, but note how volatile it is.

How about FDI? It’s doing fine thank you (RM millions; change in stock):

There’s been a solid recovery in FDI since 2008, and the experience has been pretty good since 2005 relative to the early part of the decade. Bear in mind though that this includes reinvested earnings, and not inward flows per se i.e. not necessarily new investments.

Thing is, FDI has really been overshadowed by increasing Malaysian direct investment abroad (RM millions; change in stock):

There’s been a drop off compared to 2009, but by whatever measure, the amount of money flowing out of Malaysia remains significant. The result of this is that the net direct investment position is very nearly at par (RM millions):

I have to emphasise again that this is pretty rare among developing countries, which are typically net debtors with negative net external asset positions. Where some other emerging markets are also net creditors, Malaysia’s different in that the main conduit has been through increasing private holdings of foreign assets rather than the accumulation of reserves by central banks.

The bottom line: while the outflow of funds continues to leach sources of investment funds within Malaysia, it’s also paradoxically good for growth of GNI, which includes foreign factor payments. The primary problem is less the potential reduction in internal investment, but rather the distributional effect this will have on incomes – DIA would boost income to Malaysian capital, but not necessarily to Malaysian labour.

Technical Notes:

International Investment Position 2010 from the Department of Statistics

For your information...A major and shocking report from global investment bank (sorry can't reveal the name) is published this week which says that Prejudice in race, gender, class, etc harms economic growth.

ReplyDeleteThe economist who wrote it is coming to KL to talk about his global economic views but hopefully someone will ask him why he did not mention Malaysia’s NEP policy as one of the biggest stumbling block for economic productivity and stemming the brain drain out of the country.

correction:

ReplyDelete"...biggest stumbling block for economic productivity, causing the brain drain out of the country via unattractive wages for skilled labour."

http://is.gd/iICtj3

ReplyDeleteWalla, thanks as always.

ReplyDeleteAnon, the report is on par with what I would expect from an investment bank...not very good. The author correctly acknowledges that correlation is not causality, but he doesn't address the potential for reverse causality i.e. that less developed countries exhibit greater prejudice (equivalently, greater social inequality), and not the other way around. The research that I've seen are mostly equivocal on this point, and the direction of causality has not been established to anybody's satisfaction.

I also note that some of the correlations actually displayed are really weak, with high data dispersion. Technically, that would indicate that the calculated regression lines might have coefficients that are not statistically significant i.e. the sample (perceived reality) might not be representative of the population (actual reality).

You put both points above against the short span of the sample (2005-2008), and I wouldn't want to rely on this work to prove that reducing prejudice equals greater economic achievement.

While I wouldn't want to argue against the principle elucidated here, this report just doesn't have the depth to be taken seriously.

Sorry.

In another words, you are saying that the social injustice and negative economic externalities of prejudice such as racism should not be taken seriously because the statistical causality is ambiguous.

ReplyDeleteThe line of thought is so profound: a less developed person from a less developed country has a tendency towards racism because of lack of education and intellectual maturity. Therefore, we shall have the luxury of another ten years to evolve into less prejudicial citizens.

Whatever the causality, prejudice stinks and according to the economist/writer who spoke today in front of fund managers/government officials, the world will become more politically chaotic as politicians try to run economies based on prejudice.

Tactfully, he did not mention Malaysia as one of those racist countries in Asia. But everyone got the drift. Great applause and a great sell signal warning to the incumbent government.

Sorry.

That's not what I'm saying at all. You're getting me wrong:

ReplyDeleteWhile I wouldn't want to argue against the principle elucidated here, this report just doesn't have the depth to be taken seriously.

You can argue against prejudice on moral, philosophical, or even religious grounds, and I'd support that argument. There are lots of social principles that are widely accepted and striven for, yet have no empirical economic basis - democracy for instance, and wealth and income inequality. But this paper's simply too weak to take seriously.

Testing for the presence and direction of causality is a trivial matter with modern econometric software packages, yet this was not done. Testing for the significance of coefficients is even more trivial, yet again this was not done.

Plenty of economic and social variables are correlated, but don't have a causal relationship - that's why we do statistical tests. I'm not expecting a full blown cointegration analysis (even plenty of academics get that wrong), but I'd be less than professional and objective if I didn't point out the fatal weaknesses in the analysis. In short, I have no faith in the credibility of this analyst.

I'll support reducing social inequality on the grounds of just human decency and fairness, but I'm not going to pretend on the basis of this paper that there's now real empirical evidence that there's some economic benefit derived from it.

Ok. I get your point on statistical testing.

ReplyDeleteNonetheless, there is plenty of hard evidence why prejudice hampers economic growth: the ones who benefit based on their gender/colour/religion/nationality/class will have no incentive to be productive given their protected status (e.g. look at Proton's global and local competitiveness).

Meanwhile the ones that are discriminated against will be demotivated (check Dan Ariely's experiments on behavioural finance) and will migrate, causing a brain drain of productive manpower (look at Singapore's gain in Malaysian skilled professionals).

Japan's declining and ageing labour mkt could have been resolved by allowing more immigrants to enter the workforce but for cultural/prejudicial reasons, they are against it.

Oh, I wouldn't argue that prejudice has some impact - but I do wonder how big that impact actually is.

ReplyDeleteIn other words, what I would do is put all the potential factors or their proxies (economic, social, financial) into the pot and then work out the relative impact of each. Statistical methodologies exist for looking at multiple variables across multiple countries across time, and working out not only the global coefficients, but isolating the impact of each variable on each country. Looking at each factor in isolation can result in misleading conclusions - known in stats terminology as omitted variable bias.

Interesting that you brought up Proton. I had an opportunity to sit with Proton's chairman a couple of months back, and its clear from what he said that Proton's past problems relate to two things - flawed strategy under the past management (developing too many expensive platforms without the ability to bring them to market), and sheer lack of scale.

Is there a productivity and quality difference at Proton? Yes, but it's hard to make the argument that prejudice alone is responsible, if you bring in the results and very obvious efficiency at UMW Toyota and Perodua (both Bumi-owned and dominated companies).

As far as immigration and brain gain is concerned though, it's no panacea:

http://worthwhile.typepad.com/worthwhile_canadian_initi/2011/05/aging.html

If you want to see how a correlation/causality/cointegration analysis is properly conducted, you might want to check this paper:

ReplyDeletehttp://www.imf.org/external/pubs/cat/longres.aspx?sk=25017.0

Any possibility on providing the link to this paper once again. Thanks:

ReplyDelete"For your information...A major and shocking report from global investment bank (sorry can't reveal the name) is published this week which says that Prejudice in race, gender, class, etc harms economic growth..."

Sorry Greg, I don't think I actually saved the paper

ReplyDeleteNo worries.

ReplyDeleteAs I had noted, I think racial prejudice (Malays against Chinese and vice-versa) is merely an escalation of a wrongly diagnosed situation.

There were three critical junctures.

1. Malayan Union and the creation of UMNO meant encouraged the creation of other race based parties. UMNO was created to defend the rights of Malays.

2. British interest. Had the British allowed the competitive process in the political realm in the 40s to flow smoothly (the British effectively destroyed the left to hand over power to ethnic elites to protect their own interest), it is likely that the left would have succeeded - and race based political parties would not have held sway.

3. May 13, 1969 sealed Malay dominance and made it clear that the democratic processes can never be used to overturn Malay political power.

The challenge now is to convince the Malays that leaving political power in the hands of Malays (simply because they are Malays) will ultimately undermine the Malays.

The Malays need to understand that its in their best interest to let the best Malaysians lead. I would argue the same for any race in Malaysia as there is also a subtle prejudice by non-Malays that Malays are not capable. This needs to be changed.

I've worked long enough in Malaysia to know that due to our education system (influenced by our political system), that a good number of Malaysians are not capable to compete in the global economy successfully.

"I would argue the same for any race in Malaysia as there is also a subtle prejudice by non-Malays that Malays are not capable."

ReplyDeleteHearsay and anecdotal evidence suggests its a bit more than that - that there is active reverse discrimination against Malays in business and employment.

So yes I agree that we need structural change.

You might be interested in this

Your right that there is discrimination in the private sector often by Malaysians of Chinese heritage against others. However, without a race - relation act (or equal opportunity act), its going to be very difficult to make this structural change.

ReplyDeleteHence, I welcomed the suggestion in the New Economic Model for an Equal Opportunity Act (but it did not see the light of day).

With regards to violence, the only group that can actually impose violence and be successful is UMNO as it controls all means to legitimate force (police, military, special forces, RELA, etc).

So, Malaysia, won't be like Switzerland. Its more likely we will be like Zimbabwe where Mugabe used force to intimidate the opposition (and we can see that happening already in Malaysia although not the same intensity).

Hence, the importance of using the rule of law and democratic processes to resolve problems. Its also more efficient in the long run.

Hearsay and anecdotal evidence suggests its a bit more than that - that there is active reverse discrimination against Malays in business and employment.

ReplyDeleteI think this is a bit overblown, look at the percentage of economic activities dominated by GLC, whatever left can only have secondary effects. Even then, there is no real hard evidence is there?

Sorry, that was me.

ReplyDelete