The question of the household savings rate has come up a few times in the last few weeks, so I thought I might as well set out the data and evidence for it.

At this stage, I have a confession to make. I was under the impression that gross savings excluded net changes in pension assets (contributions less withdrawals from EPF, KWAP, LTAT and the like), but a closer reading of the accounts and the SNA2008 manual showed that this is already captured under the income accounts. For that I have to apologise to everyone whom I told that the household savings rate would be substantially higher if the net pension contributions were taken into account. In fact, the opposite is true and the difference is quite significant, as I’ll demonstrate in a bit.

With that, here’s the results:

As a percentage of GDP, the household savings rate averaged about 0.8% between 2006 and 2013. As a percentage of adjusted disposable income, the average was just 1.6%.

By any standard, those are pretty terrible numbers. By contrast, the US household savings rate, which has generally been acknowledged as being very poor and contributed to the fragility of the US economy leading up to the Great Financial Crisis, averaged 5.2% of disposable income over the same period. Bear in mind also that Malaysia’s numbers are after taking into account mandatory pension contributions. Take those contributions out, and the situation becomes really dire:

The savings rate turns negative for all years, and sharply so as a percentage of adjusted disposable income, averaging –2.8% of GDP and –5.8% of adjusted disposable income. By contrast, Malaysian government savings averaged 1.8% as a percentage of GDP, and 17.5% of disposable income.

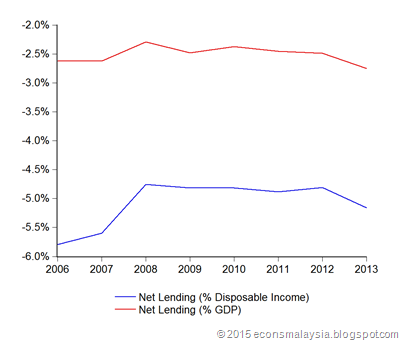

Lastly, household borrowing:

Household net borrowing averaged 2.5% of GDP, and 5.1% of adjusted disposable income. Again, as contrast, US households were net lenders (not borrowers) to the tune of an average 4.7% of GDP and 6.2% of disposable income between 2006-2013.

Note however, that net lending/borrowing under the capital accounts are conceptually different from lending and borrowing in the conventional sense. This is about sources and uses of funds, not how much you borrowed from the bank. Also, all “borrowing”, or lending for that matter, is used to fund capital formation i.e. investment. The capital account has to balance between institutional sectors (government, corporations and households), as well as against the external sector (the rest of the world). Thus the country as a whole could be a net “lender” even if one or more of the domestic sectors are net “borrowers”.

Nevertheless, if there’s something that keeps me up at night, it’s the depressing state of Malaysia’s household savings rate.

Technical Notes:

All the following data are derived from the DOS Distribution and Use of Income and Capital accounts reports for the years 2006-2013. These are free to download, but you’ll have to register on the website first. US data is from the Federal Reserve Bank of St Louis’ FRED database (series codes: HHNONLA027N, A067RC1A027NBEA, GDPA, and PSAVERT).

First, the distribution of income accounts for the household sector (RM millions):

| Distribution of Income Account | Adjusted Disposable income | Change in net equity In pension funds | Final Consumption Expenditure | Gross Savings |

| 2006 | 260,406 | 24,395 | 280,725 | 4,076 |

| 2007 | 300,961 | 23,542 | 319,517 | 4,986 |

| 2008 | 357,710 | 29,255 | 381,227 | 5,739 |

| 2009 | 367,759 | 24,420 | 387,018 | 5,161 |

| 2010 | 406,607 | 29,168 | 428,379 | 7,396 |

| 2011 | 459,078 | 29,781 | 480,865 | 7,930 |

| 2012 | 502,828 | 30,521 | 525,742 | 7,608 |

| 2013 | 543,681 | 38,178 | 574,229 | 7,629 |

Adjusted disposable income includes all current income such as wages, employer pension contributions, subsidies, property income, dividends and interest, plus social transfers and less taxes. Gross savings is equal to disposable income plus change in net equity less consumption.

Next we have the capital accounts (RM millions):

| Capital account | Gross Savings | Other resources | Gross Fixed Capital Formation | Other uses | Net Lending |

| 2006 | 4,076 | 136 | 19,967 | (658) | (15,096) |

| 2007 | 4,986 | 245 | 22,944 | (860) | (16,852) |

| 2008 | 5,739 | 229 | 22,936 | 44 | (17,012) |

| 2009 | 5,161 | 99 | 24,275 | (1,307) | (17,708) |

| 2010 | 7,396 | 394 | 27,746 | (369) | (19,588) |

| 2011 | 7,930 | 169 | 30,504 | - | (22,405) |

| 2012 | 7,608 | 297 | 32,154 | (56) | (24,192) |

| 2013 | 7,629 | 99 | 35,217 | 584 | (28,073) |

Other resources are primarily from capital transfers and capital gains (changes in asset values), while other uses are primarily net acquisitions of land. Net lending/(borrowing) is the difference between resources (savings plus other resources) less uses (investment plus other uses).

The GDP data in the distribution accounts are slightly different from the published national accounts (probably because the former include the latest revisions), so I’m including them here for reference:

| RM millions | NGDP |

| 2006 | 574,656 |

| 2007 | 642,204 |

| 2008 | 742,470 |

| 2009 | 712,776 |

| 2010 | 825,416 |

| 2011 | 911,733 |

| 2012 | 971,252 |

| 2013 | 1,018,821 |

can we say if there is a currency crisis and BNM is forced to raise interest rate, the likelihood of many goes bankrupt will be alot?

ReplyDelete@James

DeleteFrom this data, no. These are flows, not stocks. Given the BNM commitment to a flexible exchange rate, the probability of a currency crisis is minimal. Having said that, many households in the lower income segment have stretched balance sheets, and it wouldn't take much to push them over the edge.

Hi there,

ReplyDeleteI thought your article is good and I learnt something from it. Just curious, you cited DOSM as your source for household savings. I am assuming that you have calculated this by subtracting household savings from household disposable income. Have had a look at DOSM's website for these numbers but I could not find any. Could you share from where exactly these numbers are derived from? (i.e. Household Income and Basic Amenities Survey, etc ?)

@Adibah

DeleteThe report you're looking is the Distribution and Use of Income and Capital Accounts, one for each year from 2006-2013. These are only accessible under the free downloads section of the DOS website. You'll have to register first, but registration is free. Once you're logged in, the free downloads section is accessible from the menu on your left.

This comment has been removed by the author.

Delete@hishamh

DeleteThank you for the explanation. However, I tried looking at the report, can I know which exact tables that you are looking at for this purpose?

Thank

@hishamh

DeleteAlso, one more question. Can i know what is the rationale behind using savings over disposable income to get the savings ratio? can you also explain what does that mean?

Thanks

@Adibah

DeleteTable A.7 for adjusted disposable income, net change in pension equity and gross savings; the last column is for households. Table A.8 has the numbers for net lending/borrowing. The other columns detail the numbers for other institutional sectors (e.g. government).

I'm using savings over disposable income (adjusted disposable income in this case), for international comparisons. This is how household savings rates are generally calculated. The rationale is simple - on average, how much of household income is actually saved.

If you want to know what all the terms mean, and how they are calculated, the link to the manual is here. Read Chapters 7-10.

@hishamh

DeleteThank you very much for your explanation. It is very helpful for my work.

Regards,

Adibah Kamal

@Adibah

DeleteYou're welcome

Thanks Hisham for the insight.

ReplyDeleteWe have always heard that Malaysia is a 'Saving Nation'. I believe, Malaysia still is.

How do we justify these two contradicting notions?

@anon

DeleteThe full break down of national savings is here. Something like 90% of Malaysia's national savings actually comes from the corporate sector.

why are the corporate sector having such huge savings? Are they making excessive profit and keeping it to themselves, rather than compensating their workers? Why can they get away doing it for so long? Why such imbalance/injustice persists?

ReplyDelete@anon

DeleteFirst, in the national accounts, ANY profit is considered as "savings", and is calculated AFTER employee compensation.

Second, it's hard to judge whether profit levels are "excessive" relative to labour income, as the capital/labour income shares vary wildly with different industries. To take an example, the oil & gas sector pays very high salaries, but has the lowest labour income ratio, due to its high capital intensity.

Nevertheless, there are certainly some sectors where capital/labour income ratios differ from high income economy norms. Just to name a few: private hospitals, accountancy and legal firms.

Thanks Hisham for the insight.

Deletehi, may i ask you a question regarding to mismatched household income and expenditure survey from statistic.gov.my?

ReplyDeletehttps://www.statistics.gov.my/index.php?r=column/ctwoByCat&parent_id=119&menu_id=amVoWU54UTl0a21NWmdhMjFMMWcyZz09

according to that survey, average monthly household income and expenditure is RM6141 and RM3578 respectively, which mean RM2653 is "saving", assuming there are 5million unit households, it should contribute RM1592b of "household saving".

even though i dont believe it.

@cgyong ee

DeleteOne of the issues with the household income and expenditure survey is that they ask different households, so there's a degree of sample error involved.

But more simply, any investment or capital expenditure are not counted under the expenditure survey, only consumption spending. For example, some portion of housing costs as well as housing maintenance expenditure would fall under this category.

sorry for wrong calculation, i should be RM159.2b of "household saving" . derive from

ReplyDelete12 * 2653 * 5000000

Hi Hisham,

ReplyDeleteHow is it that the government actually has savings when public debt to GDP ratio has gone up so much in the last 10 years?

Good question, I don't understand it either...maybe something due to the definition or how it is calculated?

Delete@aidan and anon

DeleteSorry for the extremely late reply, but...

In the national accounts, investment = savings. Purchases of fixed assets would not therefore count as "expenditure" (i.e. national accounts use accrual accounting).

However, like about 95% of governments worldwide, the Malaysian government uses cash accounting. This means that investments would be recorded as a negative outflow, rather than a change in the government balance sheet.

assalam. may i know where did you get this data? Thanks.

ReplyDelete@rdz

DeleteIt comes from the "Distribution and Use of Income Accounts" from DOSM