A quick note on yesterday’s GDP report. The date brought the growth numbers for 2017 to a gratifyingly satisfying conclusion (log annual change and annualised seasonally adjusted quarterly change; 2010 constant prices):

GDP expanded at a 5.8% clip (in log terms; 5.9% in percentage terms), just a little lower than the 6.1% log change seen in 3Q17. That brings full year growth to 5.7% (log) and 5.9% (percentage), the best performance since 2014.

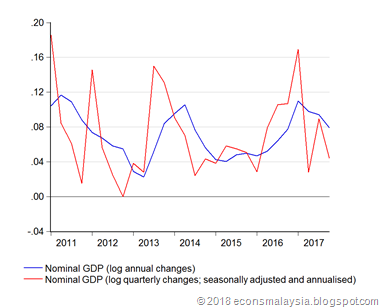

NGDP growth was even better, hitting 10.0% (9.947% to be precise), the fastest nominal growth rate since 2011 (10.993%):

What concerns me more, however, is that unlike the acceleration of growth that happened in 2016, 2017 growth was really a tale of two quarters – the 1Q and 3Q – while in the other two quarters, the economy fell back to the low growth trend of 2014-2015.

So as I said back in July, the kind of growth rates we saw last year were likely unsustainable, and we should see more “normal” growth this year. The key question is, what’s “normal”?

There were a number of factors that contributed to growth last year that won’t recur in 2018:

- First is the recovery in oil and other commodity prices. While there’s some potential upside to that for 2018, I don’t think the global growth outlook is so spiffy that we’re going to see the kind of price movements we saw last year. The oil market is rebalancing, but US output is increasing too fast for further price gains to be sustainable. I think some consolidation will be in order. If there is something to be optimistic about here, it will come from the red hot Asian LNG market, which is slowly decoupling from oil pricing contractual constraints.

- Second, last year was also a recovery year for agriculture from the El Nino effect. So we had both prices and volumes returning to “normal”, but the outlook from here on out is probably more placid.

- Third, the semiconductor and electronics cycle has likely peaked, a pattern we saw in 2013 and 2014 as well. Growth in this area, especially for exports, should also fall back to previous norms. Again, there’s some upside because of the more diversified base of Malaysian exports, but E&E exports is still a huge chunk of that.

On the whole, that seems to justify growth rates a little above potential this year, so the official forecast of between 5.0%-5.5% seems about right.

My biggest beef is that although we’ve seen a recovery in global trade, we haven’t really seen growth of global trade. What I mean by that is that trade hasn’t really expanded beyond the levels we saw 3 years ago on the one hand, and the flat numbers we’ve been seeing lately on exports on the other.

One thing I’ve always stressed is that in the event of a change in trend, growth rates won’t be an accurate gauge of current activity. You need to assess the raw level data. What I’m seeing here is that most countries don’t have a positive slope to their recent export data (exceptions: only Germany and Taiwan among the countries I cover). Even Malaysia’s has levelled off – the growth we’re seeing is largely coming from a base effect of poor volumes in 2015-2016. With the base of activity much higher in 2017, growth rates in 2018 will moderate rapidly.

Nevertheless there will be some follow-through of last year’s growth into this year’s domestic consumption, as higher salaries and bonuses boost household disposable income and companies invest more in capacity. Typically, bonuses are usually paid out starting in March-April, so that’s the data I will be paying most attention to.

Just to underscore the points above, I did a couple of quick and wholly unrigorous stabs at estimating where we are in the Malaysian business cycle:

This is a simple trend line (with all the caveats that implies) fitted to the seasonally adjusted GDP series. It’s not conclusive, but it is indicative that the upturn appears to be over, at least as far as growth is concerned. Second, a standard Hodrick-Prescott filter:

…which appears to indicate that we’re still operating well above potential, but past the peak (yes, I’m aware of the weaknesses of evaluating the end points of an HP filter).

The bottom line here is that the Malaysian economy is doing ok, and will continue to do ok. It’s not great, but given the numbers the rest of the region are showing – everyone else in ASEAN is underperforming with the possible exception of the Philippines – doing ok is better than we deserve.

Technical Notes:

National accounts data from the Department of Statistics Malaysia

I enjoy reading through the articles. I absolutely loved every little bit of this.

ReplyDeleteCurrency Exchange San Francisco

In the mist of all the good GDP growth, out come a very disturbing report - Malaysian kids more stunted than those in Africa; UNICEF Malaysia.

ReplyDeleteAppreciate your take on this and what policies can overcome this, thanks.

@Zuo De

DeleteSorry for the very very late reply. I met a couple of guys working on the problem and its far more shocking than even the UNICEF report shows. Stunting runs across ALL segments of society, not just the poor. So it's a systemic social issue, not just a result of poverty. We need a national policy on nutrition.

Always enjoy your article, Hisham. Keep it up!

ReplyDeleteHi Hisham, a lot of people don't trust the Government data, eg GDP, Inflation, Import/Export, and majority of them says those data are manipulated to fool the people. What do you think of this, is such data can be manipulated?

ReplyDelete@anon

DeleteAbsolutely not. Spinning yes, manipulation no. DOSM actually even computes a core inflation measure that excludes administered prices.

Do you need Personal Loan?

ReplyDeleteBusiness Cash Loan?

Unsecured Loan

Fast and Simple Loan?

Quick Application Process?

Approvals within 8-10 Hours?

Funding in less than 1 day?

Get unsecured working capital?

Contact Us At: standardonlineinvestment@gmail.com

LOAN SERVICES AVAILABLE INCLUDE:

================================

*Commercial Loans.

*Personal Loans.

*Business Loans.

*Investments Loans.

*Development Loans.

*Acquisition Loans .

*Construction loans.

*Credit Card Clearance Loan

*Debt Consolidation Loan

*Business Loans And many More:

LOAN APPLICATION FORM:

=================

Full Name:................

Loan Amount Needed:.

Purpose of loan:.......

Loan Duration:..

Gender:.............

Marital status:....

Location:..........

Home Address:..

City:............

Country:......

Phone:..........

Mobile / Cell:....

Occupation:......

Monthly Income:....Contact Us At: standardonlineinvestment@gmail.com

Thanks and look forward to your prompt reply.

Regards,

Muqse