Again, a couple of weeks late, but this is interesting enough to talk about, even at this late date.

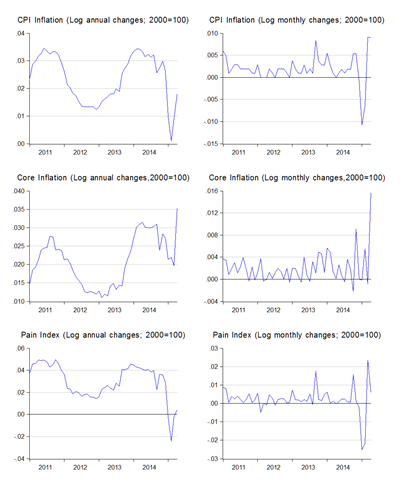

With GST implemented in April, you can see the jump in the price level (log annual and monthly changes; 2000=100):

The key points here are that the drop in petrol prices dampened, but did not fully offset, the overall impact on prices. Year on year growth of the Pain Index was just 0.04% in log terms, after three straight months of declines. Core inflation (ex-food, ex-transport) however, hit 3.5% on the year, and a blistering 1.6% on the month.

The upshot, rather amazingly, was inflation came in lower than market expectations, as April prices were just 0.9% higher than in May, lower than the earlier guidance given by MOF and BNM of about a 1% increase. Year on year, the CPI was 1.8% higher in log terms.

The full breakdown of the contribution to the increase in the CPI, by component:

| Component | Percentage Increase (mom) | Percentage Contribution |

| Food and non-alcoholic beverages | 0.77% | 27.27% |

| Alcoholic beverages and tobacco | 2.15% | 6.38% |

| Clothing and footwear | 0.81% | 2.72% |

| Housing, water, electricity, gas and other fuels | 0.36% | 9.04% |

| Furnishings, household equipment | 2.16% | 9.43% |

| Health | 1.87% | 2.73% |

| Transport | 0.28% | 4.47% |

| Communication | 3.09% | 17.10% |

| Recreation services and culture | 0.95% | 4.60% |

| Education | 0.54% | 0.84% |

| Restaurant and hotels | 1.85% | 7.04% |

| Miscellaneous goods and services | 2.52% | 17.01% |

In terms of price changes, the largest increases were in communications, miscellaneous goods, furnishings and household equipment and in alcoholic beverages and tobacco.

In terms of contribution to the increase in the CPI however, the big mover was food, followed by communications, and then by miscellaneous items, which together comprised 60% of the increase in prices. None of these were really big surprises, as most of the items in these categories did not previously attract sales or service taxes (these were previously absorbed by the telcos in the case of communications).

What was a surprise (to me), was the increase in furnishings costs, and the rather mild increase in healthcare. Based on the original GST model (before all the expansion in zero-rating and exempt lists), furniture and furnishings should have decreased, while healthcare costs would see the biggest gains.

To give you a better idea of how much more you’re paying, here’s a look at the levels – be warned, some of this is not pretty (index numbers; 2010=100; as usual, click on the image for a larger version):

Note that despite the large contribution food prices made to the increase in prices in April, food prices haven’t really deviated from their medium term trend. Neither have rent and fuel, or education. It’s business as usual here, at least as far as overall prices are concerned.

From a trend standpoint, the components that really stand out are clothing and footwear, communications, furnishings, and miscellaneous items. In all four components, the prevailing trend was flat to declining prices before GST.

The key from this point on is to watch for changes in the trend/slope of the CPI and its components. If the changes in the CPI level return to the previous trend, then there’s no second-order impact on prices – the imposition of GST would be a one time increase in prices, as predicted by theory and similar tax increases in other countries. If however there is a steepening of the slope, then BNM has a dilemma. I’m not really expecting inflation to accelerate this year (sans changes in petrol prices), but you never can tell.

Technical Notes:

April 2015 Consumer Price Index report from the Department of Statistics

Hi Hisham,

ReplyDeleteI'm pretty amazed by the exponential growth in furnishing, healthcare, and restaurants & hotels. While you said you are surprised with the changes in furnishing (should have down) and healthcare (should have up more), mind to explain why?

Fung

@Fung

DeleteI was part of a group of economists invited to attend a briefing on GST, way back before it was announced. They shared with us the expected changes in prices based on replacing SST with GST (back then, the numbers were based on a 5% GST rate). Furniture and furnishings was supposed to see the biggest drop in prices, while healthcare was supposed to see the biggest increase.

Hi, I read your articles with interest. Please can you help explain the fall of the Ringgit, in comparison to USD, GBP and even struggling to hold it's 1:4 ratio against the EUR

ReplyDeleteHi, good article. I just want to tease out your closing paragraph. M-o-m CPI from April '15 to Aug '15 shows a gradient more than twice as steep as that between Jan '13 and Mar '15. So is that a sign of second order (or possibly delayed onset) impacts of GST?

ReplyDelete