Our PM in Japan (excerpt):

Malaysia asking for yen credit to help with national debt, says Dr Mahathir

MALAYSIA is asking Japan for credit as part of efforts to resolve its debt problem, Prime Minister Dr Mahathir Mohamad said today.

Speaking at a joint press conference with Japanese Prime Minister Shinzo Abe, Dr Mahathir said he was told Japan was considering the request.

“I have explained the financial problem faced by Malaysia, and towards solving this financial problem, I have requested for yen credit from Japan and Mr Abe, the prime minister, will study this request,” Dr Mahathir said.

I don’t have much time, so I’ll keep this short. I’ll give TDM the benefit of the doubt here – he could be talking about refinancing some of the USD debt under 1MDB, which makes sense since the yield on that debt was way above market. However, using JPY loans to cover MYR debt makes no sense at all.

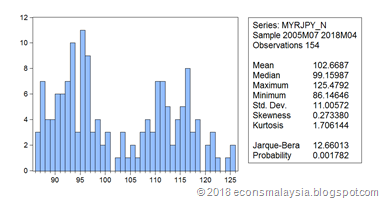

First of all there’s the exchange risk – the MYRJPY index has a standard deviation of about 11 points, or in other words, it could move ±20% in any given year:

That’s a pretty hefty risk to take on, and fully hedging it exposes the government to considerable loss every year if it gets its FX forecast wrong (which with FX and given the likely tenor of such a loan, is a near certainty).

Leaving that aside, follow the money trail:

- Government borrows in JPY but needs to convert it to MYR to repay MYR debt. This is done through the onshore market, which results in the banking system being short of MYR;

- BNM will respond to this by buying the JPY in exchange for crediting the accounts banks maintain at the central bank with MYR. In other words, BNM will print money to maintain MYR liquidity in the system. The reserve managers at BNM will also then need to invest the newly acquired FX in JPY assets, such as 10 year JGBs which currently yield exactly 0%;

- The government repays MYR loans with the MYR it purchased, reducing higher yielding MYR debt with lower cost JPY debt;

- This debt repayment, paradoxically, adds liquidity to the system which BNM will have to absorb. They’ll either issue BNM bills at the prevailing market rate, or as they’ve done for the past few years, do repo operations instead. This reduces the liquidity back to normal again.

The end result:

- Government reduces MYR liabilities, but adds lower yielding JPY liabilities, a net cost advantage.

- BNM adds low yielding JPY assets, but also adds MYR debt at domestic market rates, a net cost disadvantage.

- In essence, what’s happened is that the government has just transferred the interest cost it was bearing to BNM.

The same effect could be achieved by the government just issuing lower yielding debt securities to BNM in exchange for new money (which BNM will have to sterilise with it own higher yielding liabilities), but without taking on the FX exchange risk.

In other words, refinancing MYR debt with JPY debt makes no sense at all.

Last point: the irony, for those who are aware of the situation in Japan, is that any Japanese government loan to Malaysia will likely be funded by the Bank of Japan’s own money printing. The BOJ has been engaged in quantitative and qualitative easing (QQE) since Governor Kuroda took over at the BOJ in 2013, aggressively buying up to JPY80 trillion of government securities, or about USD725 billion, every month. Nearly half of Japan’s government debt is currently held by the BOJ.

Is the FX risk worth the interest rate difference? We walked this road before in 1980s if I am not mistaken.

ReplyDeleteIf anything goes wrong, just blame Najib. if every ok, then he takes credit. M cannot do wrong one.

DeleteU re right james..

DeleteMalay saying..

Sapi dapat nama..

Hello Everybody,

DeleteMy name is Ahmad Asnul Brunei, I contacted Mr Osman Loan Firm for a business loan amount of $250,000, Then i was told about the step of approving my requested loan amount, after taking the risk again because i was so much desperate of setting up a business to my greatest surprise, the loan amount was credited to my bank account within 24 banking hours without any stress of getting my loan. I was surprise because i was first fall a victim of scam! If you are interested of securing any loan amount & you are located in any country, I'll advise you can contact Mr Osman Loan Firm via email osmanloanserves@gmail.com

LOAN APPLICATION INFORMATION FORM

First name......

Middle name.....

2) Gender:.........

3) Loan Amount Needed:.........

4) Loan Duration:.........

5) Country:.........

6) Home Address:.........

7) Mobile Number:.........

8) Email address..........

9) Monthly Income:.....................

10) Occupation:...........................

11)Which site did you here about us.....................

Thanks and Best Regards.

Derek Email osmanloanserves@gmail.com

Dear Hisham,

ReplyDeleteIt's still too early to speculate on Tun M's JPY credit line. Let's not jump the gun and speculate on the mechanics of the debt restructuring before we get more details on Tun M's request.... which should be made public for transparency sake...

1. It is simply preposterous to conclude that the market will be short of MYR without knowledge of the quantum of the JPY debt that needs to be converted.

2. Even if BNM needs to maintain the MYR liquidity and keeps the JPY in its reserves, why can’t BNM reserve managers sell that JPY and acquire assets with higher income? For comparison against other safe-haven asset, the 10 year US Treasury bond is trading close to 3%!

Alternatively, if FX risk is a concern, what’s preventing BNM from purchasing JPY assets with higher yields? Or if you have a more vivid imagination, BNM could launch a JV with the Japanese government to provide government guaranteed loans to Japanese corporates, which i am certain, would be of higher interest rates.

Basically, it its’ too early to jump to any conclusion right now. There are many ways to structure this outside of your textbook theoretical economist framework :)

We have gone down the road with this loan from Japan before (under TDM) and you know the disasterous result.

DeleteDear sir,

ReplyDeletewhat are your thoughts on the recent news report from Star newspaper?

https://www.thestar.com.my/business/business-news/2018/07/07/signs-of-financial-crisis/

- Phlogiston -

Hisham,

ReplyDeleteThanks for the post. Enlightening as always.

I feel we won't see any MYR shortage in the system because from my understanding, the JPY loan would be used to refinance USD debt (I think this is pretty much 1MDB's). So, it would be a direct JPY-USD conversion.

So, the end result should be:

1: just lower interest repayment bill/liability for the government

2: with fewer USD supply onshore vs business as usual case (but does Malaysia need to do the conversion onshore? Feel like we can do it elsewhere without affecting USD supply in Malaysia)

Furthermore, because of this, we should be worried about whether JPYMYR volatility is lower vs USDMYR volatility, not so much JPYMYR alone.

I discovered your weblog web site on google and examine a couple of of your early posts. Proceed to maintain up the very good operate. I just extra up your RSS feed to my MSN Information Reader. Searching for forward to reading more from you afterward!… casino games

ReplyDeleteHello Everybody,

ReplyDeleteMy name is Mrs Sharon Sim. I live in Singapore and i am a happy woman today? and i told my self that any lender that rescue my family from our poor situation, i will refer any person that is looking for loan to him, he gave me happiness to me and my family, i was in need of a loan of $250,000.00 to start my life all over as i am a single mother with 3 kids I met this honest and GOD fearing man loan lender that help me with a loan of $250,000.00 SG. Dollar, he is a GOD fearing man, if you are in need of loan and you will pay back the loan please contact him tell him that is Mrs Sharon, that refer you to him. contact Dr Purva Pius,via email:(urgentloan22@gmail.com) Thank you.

Do you need Personal Loan?

ReplyDeleteBusiness Cash Loan?

Unsecured Loan

Fast and Simple Loan?

Quick Application Process?

Approvals within 8-10 Hours?

Funding in less than 1 day?

Get unsecured working capital?

Contact Us At: standardonlineinvestment@gmail.com

LOAN SERVICES AVAILABLE INCLUDE:

================================

*Commercial Loans.

*Personal Loans.

*Business Loans.

*Investments Loans.

*Development Loans.

*Acquisition Loans .

*Construction loans.

*Credit Card Clearance Loan

*Debt Consolidation Loan

*Business Loans And many More:

LOAN APPLICATION FORM:

=================

Full Name:................

Loan Amount Needed:.

Purpose of loan:.......

Loan Duration:..

Gender:.............

Marital status:....

Location:..........

Home Address:..

City:............

Country:......

Phone:..........

Mobile / Cell:....

Occupation:......

Monthly Income:....Contact Us At: standardonlineinvestment@gmail.com

Thanks and look forward to your prompt reply.

Regards,

Muqse

ReplyDeleteDo you need a genuine Loan to settle your bills and start up business? contact us now with your details to get a good

Loan at a low rate of 3% per Annual email us: namastecredit01@gmail.com

call or add us on what's app +13233665688

Please, do provide us with the Following information If interested

1) Full Name:.........

2) Gender:.........

3) Loan Amount Needed:.........

4) Loan Duration:.........

5) Country:.........

6) Home Address:.........

7) Mobile Number:.........

8)Monthly Income:.....................

9)Occupation:...........................

)Which site did you here about us.....................

Thanks and Best Regards.

email : namastecredit01@gmail.com

call or add us on what's app +13233665688

ReplyDeleteDo you need a genuine Loan to settle your bills and start up business? contact us now with your details to get a good

Loan at a low rate of 3% per Annual email us: namastecredit01@gmail.com

call or add us on what's app +13233665688

Please, do provide us with the Following information If interested

1) Full Name:.........

2) Gender:.........

3) Loan Amount Needed:.........

4) Loan Duration:.........

5) Country:.........

6) Home Address:.........

7) Mobile Number:.........

8)Monthly Income:.....................

9)Occupation:...........................

)Which site did you here about us.....................

Thanks and Best Regards.

email : namastecredit01@gmail.com

call or add us on what's app +13233665688