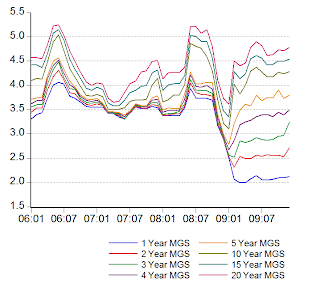

If you remember my last post on monetary conditions in Malaysia, I was scratching my head over the apparent dichotomy between a whopping increase in the supply of securities into the capital and money markets, while prices defied gravity. Turns out I spoke too soon:

Yields on MGS rose across the board, but especially for 2-yr to 3-yr maturities (which was where the bulk of the issuance in November occurred). And of course, January we've seen the KLCI falling back along with markets across most of the region. I'll call that little mystery now over.

Other interest rates however have been moving the other way - yields on BNM bills and T-bills have dropped slightly, and the average lending rate has fallen to just above 4.8% (an all time low, AFAIK). All of this of course came before the latest Monetary Policy Committee (MPC) meeting this week, which had language indicating that BNM might raise the OPR faster than the markets expect. Stay tuned for more on this subject.

There was little of note in terms of changes in the money supply situation, but there were some interesting things going on with BNM's balance sheet. There has been an injection of liquidity into the system the last couple months, though not anywhere near the scale of intervention in 2008:

This may just be a "normal" liquidity injection, as demand for cash rises at the year-end (people getting bonuses and what-not), as 2007-2008 was an aberration in terms of money demand. One last item:

BNM functions as the government's "banker", hence tracking government deposits with BNM is a useful barometer of actual government spending. With just RM0.5b in MGS redemptions in December, looks like a full RM6b was drawn down from the government's account. Note that there has been a tendency for government deposits to fall in the last couple of months of the year (seasonally adjusted, the level is actually higher than normal), but these aren't normal times. With no annual bonuses for the civil service declared, there isn't the typical one-time drain on financial resources, so I'm inclined to take this as proof of actual government consumption/investment - your tax dollars at work, stimulating the economy.

Saturday, January 30, 2010

Subscribe to:

Post Comments (Atom)

there shud be a net positive position to BNM with regards to Govt cash deposit Vs BNM MGS holdings to ensure no deficit financing position by the Central bank....so data may be "distorted"

ReplyDeleteI still cant see root of the spike u mentioned in the previous post

....or maybe gua tak paham kut

Bro, holdings of MGS by BNM is fairly minimal (around 10% of Govt deposits)

ReplyDelete