I’m back from my usual Ramadhan blogging break, and my, aren’t there lots of things to comment on. This will be a kind of omnibus blog post, covering some of the developments over the past month.

2Q2015 GDP Growth

A funny thing happened with the change in national accounts base year to 2010 – the economy all of a sudden got a lot harder to forecast. The usual indicators no longer seem to matter as much – for example, MIER’s confidence indices appear to have totally decoupled from GDP – which makes forecasting growth more than a little bit more difficult. IPI and trade remain good predictors, but their standard deviations have doubled and the forecasts are suggesting two completely different pictures of the economy.

In short, we’re seeing a lot more variability in growth, relative to the underlying numbers. I’m still reworking my forecast models but that’s going to take some time. My best guess at the moment is 2Q2015 growth will be around 5.0%, which is well above the consensus. We’ll find out if it’s as bad as people are expecting in three weeks time. My bet is that there will be an upside surprise.

Industrial Production

One of the my hypotheses for the year was that production and trade will diverge due to inventory rebuilding, and you can see from my comments on GDP growth above that that has seemingly come to pass. There’s some interesting things going on in the sub-indexes (log annual and monthly changes; seasonally adjusted):

Manufacturing growth is slowing, but still holding steady in its long term growth channel, but mining output has levelled up, while electricity output is on a slow decline. Both are puzzling, because export volumes of oil & gas are declining as well (keeping more in for our own use?), while a decline in electricity output (nee electricity demand) is indicative of slowing economic growth.

Another possibility is that with the gradual lifting of fuel subsidies (particularly those related to gas prices and electricity tariffs), consumers and businesses might be conserving more, in which case it a good sign. It’s the “on the one hand, on the other hand” dilemma of economic rationalisation.

Inflation

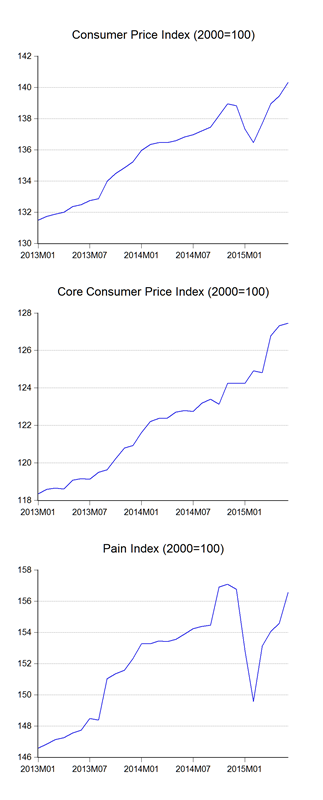

The June CPI report showed 2.5% y-o-y inflation, which was above my expectation, largely due to the change in fuel prices. July should see inflation accelerating once more, though based on the latest global oil prices, we should see pump prices climb down again come August. I’m expecting the peak for the year around September, but overall inflation will remain soft (<3.0%). The same can’t be said for next year though, as the low base will artificially raise the growth numbers (log annual and monthly changes):

Note however the elevated growth in core prices, which is largely being driven by GST in April. Looking at the index numbers however, seems to indicate that (minus the variability of petrol pump prices), inflation is already back to its long term trendline:

In which case, GST – as predicted – will have a one off only effect on prices, and future inflation will revert to the long term trend.

USDMYR

The big news of course is the breaching of the 3.80 per USD level. I’ve heard all kinds of doom stories on this, as well as BNM intervening to “hold the line”. It will certainly be interesting to see the FX reserve numbers for this period, though those won’t be out for another week or so. Then there’s that WSJ story on 1MDB…

But truth be told, I don’t think you can read that much into it. My benchmark for whether the Ringgit is moving unusually is to map against other large net energy exporters with free floating currencies, which would be Canada, Australia, and Mexico (MYR cross rates, up is appreciation):

Hmmm, over July, the Ringgit strengthened quite a bit against both CAD and AUD, and held the line against the MXP. In any case, the six month trading ranges against all of them is fairly small. What was that about political uncertainty driving down the Ringgit? A perfect example of a post hoc ergo propter hoc fallacy. It’s not just the media committing this error, but most of the analyst community as well.

I’m also getting tired of all the commentary about the Ringgit being the weakest in East Asia – the only reason why that’s true is because we’re the ONLY large net energy exporter in East Asia, and because Australia isn’t considered an Asian country. The market would have to be completely irrational not to sell down the Ringgit relative to other East Asian currencies, given the year long decline in oil prices and the more recent collapse in LNG contract prices. In other words, there are quite solid fundamental reasons for the relative decline in the Ringgit’s exchange value. Quit harping on it already, it’s a totally meaningless comparison.

One could certainly argue that it’s BNM intervention causing the recent Ringgit appreciation relative to its (real) peers, but that leaves out that it would have probably kept to its relative level absent such intervention. I would actually say that the change in the Fitch rating outlook was far more important for investors than anything to do with political stability or lack thereof.

For those who aren’t quite catching what I’m saying – it’s the USD that has been rising, not the Ringgit weakening. We’ll continue to see pressure on all other currencies (not just the Ringgit) until the Fed decides it’s time for lift off.

Apropos of that, the market for US Treasury futures isn’t fully pricing in the expected path that the FOMC is likely to take – comments from Board members indicate a preference for a rate hike every other meeting after the first. That’s twice as fast as the market is priced for. How I interpret this is – traders are going to take a hit on UST capital values when the Fed starts raising the Fed Funds Rate. And that would mean a pullback for the US Dollar bull. I’d be looking for a general reversal in USD strength about the time of the second or third hike i.e. by the end of 1Q2016, followed by a multi-year decline.

Greece

Plenty of drama in this Greek tragedy, from the lows of the breaking off of negotiations, to the highs of the referendum, and finally the capitulation to the troika (with a human sacrificial lamb in the form of Varoufakis to boot).

The worse part of it is – fundamentally nothing’s changed. The can’s just been kicked down the road, and we’ll be doing this again within the next six months. In the meantime, the Greek people will continue to suffer. Isn’t a six year depression enough already?

Hi Hisham, sorry in advance for my simplistic thinking on Ringgit. Why aren't the FDIs coming in in a big way? Our labour cost and property cost are suddenly 20% cheaper in USD term while our productivity and technology aren't getting lower. Wouldn't this create a mean reversion in the future?

ReplyDeleteOf course, I am not factoring in our politic problems. But who cares? The semiconductor companies just want to get the chips done, right?

Fung

@Fung

DeleteIt has to do with the supply side - there is global overcapacity in many manufacturing sectors. No point in investing, if you still have production capacity to spare. Another way of looking at it is that its insufficient global demand, which leads to the same conclusion.

Also, just because the Ringgit is weaker in USD terms, doesn't make it necessarily the same degree cheaper to invest here if you're not from the US. For example, Malaysia does not look that cheap to the Japanese, or the Koreans.

A week delayed but I guess never too late to convey my personal greetings..so here goes...Selamat Hari Raya Aidilfitri& Maaf Zahir Batin to HishamH and family. May you all have a blessed Raya and be showered by His Beneficience and Mercy always.

ReplyDeleteNow briefly onto to other things:

1. Dude, I think you have to go easy on the correlation stuff , in this case: Ringgit- Crude Oil.

You see, I analysed the three major episodes of MYR declines circa 1997-98; 2013 and this one and none show a distinct patterns or linkage to global crude oil price declines. Will put a longer comment on this one if need be.

For now, it is apparent that capital outflow is having a significant impact, high sovereign, household leverage; commodities (ex-oil) decline as well as some other background noise.

2. Note to that Credit Default Swaps on sovereign debt is also widening. In simple economics parlance, widening CDS = heightened risk of default and that was what BNP Paribas was hinting at below, although they may be a bit too alarmist:

http://www.theedgemarkets.com/my/article/bnp-paribas-m%E2%80%99sia-risks-%E2%80%98multi-notch-downgrade%E2%80%99-sovereign-rating

By the way, CRAs are oftentimes inaccurate as these articles below attests so why BNP is so worked up over Fitch, I wonder. Come to think of it, Fitch has the worst Accurate Ratios (AR):

http://www.voxeu.org/article/credit-rating-agencies-and-eurozone-crisis-what-value-sovereign-ratings

http://onlinelibrary.wiley.com/doi/10.1111/geer.12018/abstract (caution: I am sorry I cant share the full paper as it is gated)

BY the way, another strange thing, CDS spreads are widening but holdings of MGSs are soaring so apparently, investors are confident of the long term despite the short term heightened risks. Are we witnessing an analogous scenario to this?:

"Consider further “The Greek Surprise!” when on April 2, 2010, a story in the pre revealed that “Greece "Discovers" $40 Billion of Previously Unknown Debt, CDS Widens.” For a country that is already in deep trouble in terms of making its debt payments, the discovery of another $40 billion of debt came as a rude surprise to those that invested in Greek debt. Notice in Exhibit 1 how Greek CDS spiked around the time of the revelation of $40 billion in undiscovered debt. Markets reacted swiftly to the news, which indicates 1) the value of having CDS as a credit monitoring device and 2) the importance of fully disclosing the debt that a country is obligated to payoff."

http://mercatus.org/publication/credit-default-swaps-government-debt-potential-implications-greek-debt-crisis

For those further interested in CDS :

https://www.aei.org/publication/everything-you-wanted-to-know-about-credit-default-swaps-but-were-never-told/

3. Yes BNM has been intervening extensively given the MYR 20Billion burn from June 30 to July 15 though some of it may be due to capital outflow "intermediations". Poor Zeti is in a tizzy I guess as she has just sailed into a perfect storm. That said, she is still the one person in my book, who can keep things on an even keel though the poor lady will be riding into a maelstrom of sorts. Good luck to her.

Warrior 231

@Warrior

DeleteEid Mubarak to you and your family Warrior, may Allah bless you and yours always.

1a. I don't believe in correlations, which is why I almost always do causality tests and (if I have time) cointegration tests. Oil prices DO granger cause movements in the USDMYR exchange rate.

1b. Given the significant changes in FX regimes over the past few decades, I don't think event analysis is a useful approach.

2. You're seeing a portfolio shift. BNM has been allowing short term BNM Bills to mature, but aren't issuing new ones. As a result, there's a shortage of papers at the short end, so foreign investors are moving up the maturity curve to longer dated MGS/GII.

Did you only just discover CDS?

3. What imported inflation?

ReplyDelete4. You might enjoy this

Lastly, I'll get back to you on the LFPR, but I think you mean spurious relationship, not spurious correlation which has a very particular meaning. Since I'm not using ratios here, spurious correlation does not apply.

Rather ironically, my comments on the new difficulties in forecasting GDP growth are quite related, as some of my previously solid predictive models turned spurious (high R2, but no statistically significant coefficients). Yes, I do know how to diagnose them, thank you.

Hello Everybody,

ReplyDeleteMy name is Mrs Sharon Sim. I live in singapore and i am a happy woman today? and i told my self that any lender that rescue my family from our poor situation, i will refer any person that is looking for loan to him, he gave me happiness to me and my family, i was in need of a loan of S$250,000.00 to start my life all over as i am a single mother with 3 kids I met this honest and GOD fearing man loan lender that help me with a loan of S$250,000.00 SG. Dollar, he is a GOD fearing man, if you are in need of loan and you will pay back the loan please contact him tell him that is Mrs Sharon, that refer you to him. contact Dr Purva Pius,via email:(urgentloan22@gmail.com) +918376918351 Thank you.