P. Gunasegaran demonstrates – yet again – that he doesn’t understand exchange rates (excerpt):

How successive governments impoverished M'sians

A QUESTION OF BUSINESS | At least two ways - both very wrong in the longer term - were used to support the export sector in Malaysia in believing that growth through exports was the right thing for a developing country like Malaysia.

But even though there was economic growth, which means more wealth was created, there was impoverishment too. But how could that be? Basically, those who were rich got richer and those who were poor got poorer.

How did the government achieve export competitiveness over the years? Through two measures. First, they reduced the number of things Malaysians generally could buy by going for a policy which weakened the ringgit. And two, they imported poverty by allowing the uncontrolled import of cheap labour.

Both improved Malaysia’s competitiveness not by raising productivity, although there was some of that, but by cutting down the cost of labour through the import of cheap labour (imported poverty) and lowering the relative value of the currency or currency depreciation, effectively lowering costs in US dollars.

Let’s look at these measures in turn.

1. Currency depreciation

The ringgit fell in value from around as strong as around RM2.2 to the US dollar in 1980 to around RM4.0 now. The US dollar appreciated by over 80% during the period and the ringgit lost over four-tenths of its value relative to the US dollar.

Consider what that does: if an imported food item cost US$1, it was RM2.2 in 1980. But it rises to RM4 now, an increase of some 82%. But consider it now from the exporter’s perspective: If he sells something for US$1 overseas now, he gets RM4 versus RM2.2 then, again 82% more.

Unless he shares this benefit equally with the worker - and in practice, he does not - a depreciated currency is a subsidy to exporters and a tax on workers because everyone depends on imported goods and even services for a good part of what they consume. Think in terms of food, clothing and buying from foreign chains.

While a depreciated currency improves the appearance of export figures in ringgit terms, it is still not a long-term solution for the betterment of people because it directly impoverishes a major part of the public by reducing their purchasing power - the amount they can buy with the ringgit.

Here’s an analogy:

Take two cars, running down a road, call them Car A and Car B. Car B suddenly starts pulling away, going faster than Car A. Can you tell, without reference to their speedometers or passing landmarks, which of the following is true?

- Car A is going at constant speed, while Car B put on the gas

- Car A puts on the brakes, while Car A is going at constant speed

- Both Car A and B are accelerating, but the driver of Car B is pushing harder

- Both Car A and B are braking, but the driver of Car A is braking faster

No? Neither can I.

Because exchange rates are relative prices, not absolute ones, a change in their value tells you almost nothing of what is going on, and certainly doesn’t say anything about the direction of any given country’s policies. The long term depreciation of the MYR versus the USD says nothing about Malaysian exchange rate policies, only what Malaysian policy is relative to the US.

The mistake here is assuming that the USD has some concrete, immutable value that doesn’t change over time. The reality is that the USD has been floating since Nixon suspended the gold window in August 1971, and in the process ended the Bretton Woods system of fixed exchange rates. Since then, far from being a stable store of value, the USD has not only been volatile, it has been appreciating pretty strongly against most currencies.

Here’s the proof. This is the chart of the USDMYR since the 1980s:

Looks pretty damning, yes? Although, you could argue that even this disproves the article’s thesis. From the late 1980s to the Asian Financial Crisis, the USDMYR exchange rate was pretty stable. From the point of depegging the currency in July 2005 to the end of 2014, the general trend has been an appreciation of the MYR. Though I suppose this is more evidence that someone has been fooled into taking absolute values of the exchange rate as some valuation norm.

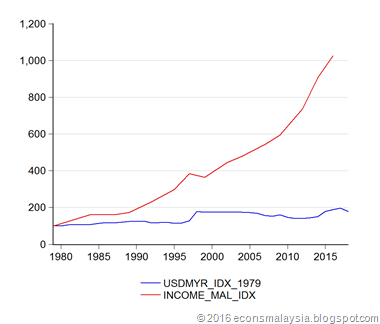

Nevertheless, here’s the trade weighted value of the USD, juxtaposed on the chart above, with both series converted into indexes using 1980 as the base year (index numbers, 1980=100):

From 1980 to the present, the USD has increased in value well over 3x versus the currencies of its trade partners, versus just 2x versus the MYR.

To explain this chart, let’s extend the car analogy further. Instead of 2 cars, it’s 25 cars running in parallel. The US car is continually pulling ahead of everyone else, but all the other cars are falling behind at different relative speeds. The Malaysian car is also behind, but not as much as some of the others. Same question as above: is the US car speeding up, or is everyone behind it braking? Unlike our two car analogy, we can come up with a probabilistic statement – it’s far more likely the former than the latter.

In other words, this seriously undermines the “weak currency for export competitiveness” argument. Since the MYR, on average, has held up more strongly against the USD than other US trade partners, we have in fact been steadily losing export “price competitivness” for a long, long time. I could also point out that the past twenty years of Malaysian current account surpluses is actually unusual – prior to the Asian Financial Crisis, trade was more or less balanced.

One last thing before I leave this (hopefully for the last time), which is this notion of losing purchasing power. This chart shows the monthly household income (in Ringgit), versus the USDMYR since 1979 (index numbers, 1979=100, change of base due to availability of data):

No contest. The growth of income more than compensates for any depreciation of the currency over time. Here’s the same data put together, or in other words, Malaysian household income in USD terms, relative to 1979 (index numbers, 1979=100):

Even after accounting for the recent depreciation beginning in 2014, Malaysian incomes in USD are still over 5x higher than they were in 1979. Over the same period, absolute poverty rates have fallen, and income inequality has been reduced. Exactly how is this “impoverishing”?

Technical Notes:

- Exchange rate and USD NEER data from the Federal Reserve Board

- Household income data from the Economic Planning Unit

Dear Hisham,

ReplyDeleteBased on my understanding, currency devaluation affects retirees the most since their pensions or EPF savings is denominated in the devalued currency.

As you correctly pointed out, skilled workers will see their income rise to compensate for the devalued currency. However, that is not the true of unskilled workers. While some skilled professionals can earn over RM20,000 per month the median office worker is stuck at RM5,000 or below.

The US is a country with triple deficits (fiscal, trade & current account). Wonder why our Ringgit can't keep up with the US dollar over time?

@Shannon

DeleteA few things on the pension issue:

1. Interest rates are higher in Malaysia than in the US. That more than compensates for any currency depreciation.

2. Stock returns are roughly equivalent, but as most savings are via EPF, Malaysians have the advantage of lower costs (economies of scale). There is no equivalent in the US, though some civil servants benefit from large pension plans (Calpers is a good example) with equally low costs. Otherwise, individual mandates aka 401Ks, are subject to higher fees that reduce the net return. We have roughly the same problem in our unit trust industry.

3. About 30% of EPF investments are abroad, which act as a buffer as currency depreciation translates directly into higher dividends.

On the worker income issue, income growth for the B40 have outpaced that of both the M40 and the T20 for the last 20 years. At the very bottom 10%, incomes have doubled in the last 5 years, which implies double digit growth.

BTW, if you're earning RM5k, that puts you in the top 20% of the salary distribution already (the cut-off last year was RM3,950).

Lastly, I'd turn that question on its head - why has the USD run away from everyone else over time?

The answer is that the USD plays the role of global reserve and invoicing currency. That means that demand for USD always exceeds what is justified by US economic fundamentals. This role has actually expanded over the last 30 years, roughly corresponding to the consistent appreciation of the USD.

Interesting. Could other countries or blocs -- such as China or the EU -- replace the US as global reserve/invoicing currency?

Delete@notaneconomist

DeleteNeither can do so any time soon. Changes in global invoicing will take time, and the other pre-conditions needs to be met as well, particularly the availability of a deep and liquid safe asset market in either.

Hello Everybody,

ReplyDeleteMy name is Mrs Sharon Sim. I live in Singapore and i am a happy woman today? and i told my self that any lender that rescue my family from our poor situation, i will refer any person that is looking for loan to him, he gave me happiness to me and my family, i was in need of a loan of $250,000.00 to start my life all over as i am a single mother with 3 kids I met this honest and GOD fearing man loan lender that help me with a loan of $250,000.00 SG. Dollar, he is a GOD fearing man, if you are in need of loan and you will pay back the loan please contact him tell him that is Mrs Sharon, that refer you to him. contact Dr Purva Pius,via email:(urgentloan22@gmail.com) Thank you.