It's been a difficult three weeks, given what's going on in Eastern Europe. I grew up under the threat of the BOMB. I was born the year of the Tet Offensive and the Prague Spring, and the first twenty years of my life was under the latent threat of nuclear holocaust. That is what makes Russia-Ukraine qualitatively different from all the other conflicts of the past 30 years, beyond the human tragedy involved, which we have seen in the Middle East and elsewhere. I'm worried and sad that it has come to this again.

More prosaically, war makes economic prognostication orders of magnitude more difficult, especially given the size and interconnections of both Russia and Ukraine in the global economy. It's not just oil & gas, but also wheat, corn, and a slew of other metals and minerals critical to global production. Ukraine supplies half the world's output of neon gas (of all things), which is critical to semiconductor manufacturing. An extended conflict will have severe ramifications on global prices and output. So this is likely to be a difficult year, with higher prices and more severe supply disruptions.

That's a shame because things are definitely looking up for Malaysia. I was on an IDEAS panel last week on the economic outlook, along with @ShakiraTeh, which can watch here. To illustrate what I mean, I'm going to break one of my rules and show some of the internal EPF data I used at the panel (all the data is as of December 2021). First is that the labour market is returning to health:

New member registrations is just a hair below the all-time high, while the number of regular monthly contributors at 5.8 million has finally exceeded the pre-pandemic peak of about 5.7 million. This figure represents the formal, wage earning private sector, and is an important indicator of labour market stability. These numbers support the general trend in the official employment and unemployment statistics from DOSM.

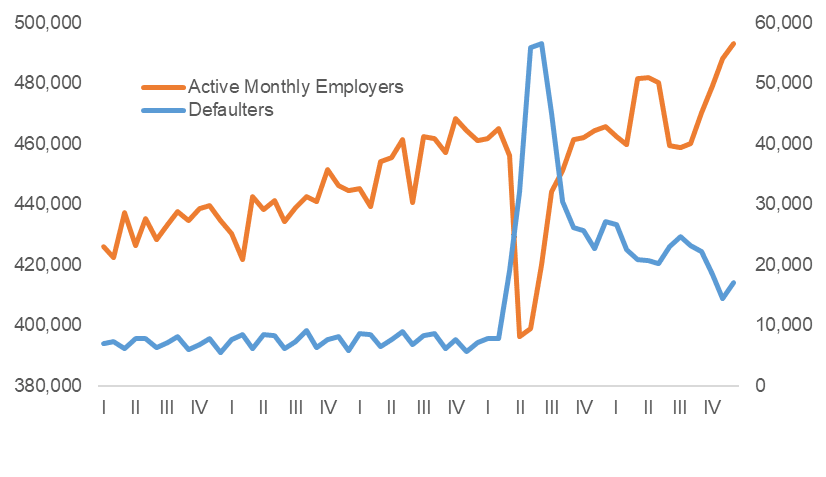

Second is that the picture on the employers side is even more positive:

Defaulters on contributions have been trending down for the past year (a 36.9% drop relative to 2020), and the numbers of regular active employers (ie paying contributions every month) is amazingly back to the pre-pandemic trendline (493k in Dec-21 compared to 465k in Feb-20). The reopening of the economy under the NRP and the rapid rollout of vaccines have had the desired economic impact.Lastly, to underscore all this, people have gone back to work:

So a mixed picture, with a significant deterioration in the geo-political situation, contrasting with much more positive domestic economic numbers. What developed economy central banks do next will be critical, as its not clear that raising interest rates and tightening policy will do much to rein in prices. Nor am I so sanguine on the longer term structural challenges that Malaysia is facing. Nevertheless, as far as the pandemic is concerned, we're finally seeing real light at the end of the tunnel.

Will high commodity prices be that great? Agri employs only 10% of the workforce

ReplyDeleteThere's a much bigger spillover into the domestic economy, relative to oil & gas which employs about 0.5%

ReplyDelete