I’m still hearing people talking about the 1MDB effect on the Ringgit. Here’s what I’ve worked out:

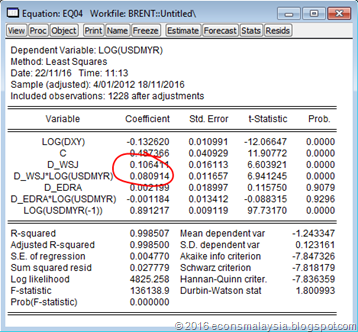

- USDMYR is the (inverted) Ringgit exchange rate (i.e. USD denominated in MYR. I know, I should flip the nomenclature, but I’m too lazy to);

- DXY is the Federal Reserve’s Broad Nominal Trade Weighted Dollar Index (daily data from 2012 to present);

- D_WSJ is the dummy variable for the July 2 WSJ report that linked the PM with 1MDB (July 2, 2015);

- D_Edra is the dummy variable for the announcement of the sale of Edra Energy to China General Nuclear Power Generation (November 23, 2015);

- D_Trump is the dummy variable for the US Presidential Election (November 8, 2016);

- D_PBOC is the dummy variable for the August 11 2015 devaluation of the Yuan;

- The other three terms are the two dummy variables to test changes in the slope coefficients from the PBOC move and the US election, and the last term is to handle serial correlation in the data.

Here’s how to interpret this:

- A stronger USD in general leads to a weaker Ringgit USD exchange rate (but you knew that right?);

- News on 1mdb had a statistically significant (just barely) impact on the Ringgit, but the effect was very, very small;

- The sale of Edra basically reversed the 1MDB effect and then some (net effect was slightly positive), but again, the effect was very, very small;

- The PBOC devaluation had a huge impact. The sign however is positive, which I interpret to mean that it caused a general sell off in emerging market currencies (USD strengthening), which benefitted the Ringgit because it had already been sold down. The positive sign on the slope dummy however indicates that Ringgit volatility increased after the PBOC move (which is bad);

- The Trump dummies (no pun intended) are NOT however statistically significant, at least up to the latest data I have available (last Friday, Nov 18), by which I take to mean that the selldown so far has been entirely due to USD strengthening, and not Ringgit weakness per se. Bear in mind though, that a) we’ve only had one week’s worth of data and a bit, and b) the change in the slope coefficient from the PBOC devaluation meant that Ringgit sensitivity to USD moves is already elevated relative to before August 2015.

Why no oil prices? Because the effect of oil prices basically disappears if you put both oil prices and the USD index in a single regression. Technically, we have a multi-collinearity problem, since oil prices are themselves partly determined by USD movements.

What if we want to isolate the impact of 1MDB, without the other factors? It looks a lot bigger:

However, the coefficient signs are wrong – this says the Edra sale had no impact (not statistically significant), while the WSJ report impact was positive. If you believe that, I have a bridge in London I want to sell you.

Overall, what I think is that many people are confusing the effect of PBOC policy and general USD movements on the Ringgit and reflexively blaming a 1MDB effect, regardless of the evidence. It’s also implied here that the most recent moves are largely a function of USD appreciation, and not something specific to the MYR.

Technial Notes:

Exchange rate data from the Pacific Exchange Rate Service and the Federal Reserve

Thank you for sharing your results, but I was wondering what are the (theoretical) reasons for interacting the dummy variables with the dependent variable (log(USDMYR)) in your models?

ReplyDelete@KY

DeleteStandalone dummies are for shifts in the intercept (alpha); interaction dummies are for shifts in the slope (beta)

I'm surprised that the ringgit is depreciating against the rupiah. Could you shed some light on this? Thank you.

ReplyDelete@anon

DeleteShort term answer: Roughly half of Indonesian sovereign bonds are denominated in USD. A selldown affects the currency less, though it exposes the government to FX fluctuations on its liabilities. A second reason is that Indonesia tried halting trading on the NDF market last year, but eventually gave up. This year, it's our turn to be Sisyphus.

Long tern answer: MYR is still up 300% on IDR since 2000, and approximately at the same level it was in 2012. Given the drop in Indonesian inflation, it was only a matter of time before they stopped losing ground.

Mmmm...I was just wondering...never mind. Can you then hazard a FV for the ringgit based on current fundamentals or would that be too much of an ask?

ReplyDeleteWarrior 231

@Warrior

DeleteIt's undervalued - but you knew that, right?

Fundamentally, we're thinking 3.60-3.80 (and I think that's BNM's view as well), but fair value is higher, probably around 4.00-4.20.

If you're wondering why the difference, exchange rate equilibrium values have short term, medium term, and long term components. I tend to use "fair value" for short term, "fundamental" for medium to long term estimates.

No US interest rate variable? Surely taper tantrum episode must count?

ReplyDeleteCurious: Why do you use DXY? Isn't DXY a bit of multicollinearity? (I won't dare touch exchange rate models)

Hi Jason,

Delete1. We actually do have a interest rate parity model (based on a global interest rate differential variable). Not really necessary in this one, since interest changes would be reflected in USD strength. Note however, that the effect of the taper tantrum would be difficult to capture, since it was based on expectations of a change in QE, not in interest rates.

BTW, our interest rate parity model suggests the Ringgit is overvalued. My analyst still has trouble accepting that.

2. I used DXY as shorthand, but this is not the Bloomberg index, but the Fed's trade weighted exchange rate index. Using Bloomberg's DXY would counter your objection, as it doesn't include the Ringgit, but ignores all emerging markets (which is part of the effect I'm trying to capture).

In any case the Fed index weight for Malaysia is so small (1.59%), I don't think it biases the results (much):

https://www.federalreserve.gov/releases/h10/weights/default.htm

1. But you can 'sorta' build in the expectations in the interest rate model? Textbooks say use forward rates, but i'm just regurgitating knowledge

ReplyDelete2. As much as I like the idea of an explanatory model for the MYR, it seems kinda impossible with this type of exchange rate regime (*hoping BNM doesn't lynch me). Using another currency (or currency basket) as an independent variable *seems* counter-intuitive to what (little) I know about exchange rate models.

To me it's saying:

"I'm trying to explain the 'true' value of my currency (against USD) by using a composite 'market' value of USD"

Speaking from my office desk now, why not use CDS or sovereign yield differentials?

@Jason

DeleteYou got caught by the spam filter!

1. Since the taper tantrum was in reference to a reduction in QE, kinda hard to build an interest rate expectations model based off of it, even using forward rates.

2. You have to - exchange rates are relative prices, not absolute ones. It's always with reference to another currency or currency basket. Even when you're using economic fundamental variables, they have to be relative, not absolute (e.g. GDP differentials, interest rate differentials etc).

Also, we're not looking for a "true" value here. I'm just trying to explain what goes into the movements of one particular currency pair. Since exchange rates are always relative, the absolute numbers themselves are actually pretty meaningless.

ref: CDS. Had a look a couple of years ago. CDS prices appear to be correlated with the degree of exposure (more CDS contracts, higher pricing), and might not be a good measure of valuation or risk.

ref: sovereign spreads. That's the interest parity model I referred to earlier.