I’ve always found it useful to dig into the numbers and chart out the evolution of the various components of the budget. It helps enormously in cutting through the rhetoric – actions, after all, speak louder than words (RM billions):

Off the bat, I’ve already found some reordering of priorities – defence spending is set to be cut but internal security raised; operating expenditure on education and training is up, but the development expenditure cut substantially; development spending on agriculture has doubled, but at the expense of trade and industry, which halved. My first instinct, looking at the gross numbers and all the goodies in the budget, was that something had to give – and that seems to be borne out by the breakdowns.

If your reaction to the announcements during the budget was that this was a bank breaker, I don’t blame you. But the reality is that planned government expenditure (operating + development) shows almost zero growth over this year’s (log annual changes; 2011 data based on estimated expenditure; 2012 expenditure data based on budget allocation; 2012 revenue estimate without 2012 tax measures):

See anything showing growth much above zero? Neither do I. The reason why so many commentators have been fooled into believing that there will be expenditure growth next year is that they’re comparing this year’s budget numbers against last year’s. But from a macro perspective, what matters isn’t what the government thought it would spend, but what it actually spent and thinks it will be spending for the rest of the year. And that number (RM229 billion) isn’t all that far off from the 2012 budget allocation (RM232 billion).

It’s also been a habit for the government to underestimate both revenue and expenditure almost consistently by about 10% every year over the past decade. The only exception to that pattern was during this past recession when for obvious reasons revenue tanked, but amazingly expenditure hit the planned target almost exactly despite two additional stimulus packages totalling RM65 billion (in short, there was no stimulus). But if both revenue and expenditure go up by about the same amount, the net figure would be approximately the same.

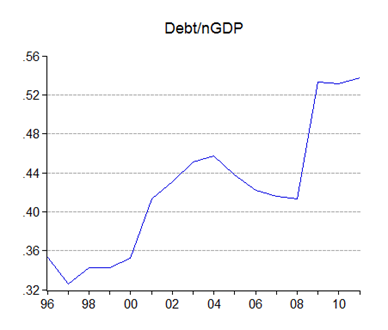

The debt position, much like the fiscal balance, won’t change a great deal either:

I wouldn’t worry too much about whether worsening conditions next year will force a substantial change in the net figures. This government has shown a remarkable facility for managing its expenditure when driven to the wall. If there is a change and the deficit comes in higher than expected, it will almost certainly be through a shortfall in revenue, rather than through chronic overspending.

So taking it all in there’s a few of ways of looking at this – first, you might want to give some kudos to the government for managing to pull together all these social benefits, temporary though they may be, at virtually no increase in total cost. Or you might say, which services are we losing due to these handouts, since there’s been an effective transfer from the 2 million-odd taxpayers to the rest of the population. Or third, you might take Hafiz’s tack and point out the counterfactual – how much lower could the deficit be if you could muster all these savings while not providing these social benefits at all?

They’re all valid viewpoints.

All said, Hishamh, you will note that operating expenditure is eating up current revenue. Think of what can be achieved if we keep a tight lid on spending to run our country-no wastage and leakages. The debt situation is also a concern, especially if we invest in projects whose rates of return are zilt.

ReplyDeleteYou have been most generous in your comments. I will accept the 2012 as a short term solution. But structural changes in the budget are needed if we are to avoid future problems of debt service, deficit financing and inflation. I welcome your comments on my blog.

Dato' Din, thank you for your comments. I think waste and inefficiency are probably endemic to governments everywhere. Having said that, there's certainly many good reasons to address the issue. But as in any large organisation, culture change is going to be a hard slog.

ReplyDeleteI think one of the problems when looking at this budget (in fact, all Malaysian government budgets) is that the methodology used is misleading. There are structural reforms involved here, but they are not articulated - it's been the fashion to lump them all together under the 5-year Malaysia Plans.

The development budget is in essence just each year's allocation for implementing the reforms, structural changes and social supports outlined in each MP - hence the seeming absence of anything concrete in the budget but changes in taxation and the occasional handout.

Then too, we are probably relying too much on the budget as a guide to what's needed going forward. There are quite a few structural changes implemented that don't really require much in the way of budgetry outlay - the NWCC and the minimum wage are a good example, as are the changes in the Employment Act, and the enforcement of the Competition Act (as emasculated as it is).

From a strictly fiscal perspective, I think the priority should be the rationalisation of subsidies. In this, we're using taxation and borrowing to support current consumption and in no small amounts. This is indefensible - my stand is and has been that petrol should be taxed, not subsidised.

You take off nearly 10% of the budget outlay right there, and have enough to properly fund a comprehensive public transport system within the Klang Valley (incidentally, helping resolve housing pressure at the same time). That is, shift spending from consumption to infrastructure investment. PR's idea of renegotiating the IPP contracts should also be fast tracked - leaving them as they are is equally indefensible.

is the massive MRT capex included in the budget.

ReplyDeleteIt shouldn't be as its under Prasarana Negara, even if the government is 100% equity owner.

ReplyDeleteDear HISHAM,

ReplyDeleteUnder current political scenario I would rule out hafiz contention. In fact I think there'll be more handouts given by both parties to appease voters welfare. That's why I'm concern on limits or parameters that budget must set aside for social welfare or safety net.

in that case Govt "real" debt is even higher...cos if it all doesn't work out,govt will hv the liability.

ReplyDeleteIs there any data on all these govt guaranteed off budget borrowings?

Nope, contingent liabilities are off the balance sheet.

ReplyDeleteHi Hisham,

ReplyDeleteSome points:

(1) The BN govt has no fiscal discipline - having deficits during even high growth periods.

(2) The BN govt has no credibility. Its inability to keep spending within targeted deficits.

https://malaysiasdilemma.wordpress.com/2010/05/22/najib-%E2%80%93-fiscal-discipline-and-efficiency-first/

Do you think that this government is still credible - if it systematically underestimates revenue and expenditure for long periods of time?

Dr. Shankaran Nambiar on a possible financial crisis in Malaysia.

ReplyDeletehttp://www.eastasiaforum.org/2011/10/07/malaysias-fiscal-policy-and-the-looming-financial-crisis/

Greg,

ReplyDeleteApart from 1993-1997, Malaysia has continually run budget deficit, at least as far back as my data goes (1972-2010; average deficit is 3.9% of GDP).

As far as credibility is concerned, I don't think any government will be immune from overspending - the incentives to do so are too strong. And since they underestimate both revenue and expenditure, I think it's less of a credibility problem and more that they need better forecasting models!!

Thanks for the link, but I think I read that already. You might be interested in this - I'm not inclined to put too much weight on what S&P thinks.

Thanks Hisham.

ReplyDelete