There’s quite frankly not going to be a whole lot of posts until the week after Hari Raya, just a few quick ones on data releases as they come. With luck something like normal posting volume should resume after the Raya break.

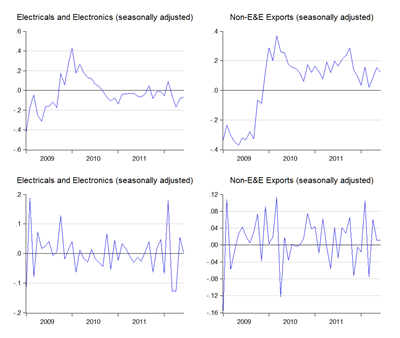

Today’s releases of last month’s trade numbers weren’t terribly inspiring (log annual and monthly changes; seasonally adjusted):

Although exports registered an increase of 5.3% y-o-y in log terms, that’s well below the double-digit growth projections from both my models.

As has become customary, electricals and electronics exports have continued to shrink (log annual and monthly changes; seasonally adjusted):

One interesting thing to note is that with the potential structural change in imports (higher capital goods, flattish intermediate goods growth), the odds are high that my predictive models will continue to be overly optimistic regarding future export performance (RM millions):

So take the following numbers with a large bucket of salt:

Seasonally Adjusted Model

Point forecast:RM60,483m (2.1% yoy, –0.1% mom) Range forecast:RM68,295m-52,670m

Seasonal Difference Model

Point forecast:RM63,162m (6.4% yoy, 3.5% mom) Range forecast:RM72,299m-54,025m

Technical Notes:

June 2012 External Trade Report from Matrade

Salam saudara,

ReplyDeleteI'm sorry for not being able to understand what was written by you above. In layman terms, is the info presented by you good for this country or not? And should we be worried about it?

In dire straits.

It's neither...the trade data is neither good not bad, just ok.

ReplyDelete