It’s been a really hectic week, which is the reason I haven’t put down my thoughts on the budget sooner. In one sense, that’s an advantage – it means I get some time to think about it more. In another sense, it’s not – people are probably suffering from budget “fatigue”.

Be that as it may, here’s what I really think: there was a little something in here for everyone…emphasis on “little”. Ok, I’m kidding, just a bit.

There were of course some major changes in the tax regime, of which GST was the biggest. The personal and corporate income tax cuts and increase in BR1M payments were also pretty big, as were some of the projects that were announced. The thing is though, all or most of these were actually announced last year in the budget speech for 2014, while most of the projects announced will either be off-budget through SPVs or via PPPs. So there was little in the way of new major fiscal policy changes for next year.

But before diving into some of the details, here’s a little something to put all of this in context (USD per capita):

That’s my current forecast for when we’ll cross into high income territory, relative to the World Bank’s high income classification (extrapolated to 2020 from the current level). It looks like we’ll cross the threshold by the end of 2017, and the USD15,000 mark by 2019. A lot can happen between now and then, but I’ve no doubts we’ll get there a little earlier than 2020.

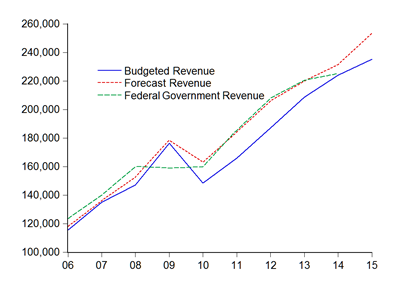

On the aggregates, revenue is expected to hit RM235b next year, a 4.5% increase over this year’s estimated RM225b (RM millions):

Note that this year’s revenue numbers – for once in a long while – is actually close to the original budgeted figure. So in fact is estimated opex (RM millions):

The difference here is a matter of RM3.5b, a variance of just 1.6%. It sounds like a lot of money, but for an enterprise as big as the government is, that’s not bad at all. Especially in comparison with the historical experience.

You’ll note that both my revenue and expenditure forecasts are considerably higher than the government is budgeting for – that’s a function of the models I use, which tend to accentuate past performance trends. I’d be very happy to be proven wrong.

With development expenditure, there’s been a consistent shortfall relative to budgeted levels (RM millions):

We’re not talking small amounts here either – the average variance is about 7% below target levels. Even with the higher allocation under Budget 2015, total development expenditure would still fall RM10 billion short of the allocation under RMK10.

As for criticism that we’re not spending enough on development – we have one of the very few governments who actually split up the budget this way (Singapore is the only other one I know of). So there’s no basis of international comparison to say whether we’re not spending enough. Also bear in mind that development expenditure = fixed asset expenditure i.e. it covers everything from roads and buildings to submarines and armoured personnel carriers.

On to the specific measures, with my comments:

Like

- Services Sector Guarantee Scheme – nice to see the services sector receiving more love.

- Capital allowances for increasing automation – not a whole lot, but you have to start somewhere.

- Enhancing HSBB capacity – we’re still way behind where we should be.

- Soft loans and funds for SMEs – again small, but useful.

- Allocation for students under vocational and community colleges – absolutely necessary, but I think we will need a more holistic approach to improving take up. Having said that, the budget is the wrong place to make statements about strategy, so I hope there’s an actual strategy underlying this measure.

- Revamp of JobsMalaysia – this was actually one of the suggestions I was hoping to forward to MoF (it didn’t make the final cut). Nice to see it taken up anyway.

- Employment Insurance Scheme – no details as yet, beyond the bare announcement. Funding for this will be critical in determining how effective it might be. I’m leery of the law of unintended consequences here.

- Rebate and discounts for PTPTN borrowers – there’s a proposal towards listing PTPTN debt in CCRIS, which would have the effect of crimping access to credit for PTPTN defaulters. There’s an equity issue here (some still don’t have jobs), but for those who do, there’s obviously a civic duty that hasn’t been fulfilled. At some stage though, we’ll have to revamp the entire system because it isn’t sustainable as it stands. Want to know about government contingent liabilities? PTPTN is at the top of the list.

- Allocation for transport costs to Sabah and Sarawak – nice but what about cabotage?

- Skills training and incentives for housewives returning to the job market – helpful, but implementation is critical.

- Women Special Protection Homes – this one’s an allocation for purchasing the property. How about funding these homes as well?

- Expansion of child care centres – companies can now use facilities located above the second floor. I don’t know if there have been previously granted incentives to actually prompt companies to open one however.

- Low and affordable housing schemes – plenty of schemes here, from PR1MA to Rent-to-Own, to PPR and RMR. All told, 143,000 units announced, but obviously not all will be completed within the next year (probably over the next 2-3 years). As much as that sounds like a lot of homes, this is barely equivalent to a year’s worth of housing, and in the most under-supplied portion of the market.

- Expansion of BR1M and student allocations – BR1M goes up by RM300 and to be paid in three tranches. It’s a big jump, but what I want to know is whether this is a permanent increase, or a temporary one. When we were briefed on GST last year, the increase in BR1M was supposed to be a one-off measure to take the bite off of GST implementation. I’d rather see it permanent.

- Expansion of assistance to the OKU – thumbs up.

So-so

- Expanding the list of zero-rated and exempt items under GST – I like some of the items to be zero-rated (books and medicines), but I’m not keen on the relief on fuel. Yes, that means I’m in disagreement with 99.999999% of the population.

- 30% quota for Women Directors scheme – Research shows board quotas don’t enhance women’s labour market participation over the short term. Over the long run it’s likely to be helpful however, especially since it gives an excuse for giving some “legacy” directors the heave-ho. Companies with a good leavening of women directors tend to perform better.

Don’t Like

- Reduction in income tax – I don’t like this AT ALL. Not the personal income tax cuts, nor the corporate tax cuts. As a compensation for GST, the cuts are uncalled for – personal income tax cuts only affect the top 20% of income earners (the biggest gainers are in the top 1%), and companies and corporations are beneficiaries of the switch from SST to GST to the tune of RM4 billion a year. This simply doesn’t make any kind of economic or fiscal sense, even if it makes political sense.

- Youth Housing Scheme – Luckily, this scheme is only open to the first 20,000 applicants. Otherwise, this would put a lot of young people into a serious debt commitment, by allowing a debt service ratio of up to 75% and effectively 100% financing. That substantially raises the risk of default with any kind of financial or economic shock, and over commits those households to holding one investment asset (property). But then, I’d be against encouraging home ownership in principle anyway. The home ownership ratio in Malaysia already exceeds 70%; raising the ratio further exposes the economy to the property cycle. I’d rather see some scheme to support expansion of affordable rentals.

What are they thinking of?

- One year child care leave – I’ve had more than one woman say what a crazy idea this is. Some specifics first: this new “benefit” is apparently on top of the existing paid maternity leave, can be taken at any time (not necessarily immediately after the existing maternity leave eligibility), but will be unpaid leave. The unsaid drawback is that for employers (should any but the government actually be crazy enough to take it up), is that this is equivalent to a tax on women’s labour even if it involves unpaid leave, and could see discrimination against women in the labour market increase. It also benefits existing women employees to the detriment of new ones.

Overall, this budget tries to touch all the bases. As I said, there’s something here for everyone, even if those somethings don’t amount to very much. It may be that the government is trying a little too hard to please every constituency, while simultaneously shrinking the deficit. That’s a really tough balancing act to do, especially with everyone watching every measure like a hawk.

I’ll note for instance, that the allocation for emoluments, pensions and gratuities is barely 0.5% higher than for 2014 – civil service pay and retirement allocations have obviously taken a back seat to everyone else. Something, or more precisely someone, had to give. The other obvious bearer of all the largesse is the public at large, via subsidy rationalisation. But that’s a more straightforward give and take, and one that makes better economic sense.

In the larger scheme of things, I’ve made no secret of not being a fan of trying to balance the budget. Given the specific circumstances Malaysia is in (current account surplus, large corporate surplus, household deficit and fiscal deficit), reducing the government deficit needs to be counterbalanced by private sector investment or increased (debt-financed) household consumption. It also shifts all of the burden of macro management onto Bank Negara. This suggests economic growth will become more volatile in years to come – not exactly something I’m looking forward to.

Technical Notes:

- 2015 Budget Speech and appendices

- Economic Report 2014-2015

Non-volatile growth will put both of us out of a job :P

ReplyDeleteI dun like the idea of high income country. It makes a lot of people suffer.

ReplyDeleteYou are sadly right, anon. I don’t think you would fancy being a prole in a high income country like Equatorial Guinea or errr…….Cayman Islands :

Deletehttp://en.wikipedia.org/wiki/World_Bank_high-income_economy

Being a high income nation is a misnomer when you have squalor and lux living side by side….or more accurately in the valleys and the hills…cue Rio or Lembah Pantai and Bangsar…..hahaha . So one should not be needlessly besotted by meaningless nomenclatures, inane sobriquets or esoteric monikers . And high income is nothing when you cant have quality like this:

http://www.youtube.com/watch?v=TCbvxb5t5_8

http://www.youtube.com/watch?v=Vy_BVQ_uCAY

Great project to make life easy for almost everyone while saving the environs in the bargain..way to go Anil, Wonderware, Aena and the Barca technocrats!! (my full support and commitment!)

Elsewhere the blogger is right regarding tax cuts favouring the 1%. Probably he has an eye on the Gini that’s waiting to be released from the bottle…hahahaha. Especially when we know the super-human (wink wink) composition of the 1%, 10% , 0.1% whatever as much as we do know the human composition of the penjawat awam (wink wink):

“Majoriti penjawat awam - kira-kira 60% atau 630,000 diwakili Cuepacs - menerima gaji RM3,000 ke bawah sebulan.”

http://www.themalaysianinsider.com/bahasa/article/penjawat-awam-sambut-dingin-bajet-2015-isu-struktur-gaji-tidak-ditangani

mmmmmind- boggling or mind-blowing ….. 1 free brim ringgit for a prole and 8 free tax ringgit for a tuxedo…

http://www.nbc.com.my/blog/budget-2014-reduce-personal-tax-2015/

very equitable indeed dont yah think ma Cherie Marie? ….must be pleasing to tighten the tourniquet …ah mrs Antoinette? ……….hahahaha

But then again, the clouds are not too silver lined on the horizon as this euphemistically pregnant Moody seems to imply

http://www.themalaymailonline.com/money/article/moodys-household-debt-high-in-some-sea-countries-but-manageable

the bluesy mood of which effortlessly segues with Nancy’s a capella:

http://news.asiaone.com/news/malaysia/more-malaysians-red

Me? While Rome burns , I like to enjoy making love with ideas nowadays…like exploring the curvy mysteries of marginal utility and the esoteric pouty lips (both..wink..ahem! ahem!) of high class lifestyles:

http://www.themoneyillusion.com/?p=26694

or orgasming about race relations elsewhere far from nowhere.

Maybe the American experience is a jalousie or an ajar bay window into our own tortured soul:

http://www.slate.com/articles/news_and_politics/politics/2014/10/the_whiteness_project_whites_and_blacks_are_still_living_in_separate_worlds.html

Time for some kebaya jazz, and some Don Perignon….g’night

Warrior 231 (sorry blogger ………just couldn’t resist a comment )

Yet most of the most prominent advances in the field of IT have come from a country where lux and squalor coexist side by side.

DeleteYup, the good old US of A.

The birthplace of Amazon, Apple, Facebook, Google, Microsoft, Twitter etc etc.

And home to Silicon Valley, private equity funds, venture capitalists....well, you get the picture.

I'd postulate that it takes marked inequalities and income differentals in a country to trigger and fuel technological advances.

But it's not happening in Malaysia, where there are inequalities galore, perpetuated by what is euphemistically referred to as "inherited wealth".

Maybe Hisham can postulate a theory or two to account for this seemingly unfair state of play?

With all due respect, I don't think it's that simple.

DeleteYes, the US has been the home of great technological advances and developments.

But it had (and still has) the advantage of being able to pick and choose the best and brightest of immigrant talent.

A visit to the corporate campuses of Apple, Google or Facebook will show this.

But it's not really relevant to the Malaysian Budget and the country's vision for the future, is it?

Like there can only be one USA. And that it can't be replicated, for any number of reasons.

@Rithmatist, you are spot on with that observation, dude. When I was involved with the Ivy Bridge project a couple of years back, Intel was actively tapping the resources of its cosmopolitan researchers from its facilities the world over. And those facilities are essentially stocked with American trained locals who can think outta a box or “beyond the mind” in a jiffy

DeleteWarrior 231

Re: one year child care leave. I support this, in fact I think gov'n & companies should be encouraged to allow employees regardless of gender to take unpaid career breaks. Of course there needs to be certain ground rules established. Trust me, not many employees will take this option unless they have to. For one, not many can afford the loss of income; secondly, your career do suffer a bit for being away for an extended period.

ReplyDelete