This was supposed to come out a couple of days ago, but I was just to busy to write this post. Better late than never I suppose.

In any case, what follows is a look at both the official and opposition budget proposals head to head (hereinafter called OB and AB). First, in terms of revenue:

Revenue:

| Official Proposals | Alternative Budget | |

| Direct Taxes | 121,953 | 109,756 |

| Companies | 57,674 | 51,268 |

| Individual | 24,568 | 24,122 |

| Petroleum | 30,507 | 26,889 |

| Other | 9,205 | 7,478 |

| Indirect Taxes | 37,200 | 34,525 |

| Excise Duties | 12,782 | 12,594 |

| Sales Tax | 9,645 | 9,189 |

| Other Indirect Taxes (incl. service tax, export/import duties) | 14,773 | 12,742 |

| Non-Tax Revenue | 49,496 | 52,827 |

| Total | 208,649 | 197,108 |

There’s an RM11.5 billion gap between the two different proposals arising almost entirely from differences in direct tax estimates. Before getting into that, here are some points to note about the other revenue estimates:

- The AB has a much larger figure for licensing fees than either the official budget, or even the revised estimates for this year (nearly RM12 billion compared to about RM6 billion in 2011, and not much more than that this year). New regulations being imposed? That won’t make businesses happy.

- Despite the proposal for cutting excise duties on cars in the AB, its actual revenue projection for excise duties is almost identical with the OB. Draw your own conclusions.

- Non-tax revenue, which is largely related to oil & gas royalties and dividends from Petronas, is about RM3 billion higher in the AB than in the OB. Probably because the AB didn’t factor in the future downward revision in Petronas’ dividend rate, which should reduce the take by RM2 billion.

As for the differences in direct taxation, since the AB isn’t contemplating a tax cut, it is seriously underestimating potential revenue. As the government is likely understating future revenues as well, that makes the AB even further off what could be realistically achieved.

The AB doesn’t talk about revenue measures apart from the cut in excise duty, so its hard to understand why this is, especially since the excise duty cut is to be phased in and will thus have a relatively small impact.

Moving on to expenditure:

Operating Expenditure:

| Official Proposals | Alternative Budget | |

| Emoluments | 58,621 | 56,017 |

| Pensions & Gratuities | 13,597 | 12,088 |

| Debt Service Charges | 22,245 | 19,430 |

| Grants and transfers to state govts | 6,276 | 12,261 |

| Supplies and Services | 33,659 | 24,384 |

| Subsidies | 37,612 | 29,877 |

| Asset Acquisition | 1,046 | 899 |

| Refunds and write-offs | 1,109 | 1,362 |

| Grants to statutory bodies | 14,041 | 13,006 |

| Others | 13,712 | 16,009 |

| Total | 201,917 | 185,335 |

The difference in expenditure proposals is slightly bigger than the difference in revenue, but of course, we’re talking billions here – RM16.5 billion to be more precise.

Are the savings in the AB realistic? The one area I agree on is the supplies and services line item – I think it’s possible (not probable, mind) for the 20% savings the AB is aiming for to be achieved. Based on the Auditor-General’s report, there’s certainly scope for more efficiency in procurement. You could also opt for *gasp* not buying so many things, although this might whack down the public investment numbers in the national accounts (i.e. this would be a growth negative measure).

As for the rest, I’m more inclined to accept the OB figures as the more “realistic”. Emoluments, pensions and gratuities are “sticky” items; the revision in civil service pay is on the books, and that makes for a real increase as both AB and OB are also contemplating increasing certain allowances and revising some pay scales. The increase in pensions is understandable in the sense that longer life-spans and a continual supply of new pensioners means that some increase is inevitable.

With debt service charges, AB is looking at clawing back some of the – shall we say – less savoury government commitments. I think the actual figure will be somewhere between AB and OB, based on the projected increase in government debt – the OB estimates appear to be a little inflated, while the AB might be a bit too optimistic about loan recovery. The differences in deficit targets amounts to just a little over RM205 million in savings under AB; not worth mentioning at all.

In grants, the AB is looking at increasing oil royalty payments (is there going to be a revision in the state grant formula, as PR mooted years ago? That wasn’t clear in the AB document), while the OB is essentially status quo ante, hence the difference of RM6 billion.

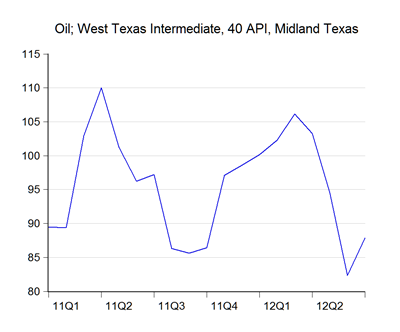

Subsidies is where the biggest departure in estimates occurs. This doesn’t make much sense at all, unless the AB was based on 2011 budget estimates, which are already seriously out of line – this year’s subsidy bill is estimated to reach RM42 billion, driven mainly by considerably stronger than expected oil prices in 1H2012:

Oil prices have since come down to more palatable levels, which is probably why the government penciled in an RM5 billion reduction in the subsidy bill next year. But any improvement in the global outlook should push oil prices back above USD100 per barrel, which is a significant risk to the “lower-average-prices” view – I think Europe hit bottom this quarter, and while we have slowdowns in other major trading partners I think we’ll start seeing a turnaround by the end of this year, as the coordinated policy loosening starts taking hold.

So to take a realistic view of this – the gap in subsidy costs between AB and OB is probably more apparent than real. But if that’s true, the gap in the overall expenditure is also much smaller than the published numbers would indicate.

That doesn’t mean that the AB’s deficit target is out of reach however; it just means that the overall size of the alternative budget is too small, on both revenue and expenditure sides.

Bottom-line: in the numbers, the two proposals aren’t really so different after all. The gap will be a matter of about RM5-10 billion at most, which is big on an absolute scale but works out to about 2%-4% or so of the total outlay.

Now, as to the question of which of these budget proposals is “better” – that depends on your point of view. The official budget is considerably more comprehensive, looking at a much wider scope of obligations, aims and commitments. The opposition’s alternative budget is more of a policy platform, with a focus on hot-button issues.

The difference is understandable if you look at it from each side’s perspective – the government has to cover all the ground required (since it is after all, a “working budget”) but for which it has all the necessary resources; while the opposition can pick and choose the spots it wants to focus on and ignore the rest, but is also limited in its access to pertinent information, like current and future ministry-level initiatives.

Looking at the specific proposals with underlying strategic themes, there’s good and bad on both sides. I think the household income proposals in the AB is largely the product of wishful thinking; but I like some of the ideas on transport and housing. I absolutely support the principles behind BR1M, but admit that the smartphone rebate to be a bit of a head-scratcher.

The proposals under public transport in the AB are sensible, but I’m against the cut in excise duties for cars (the two aims are largely inconsistent with each other). Another inconsistency in the AB is the push for breaking up public and private monopolies and encouraging competition, yet simultaneously proposing the establishment of state-owned oil & gas service companies.

There’s also some items in the OB that are really clever and that I really, really, like – the insurance and takaful coverage for padi farmers, fishermen and hawkers, which is a proposal that hasn’t gotten the coverage its deserved. That’s a way of providing real benefits to the lower-income group for a modest fiscal outlay.

I’m also really encouraged by the large allocation for jump-starting pre-school education – contrast the fiscal outlay on this with the allocation for technical and vocational training, and then look at the numbers of students involved. I have no doubt that 20 years down the road, the push for greater pre-school enrolment will bring dividends out of all proportion to the cost.

On the other hand, I thought the measures to improve innovation and R&D in the OB to be on the weak side. The allocation to universities to jump-start high-impact R&D is nice, but its not a game-changer – the fact remains that public and private spending on R&D in Malaysia will still be scandalously low.

And that’s my take on things as they stand, or at least, as much as my fingers and my overheated brain will allow me to write up for today.

At last. Good job as always :)

ReplyDeleteOne question though, why is that subsidies for AB much lower than OB apart from your statement above? I mean, PR said that they will make sure oil prices is lower than today's prices, meaning they should increase oil subsidies right?

sicfallacy,

DeleteNo details were provided on a potential increase in petrol subsidies, except on pg 2 where it is implied that it will be part of the cost savings for the "average Malaysian household", and on pg 10 where the notes on the breakdown of expenditure imply a phasing out of all other subsidies and toll concession compensation.

I think what that means is that any increase in oil subsidies will be paid for by a reduction in other subsidies. But I can't be sure, because its not made explicit.

Brother, brilliant analysis and fair views on both sides. I would agree with most of them.

ReplyDeleteI just wanna ask your opinion on the proposed reallocation of the fuel subsidy which it was said to be allocated only to the deserved ones. What do you think the most effective and practical mechanism suppose the government is really serious about reallocating the fuel subsidy and how?

Thanks and wassalam.

Salam Izuddin,

DeleteAs we saw a couple of years ago, targeting the fuel subsidy is really, really hard.

My preference would be to gradually phase out the subsidy and replace it with cash transfers. One, we already have the mechanism in place under the BR1M program; Two, the money will go where we want it to go; and Three, people will have a choice in how to allocate their consumption.

That's more doable solution than trying to manage a segregated price structure for petrol.