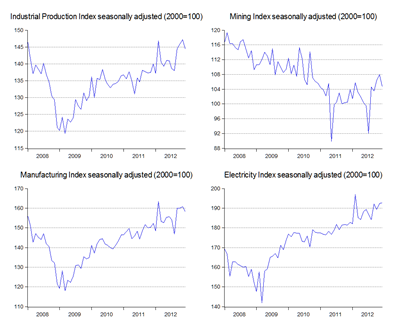

Next up from last week’s data releases, is December’s industrial production numbers. It’s only slightly better than the external trade data (log annual and monthly changes; seasonally adjusted):

Growth in the overall index slowed to 3.1% in log terms from 6.9% in November. On the month, output fell 1.9%.

It’s not all bad though, as we’re looking at a generally higher level of output for 4Q2012 (index numbers; seasonally adjusted):

While I wouldn’t want to put too much credence for the future path of output on what amounts to a quarter’s worth of data, for the last quarter of 2012, it’s a fairly encouraging sign.

Based on the IPI alone, that suggests real GDP growth for 4Q2012 at 7.0% (!!!):

That’s…unlikely, as fun as it might be to contemplate.

More plausibly, my latest composite forecast (from three different time series models incorporating the KLCI, US PMI and Malaysian exports along with the IPI) suggests a point estimate of about 5.4% with a ±1% range forecast (i.e. 4.4%-6.4%) at the 95% confidence level.

That would give a full year GDP growth estimate of about 5.3% which, given where we began 2012, isn’t bad at all.

Technical Notes:

December 2012 Industrial Production Index report from the Department of Statistics (warning: pdf link)

No comments:

Post a Comment