First off, I have NO idea what BNM is going to do today. I have decided opinions on what they SHOULD do, but there’s a striking divergence of opinion in the market about this.

So here’s the situation – the MPC decided in July that with growth looking robust, it’s time to normalise interest rates and head off the risk of “financial imbalances”, which could mean anything from excessive borrowing by firms and households, or an imbalance in net foreign asset holdings, or pretty much anything really. I didn’t agree with the decision then, and I still don’t.

But having embarked on a course of normalisation, my preference would be to see it through – a 25 bp hike wasn’t going to hurt the economy then, and another 25bp hike today isn’t going to hurt the economy going forward either. It’s just too small of an adjustment, and the transmission mechanism isn’t perfect (translation: long borrowing rates won’t respond as much as short term money market rates will).

You can see that in the changes in the lending rates and bond yields. While the OPR went up 25bp in July, average lending rates only went up 10bp. 5 year MGS actually fell by 7bp on average in July, and are now trading little changed from June levels.

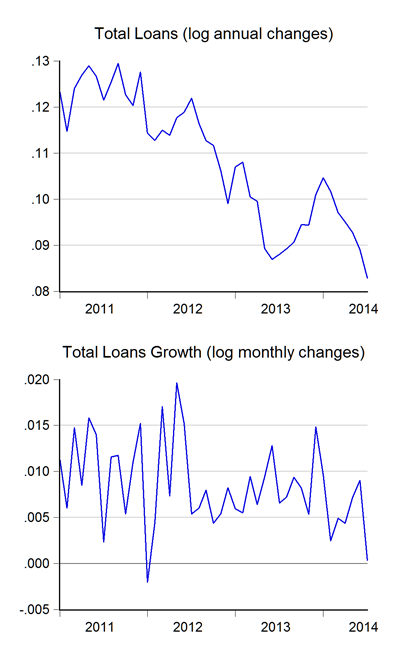

On the flip side, July IPI figures and exports were extraordinarily poor, and loan growth has been trending down:

Loan growth in July was barely positive over June levels. But that is more likely a factor of the macro-prudential measures that BNM put in place earlier and I don’t think it’s really a due to higher borrowing costs at all, though you can never discount psychological factors. On the other hand, household leverage, particularly at lower income levels, is still high and there’s no evidence of any serious attempt at balance sheet repair.

I also think the poor July production and export figures are a one-off – there’s no break in the growth trend, if you look at the levels. Then there’s the concurrence with Ramadhan, which tends to have a dampening effect on output and shipments anyway, which isn’t quite captured by DOS’ seasonal adjustment.

Inflation isn’t, or shouldn’t be, a factor. While headline inflation is above the long term average, this year it’s been almost entirely supply-side driven – subsidy rationalisation, hikes in excise duties and the electricity tariff hike from Sept-13 to Jan-14. Without these factors, inflation would be well below the long term average, closer to 2.0% than to 3.0%. The line about inflation being above the long term average in the previous MPC statement was a red herring – given BNM’s mandate, you have to say something about inflation in the MPC statement, but the brevity and the purely factual content of the comment (it was two lines) showed that it wasn’t really a consideration.

Some further background: in July, the MPC and nearly everybody in the market, including me and my two hamsters, were expecting the government to resume fuel price hikes by September or October at the latest. There was some rumours about a much more complicated scheme involving income levels and quotas, but this now appears to be on hold.

More importantly, global events have made fuel subsidy rationalisation much less pressing. Next time you fill up at the petrol station, pay attention to the stickers the Ministry of Domestic Trade has kindly plastered on all the petrol pumps – the current level of the petrol subsidy, given the drop in global oil prices, is about 20-25sens below where it was in July. WTI prices are now at their lowest levels in a year, and there are few short term prospects for a rally in the global markets. Essentially, the government will meet its subsidy rationalisation target without lifting a finger. Having said that, the nasty side effect would be slower nominal domestic income growth, from weaker commodity prices (CPO prices are also very low).

You put all that together, and it’s a tug of war. Some indicators are pointing to the need for higher interest rates, while others are showing slower growth and the need for more accommodative monetary policy. Personally, I think the decision should be forward looking – is the path of growth really going to fall off enough to justify keeping rates on hold? Is household and corporate sector leverage going to get better or worse at the current level of interest rates?

I think the global scenario has been brighter than it has been for many years – the US is finally on a path for sustainable growth, Europe is finally going to get the monetary stimulus it needs, and Japan has committed to reflating their economy. China has very recently plugged in further liquidity to keep their growth afloat at around 7.5%. So near term external growth prospects are still there, even though lower commodity prices will cause a short term hit to nominal growth. On the domestic side, my two concerns over the medium term would be household borrowing (from non-bank lenders) and the potential overhang of commercial property coming on-stream over the next couple of years.

That tends to argue for a continuance of interest rate normalisation, with a simultaneous bias towards weakening the exchange rate (i.e. unsterilised intervention of fx inflows) if the Ringgit doesn’t weaken on its own. But there’s a fine balance here, and I honestly don’t know which why the it will tilt.

No comments:

Post a Comment