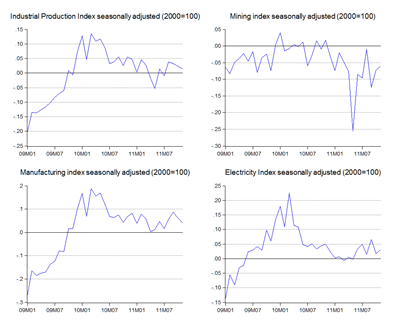

The November industrial production numbers provides some ammunition for pessimists regarding Malaysia’s economic prospects (log annual and monthly changes; seasonally adjusted; 2000=100):

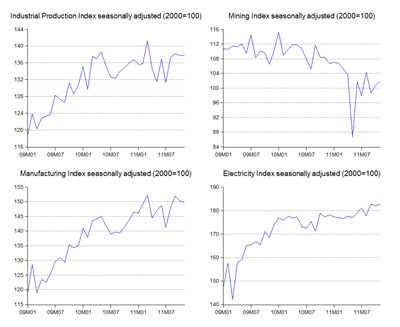

Industrial production has been essentially flat for the last couple of months, pretty much across the board. In fact, looking at the levels, it’s been flat for most of the second half of 2011 (index numbers; 2000=100):

On the one hand, this looks bad – it’s obviously going to negatively impact Q4 2011 growth. On the other hand, considering the feared impact from an incipient Euro recession, it’s actually holding up pretty well.

Whichever way you look at it, it definitely changes my 4Q 2011 and full year forecast (RM millions):

Taking into account the November IPI numbers, the revised forecast is for real GDP to hit RM151.8 billion for 4Q 2011, which is 5% above the same period last year (last month’s forecast: 6.1%). That gives an SAAR of 6.3% (last month: 10.7%) and full year forecast of 5.1% (last month: 5.3%).

So far that would still give some credence to the official government forecast, but it’s getting closer to the lower limit. But looking forward, we’re still seeing some momentum here, as if this forecast is anywhere close to the actual realisation, we’re still looking at 4Q growth higher than 3Q 2011 on a quarter on quarter basis.

Does this say anything about prospects for the current quarter, or even 2012? A little – we’ll see some better annual growth numbers over the next few months, as 1H 2011 production was affected by the Japanese tsunami, even if production turned out totally flat. Chinese New Year will also have a significant impact on January and February output (it’ll look lower).

Beyond, that I suspect we’ll see some upside surprises – US growth is getting stronger, and Europe doesn’t look quite so bad as it did a few weeks ago. China’s growth slowdown appears to be bottoming out, or will bottom out soon. India’s in trouble, their impact on Malaysia’s economy is far smaller than even Europe’s.

Technical Notes:

November 2011 Industrial Production Report from the Department of Statistics

Have you noticed that if you calculate the y-o-y difference for the IPI, the reported percentage change differs a bit from the calculated ones?

ReplyDeleteDo you know why? I've tried several difference methods (namely the typical arithmetic and natural log method) but it doesn't match the reported percentage change.

Wow, you're right.

ReplyDeleteAnd the answer is...they revised all the numbers for 2010 (see page 5). Darn, now have recheck all the data going back to 2005.

If the 2010 numbers have been revised, shouldn't they report the new numbers instead?

ReplyDeleteIf they used the new numbers in the publication, the percentage change should match. I don't understand how they could report the old numbers and have the new percentage change published side by side. Maybe it is just a mistake at the DoS?

I noticed this since a month ago, but decided to be safe by using the reported change. Maybe next time, I'll use my own numbers.

And shit, the DoS should really publish the numbers in Excel or text format. Publishing it in PDF is just f-messed up.

Yeah, it looks like an oversight.

ReplyDeleteDOS is a little behind the times when it comes to presenting official data.