Monetary conditions were more or less stable over the past few months, but with narrow money falling as BNM took in old notes and coins in the aftermath of Ramadhan (log annual and monthly changes; seasonally adjusted):

Currency in circulation dropped by a cool RM1 billion in September, after a RM1.7 billion increase in August.

The story of September however is really BNM’s forex intervention, as mild as it was. Apart from an increase in reserves, there’s more corroborating evidence from foreign currency deposits in the banking system, which also dropped by nearly RM9 billion (RM millions):

As I described in this post, under the current monetary regime any intervention BNM makes will, all things being equal, result in an increase in its balance sheet due to intervention. This is due to an increase in Ringgit reserves of the banking system from the intervention, and an offsetting increase in BNM bills to maintain the overnight interbank interest rate at the OPR target (BNM balance sheet components; RM millions):

As far as I can make out, BNM carried out full sterilisation of their August-September intervention when it acted to limit the Ringgit’s appreciation, but not in July when it bought Ringgit instead. That makes some sense, since the central bank was already acting to limit domestic money supply growth to meet the higher OPR target.

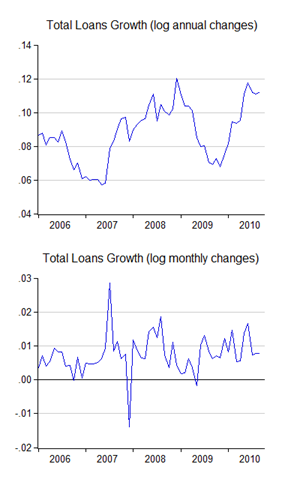

There’s still a lot of liquidity to go around though (log annual and monthly changes):

Although sequential growth has come down over the past three months compared to the first half of the year, it’s still a little on the high side relative to the average over the past decade. There’s expectations of an announcement by BNM sometime this week on curbs on mortgage lending, which may slow loans down to a more comfortable level.

Interbank interest rates have settled down, but MGS yields have continued to converge from the long end down, implying a flattening of the yield curve:

The Government borrowed RM3 billion in September, adding to supply, which indicates excess demand is continuing to compress spreads between the long and short end:

Where will this stop? I think when we hit close to the 2007–2008 norm, which means that this “bull run” still has a ways to go.

Technical Notes:

Data from BNM’s September 2010 Monthly Statistical Bulletin

bro hishamh

ReplyDeletere rate movements on the long end

wonder if the market is preparing for the berbillion billion of corporate papers in the pipeline to finance the Acronym Projects...

if they feel some "guarantee" mechanism may come into play creating quasi..the move towards pure sovereign can be justified...

on another note..the fall in Foreign Currency Deposits? Is BNM withdrawing its FX placements with Local banks? if so this may add to reserve positions if they reinvest outside

Just a hunch...

No, I think it's just normalisation of the spreads from "crisis" conditions to "normal" conditions, though I wouldn't want to discount any pre-positioning for corporate issuance.

ReplyDeleteRe: the fx deposits - that's just the effect of intervention. The drops in banking system fx deposits closely matches the timing of changes in my adjusted reserve series - for this year anyway.