Some of this discussion may be pretty esoteric to the layman, even if on the face of it the changes BNM are implementing look pretty simple and straightforward. I don’t know if I can fully understand all the ramifications myself, and this whole post is probably sheer speculation.

Nevertheless, the changes in forex administration rules for instance are pretty easy to absorb (full list available here). Basically, the measures liberalise the depth and scope of forex services and products that can be offered to both residents and non-residents via the onshore market, including by FIs based in Labuan (something IIRC not previously allowed).

The measure that really caught my eye on this subject is the one allowing foreign-currency-denominated securities to be offered by non-residents to residents, which opens the way for locally issued debt instruments (particularly Islamic debt instruments) to be expanded beyond the Ringgit alone. That’s a big change, and a potentially significant fillip to our already well-developed bond markets, particularly Islamic finance.

The changes to the fee structure for payments is, on the face of it, even simpler – online giro transactions will be capped at RM0.10 per transaction (effective May 2013) while cheques will attract a processing fee of RM0.50 from April 2014 onwards. ATM charges will also be gradually increased in future.

These changes will be levied to reflect the “cost of production” of each payment channel, estimated at RM3.00 per cheque for example, with a goal of quadrupling per-capita transactions via electronic channels and halving cheque payments by 2020. BNM expects the shift to save up to 1% of GDP if the transition can be fully achieved – great if we can get it. Lower transactions costs can and will increase the volume of economic activity, all other things equal.

Here’s where it gets interesting for me – one less obvious implication of promoting the already strong trend away from cheques and cash towards electronic transactions is that it blurs the distinction between M0/M1 and broader monetary aggregates like M2 and M3. That’s because savings deposits – which are under M2 but not M1 – will become a much closer substitute to both cash and cheques (which are aggregated under M1).

But this suggests that changes to the monetary base (M0/M1) – either endogenously through the banking system or exogenously by central bank policy – will have much less policy traction on broader monetary aggregates, and thus on economic activity as a whole. In other words, it makes Bank Negara’s job of keeping track of monetary conditions and the health of the economy a little harder.

Further, there’s also a continued blurring of the line of what constitutes money (in its economic sense, not its legal sense), not just from the shift in use of cash substitutes like bank deposits, but also from increasing use of E-money (such as Touch’n’Go cards) and other payment instruments. For example:

The Bank has provisionally allowed telecommunication companies to offer mobile airtime to be used as a mode of payment for limited products and services while the Bank assesses its usage pattern and associated risks to form the basis for the development of a suitable regulatory framework for such payment services.

2012 Financial Stability and Payment Systems Report (pg 137)

I recently read some of Milton Friedman’s reminiscences of working for the Marshall Plan after WWII helping in the reconstruction of West Germany, in which he noted the widespread use of American cigarettes as a medium of exchange (i.e. money). This is something akin to that, but without post-war hyperinflation as an excuse.

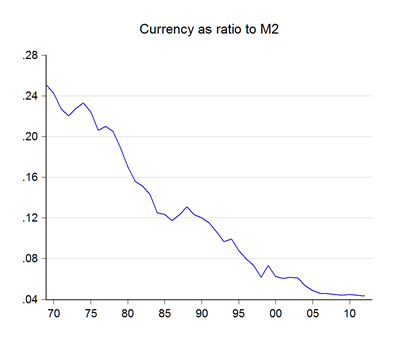

Beyond the historical significance of the changing modes and uses of money, there’s the more practical issue of monetary aggregates as indicators and levers of monetary policy. Cash has already become a minor part of the money supply:

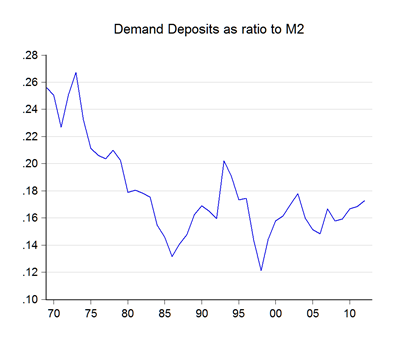

Currency in circulation as a percentage of M2 is now just 4.3%. The relative pricing changes promises to take even this paltry share even lower. Demand deposits have held up better, but I suspect this new pricing framework will pull down the share here as well:

Cheque transactions have been static over the last five years, while electronic transactions are showing zooming growth. More importantly, these shifts to substitutes for what has traditionally been considered money makes monitoring monetary conditions a little more complicated and diffuses the link between narrow and broad monetary aggregates.

In a certain sense, this concern might be overblown – for instance, if I reload my TnG card with RM200 from my current account via ATM, that just shifts RM200 from my account to TnG‘s account and there’s no change in monetary aggregates, just a change in the form of assets and liabilities. Lower transaction costs means higher productivity and higher profits, while banks will not have to subsidise the payments system as much as they have before.

But what will change and continue to grow is that there are now economic agents in the monetary system that are not banks and are not regulated as banks, yet have financial liabilities akin to banks. Is the purchase of E-money and reload cards similar in function to a bank deposit for payment purposes, even if legally they are not? If so, can you conceivably imagine a bank run on TnG or Maxis or Celcom? They might not have the maturity mismatches between assets and liabilities that a bank would have, but I can certainly imagine a shortfall of liquid assets and it worries me. It’s not going to be a problem for the near future, but it could be 10-20 years down the road.

That’s probably one reason why the new Financial Services Act expands BNM’s regulatory powers to cover “shadow” banking – if it looks like a duck, quacks like a duck and waddles like a duck, chances are its a member of Anatidae Anseriformes and should be treated as one.

But beyond my disjointed and speculative ramblings above, I’m fairly sure that BNM keeps very close track of transactions data – it is after all, part of their function as guardian of the payments system. But it would be interesting and useful for high frequency data on payment transactions to be made publicly available for the rest of us poor economics wonks. I suspect it would be a very good way to monitor not just monetary conditions, but the economic health of the country in general.

One can wish.

Actually the cost of overall transaction will be increased instead of otherwise.

ReplyDeleteRM.1 per transfer does encourage cashless exchange but it is a move away from paying cash to giro transfer. Paying via paper notes cost me nothing but the transfer charges me RM0.1 with other indirect cost i.e broadband/mobile connection fee. Reload T'nGo is not free too, it costs .50 now. Not withstanding the card could be damaged and cost money to replace. For instance.

Main beneficiary is the finance/business industry, not really the general folks on the street. Such as eliminate needs for paper notes printing that is getting more expensive nowadays, lowering staffs (can we blame the min wage law?) and etc.

Just curious, will the CPI able to capture all that was mentioned above?

Actually, paying via paper notes is enormously expensive - it's just not charged directly to you or other customers of the payment system.

DeleteHistorically, the use of cash and cheques is almost entirely subsidised, with the cost borne by bank borrowers, not by payment system customers. This used to be explicit in the calculation of BLR, before interest rate liberalisation in the early 1990s.

In any case, what it means is that usage of cash or cheques influence the cost of credit. Lowering transaction costs by shifting away from expensive paper transactions to cheaper electronic channels should reduce the operational overhead charged to bank customers (i.e. lower borrowing costs), since payment system costs are better covered by those who actually use them.

I doubt "telco banks" entities will suffer from bank run as long as one can't really withdraw money from them. I'd think that's the case. It's essentially a prepaid wallet: the only direction cash flows is into the telco. Towards the opposite direction will just be credits which cannot be "bartered" into cash. Cash and credits aren't convertible both ways.

ReplyDeleteIf a telco is about to collapse or there's significant rumor that it's collapsing in the style of traditional bank run, there's just no avenue for cash to go out from the telco.

In its place, would one go and buy as many products from the telco as possible instead to preempt the collapse?

Most telco products are digital so there can't be scarcity and for the hard stuff, it depends on stock. If no stock, the credits just won't go anywhere. It just sits there as maybe a deposit.

Agreed - there can't be a bank run in the traditional sense. But that's not the only way bank runs happen. You have to look at the other side of the payments system (the acceptability of prepaid credits as payment instruments) and on the wholesale side (the balance of liquid assets relative to on-demand liabilities).

Delete