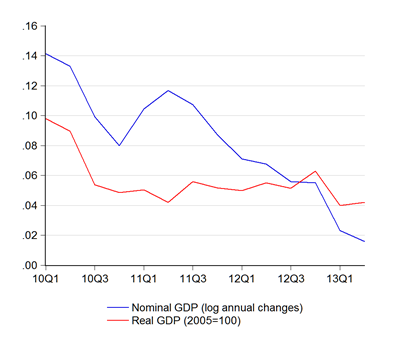

Yesterday’s GDP release showed the Malaysian economy continuing to expand, but well below expectations (log annual changes, 2005=100):

Growth was marginally higher at 4.2% (log terms) compared to last quarter’s 4.1%, but it’s hardly a picture of glowing health. Exports have contracted for the 4th straight quarter, while overall investment has dropping to earth to 5.8% compared to the double digit growth rates recorded since 2011. What’s kept growth going is still strong private and public consumption. External weakness is the key story though.

On the supply side, manufacturing showed some signs of life, but the thing that stands out to me is the poor growth in services (log annual changes; 2005=100)

Both mining and construction also recorded growth slowdowns, but the services sector is so much larger that the impact on the economy is greater. Having said that, the services sector contributed more than 60% of growth in 2Q2013. The main laggards in the services sector are motor vehicle trade, finance and insurance as all three contracted in the quarter. Funnily enough, manufacturing of motor vehicles showed a big jump, while communication and retail trade were the main contributors to growth on the services side.

Prices played a big part in this slower growth phase (log annual changes):

Nominal GDP growth is barely breathing, falling to just 1.6% – no wonder people don’t believe in the growth of the economy. The implicit GDP Deflator (which measures price changes across the whole eocnomy) has now hit negative territory for a third straight quarter:

The deflator is now running 4.3% below CPI inflation, which gives you a pretty good idea of the hit on incomes. There’s some fairly serious implications on the budget deficit and government debt targets as well – slowing nominal GDP growth changes the denominator, which means both deficit and debt ratios will rise, even if the government hits its absolute deficit target squarely. I think we need to look for a pullback in public expenditure over the coming two quarters.

One interesting about yesterday’s data release was the inclusion for the very first time of official seasonally adjusted data for GDP. Here’s what the differences are, shown side by side:

The blue line is unadjusted and year-on-year, while the red line is seasonally adjusted quarter-on-quarter and annualised (as per standard international practice). There’s some minor differences with my own rough and ready seasonally adjusted data that I’ve used previously, but the DOS figure is more rigorously calculated (there’s a briefing today at BNM about the methodology).

A c0uple of things of note are just how bad the 1Q2013 numbers really were, and the relative recovery in 2Q2013 – so things aren’t quite as gloomy as they seem.

As far as my forecasting models are concerned, this is the third straight quarter where the generated forecasts have missed the actual by more than one standard deviation (two forecasts over estimated, one under), and this quarter’s miss was the worst of the three and the worst forecast error since 1Q2009.

I have no reason to abandon or modify them just yet however; partly because the 2Q2013 realisation was within the 95% confidence interval of the generated forecast – barely – and partly because I’ve yet to devise anything better. They forecast 3Q2013 GDP to keep showing growth and at a faster pace than in 2Q2013, but not much more. Point estimate is at 4.7%, and range forecast is between 4.1% to 5.3%.

Technical Notes:

2Q2013 National Production and Expenditure Accounts from the Department of Statistics

Hi, Hisham

ReplyDeleteSo, have we entered a period of gloom and doom as far as the economy and government finances are concerned?

Today's front page report in the Singapore Business Times carried a particularly evocative headline "It's a RRRout as rupee, rupiah, ringgit get hit"

For the ringgit, as shown in a table in the report, on a spot basis, it's down 5.37 per cent against the US$ and 3.39 per cent against the Singapore $ (on a 12-month basis).

This, according to the table, makes the ringgit the 3rd worse performing currency in developing Asia, after the rupee (-13.82%) and the rupiah (-11.81%).

With the Malaysian economy continuing to slow down, with a fall in exports, a shrinking current account surplus, rising debt levels, lack of budgetary reform and the fact that "foreign investors hold close to 50 per cent of outstanding Malaysian government debt - the largest share among all the countries in the region (Sim Moh Siong, Bank of Singapore currency strategist), could there be more pain ahead, especially when investors "start to pull money out from emerging countries en masse" (Marc Lansonneur, Société Générale Private Banking (Asia Pacific))?

Hi Jasper,

DeleteI wouldn't read too much into market movements right now. A lot of it is due to rumours the Fed will be ending QE3 soon, which has foreign investors more than a little jittery.

The USD is appreciating against almost everybody as a result, while the appreciation of the SGD is more a result of Singapore's monetary policy. On a trade weighted basis, I have the Ringgit down just 1.2% from last year, and it hasn't really moved out of its normal trading range since 2009.

Yes, the level of MGS held by foreign investors is at an all time high (on a regional basis, Indonesia's exposure is actually slightly higher), and I and other analysts have voiced concern over this for a couple of years now, so much so BNM addressed the issue during the annual account briefing a few months back. Nevertheless, the pullout over the last couple of months hasn't materially affected MGS yields (even if it has the Ringgit), which would be the mechanism for propagating interest rate hikes into other debt instruments and loans.

Doom and gloom? In the press maybe, but it looks like the economy's already moved past it.

Hi Hisham, do you have DOS' methodology for their SEAM adjustment? I asked them for it at BNM today and was told it's in their journals page, but it's not :/

ReplyDeleteJust wondering how you graphed your SA chart above.

Barry,

DeleteThey're referring to this paper.

Good luck figuring it out. I read the paper a couple of years ago, and still can't work out exactly what they've done - it involves a modification to the ARIMA-X12 program, which should be programmable (the required interface is available in EViews for example), but there aren't any details that we can use to replicate the adjusted data. For example, the number of days used for each holiday, and the distribution before and after the holiday dates.

The graph above was constructed from the adjusted DOS data, which is available as a separate download.

Now this looks familiar...thanks H. I get the sense that DOS will be eventually migrating to SA series entirely, even in reporting, the way they keep talking it up. Us econ oompa loompas are going to need to know how to replicate this.

DeleteBarry,

DeleteFrom your lips to God's ears. We're hoping to arrange a visit with DOS. They really ought to do a full workshop, because I think the demand is there.

Dear Hisham H,

ReplyDeleteThanks for your narrative. Some items for discussion (with your kind acquiescence)

(1) Seasonally adjusted Real GDP growth

I reviewed the paper and here are my issues.

Shouldn't the effect of a seasonally adjusted time series result in a less volatile graph, as a seasonal effects are "smoothed out"? But the real GDP graph shows a much more volatile effect which makes me think that the adjustment is suspect.

So I reviewed the paper.

I want to go in the reverse order. The last part of the paper deals with the statistical test of stable seasonality and moving seasonality. You could reject the null hypothesis of no seasonality for most of the economic time series.

So it exists - but what is it? For example, palm oil production will be more affected by the rainfall pattern than whether we Hari Raya in January or September. And the external sector is affected by the seasonal demand for goods and inventory flows.

So even though seasonality exists, we cannot equate it solely to the local Malaysian celebrated holidays.

Now we can go and de construct the initial model. It is based on a survey of 300++ people on the average holidays taken before and after

the major holidays. Making generalizations about an economy with 11 million actors based on a survey of 300?? And was the sample skewed? Was the sample proportional to the weights in the economic sector (i.e. skewed more towards those in services vs. those in Gomen). And lastly was it reflective of the people who actually did the work? Like a person should survey branches rather than HQ. And then there is the effect of rostering - people swap holiday breaks so that the total work still is relatively constant.

So do you see - I really have an issue with the methodology. I say, be done with a seasonally adjusted series and accept it as it is. So a bump in growth, is a bump in growth, regardless of whether its due to CNY or Hari Raya or Thaipussam or Happy Sir Wenger day.

After all, since we have so many races here, and since a lot of economic output is lost due to internal bickering ,so thus, the variation in growth due to holiday effects is an endogenous effect similar.

Now if only somebody could come up with a racially adjusted data series or a politically adjusted data series?

Just kidding.

Shadow Banker,

DeleteI wrote in the post:

"The blue line is unadjusted and year-on-year, while the red line is seasonally adjusted quarter-on-quarter and annualised (as per standard international practice)."

The apparent higher volatility in seasonally adjusted real GDP is due to the different methods of calculating growth, not to any deficiency in the methodology itself. If you refer to the link I gave Barry on the actual data, you will find that seasonally adjusted GDP is indeed "smoother" than the unadjusted series. You can find a further discussion of the two methods here (which happens to be the second post on this blog that I wrote).

As for the problems in the paper, note that its an old paper and used more as a proof of concept rather than how SEAM might be used operationally. I would think that improvements in sampling would have been conducted since then (the people at DOS aren't dummies); but I;ll be certain to ask when I've had a chance to visit.

Also note, in Thursday's briefing, DOS provided the results of tests on a sector basis, so it doesn't look like adjustment was made solely on the basis of the aggregate figures. Again something I will try to confirm.

In any case, empirical experience with quarterly seasonally adjusted data suggests that the moving holiday effect is considerably muted compared to monthly data.

(2) Real GDP versus Nominal GDP

ReplyDeleteOkay. My issue with this. As I am engineer, now financier and part time political hack, but never an economist, differences will emerge.

Firstly, what exactly are we trying to mean when we say "oh the real GDP increased by 4.xx%"

You, I and the economic world knows its a volume measure. You, I and the economic world knows that it is a function of the growth in the labour market and the productivity + some knowledge effect (this is Malaysia, who are we trying to kid)

But here is where you and I would disagree. The influence of deficit spending on real GDP. I mean, if tomorrow Sir Wenger, who is a complete quack, was elected President of UMNU, then I can guarantee we would have 10% real gdp growth for the first 2 years. Why? Because Sir Wenger would run a loose monetary policy, quintuple BRIM and aim to crack the RM 1 trillion debt barrier in no time.

So that is why I think real GDP should be taken with a lot of salt. Firstly, a great thing to show the comparison between nominal and real. So the collapse in the GDP Deflator and its divergence between CPI makes this an extremely weird scenario. Retail prices rising, producer prices falling.

A-ha, must be corporates squeezing extra profits from the people. Does that make sense?

Of course, the weights are different. But some food for thought..

Lastly on nominal GDP. It is a point number, but the trajectory is more important. Off hand, it was in a decline, but the decline has accelerated over the last several quarters. Now, this decline has happened even though we have been running huge deficits and even giving up free money on an annual basis.

So assuming that we continue with the following parameters

Good Case Scenario

Nominal GDP Growth : 5%

CAGR in Government Debt : 11%

( "Endless Possibilities" CAGR)

We end up with debt to nominal GDP of 74% in 2018 with total debt stock being RM 915 billion.

Likely Case Scenario

Nominal GDP Growth : 3%

CAGR in Government Debt : 13%

(Magic of compound interest)

We end up with debt to nominal GDP of 90% in 2018 with total debt stock being RM 1 trillion.

So what does this say about the ringgit, interest rates, economic growth and the state of the union?

Shadow Banker,

DeleteI'm not sure what your understanding of the GDP Deflator is, but it is not "producer prices". Both nominal and real GDP are aggregates at the final consumption/production level, so input prices are already subsumed into the numbers.

The difference in CPI inflation and GDP Deflator inflation is currently largely due to lower global prices of our exports. While this could indeed lead to lower producer prices, it is not quite the same thing.

Second, the GDP Deflator does not have "weights". It's simply an index of the difference between real and nominal GDP, and is not constructed by aggregating weighted price changes as the CPI is. That's why it is commonly used with the word "implicit", because it's not a directly calculated price index.

As for the last, debt growth last year was 8.3% and that figure should stay the same if the government hits its absolute deficit target this year.

BTW, Malaysia's median long term nominal GDP growth rate is over 11%, and 10.9% over the past decade. If we presume a protracted global commodity downcycle, that growth rate should still hold - the last time something like that happened (the 1980s), NGDP growth still hit above 11%.