One of the big themes over the past year has been the strength of the US Dollar, which has appreciated against currencies and commodities since the middle of last year. That pushed many currencies into “undervalued” territory – exchange rate levels that are below what is suggested by their economic fundamentals. That’s certainly the case here in Malaysia, oil price declining notwithstanding.

But given that its been largely a move by the USD, it would be fair to flip the question on its head: If other currencies are “undervalued”, the opposite must also be true. How “overvalued” is the USD?

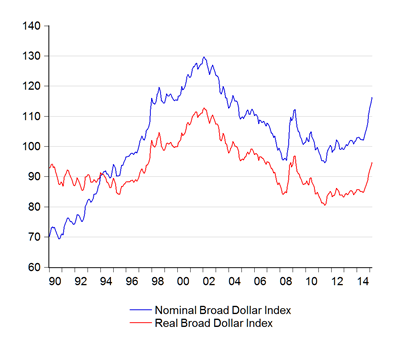

So for your weekend amusement, I present a quick and dirty approach to doing just that (index numbers; 1990-2015):

The two indexes above are the USD nominal and real broad effective exchange rate indexes, from 1990 to the present. In theory, if the Dollar was correctly valued, both indexes would be quite close to each other.

Instead, what we have is a convergence up to about 1994, and then an increasing divergence up to about the time of the Asian Financial Crisis. Thereafter, the deviation between the indexes has been approximately steady, until a creeping divergence set in after the GFC (log difference between indexes):

From about 12% overvalued in 2008, the USD exchange rate has progressively gotten overvalued until the difference reached 20% at the end of the plot (the data I have above goes to Mar-15).

We’re talking here about a period of fundamental deviation in the nominal value of the USD away from its real value, that goes back over twenty years. Explaining this would take some doing, which I won’t even attempt here.

Technical Notes:

Nominal and Real Broad Effective Exchange Rate Indexes from the Federal Reserve Board

Hi Hisham,

ReplyDeleteSome questions in my mind:

1. Wouldn't someone question the significance/purpose of the real broad dollar index?

2. People seems to believe that the Feds will raise rates this year, however, given that domestic inflation in US is controlled and ECB's deposit rates is now negative, wouldn't the Fed be compelled not raising rates? what is the purpose for the Fed to raise rates?

I am compelled to believe we will live in a world with low interest rates(and gasp, negative rates) for a couple of years more.

3. Is there any correlation between interest rates and competitiveness? Eg. If it costs more for Msian businesses to borrow vs lets say, a Singapore business, wouldn't the Msian business lose in competitiveness?

I'm of the opinion that it's a good strategy for businesses in countries with low rates to borrow locally, invest abroad, purchase huge chunks of equities in other countries and repatriate the funds back to their own countries as dividends.

Your thoughts?

Thanks and keep up the good work.

@Kenny

DeleteThanks!

1. The real dollar index is just the nominal index adjusted for inflation. It's a fairly standard measure, and the way the Fed calculates it constitutes international best practice.

2. The Fed does not look at the international situation when deciding on monetary policy. Their dual mandate is to ensure price stability in the context of an economy at full employment. The trajectory of both core PCE (their preferred measure of inflation) and unemployment suggests the hiking cycle should begin soon.

3. Not that I know of.

4. You're describing the carry trade:

http://www.investopedia.com/terms/c/currencycarrytrade.asp

http://www.forbes.com/sites/investor/2014/09/04/carry-trade-the-multi-trillion-dollar-hidden-market/

https://agenda.weforum.org/2015/04/should-we-regulate-the-carry-trade/

The above tends to be US centric. One of the most favoured carry trades in recent times has been Yen-Aussie