Yesterday’s MPC statement was as bland as they come, until the very last line:

At the Monetary Policy Committee (MPC) meeting today, Bank Negara Malaysia decided to maintain the Overnight Policy Rate (OPR) at 2.75 percent...

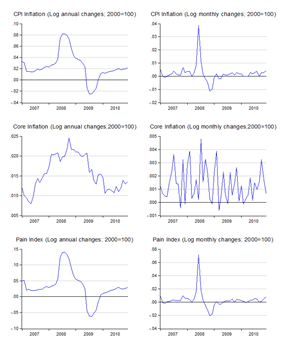

…At this stage, the MPC considers the current monetary policy stance as appropriate and consistent with the current assessment of the economic growth and inflation prospects. The stance of monetary policy continues to remain accommodative and supportive of economic growth. However, the large and volatile shifts in global liquidity are leading to a build up of liquidity in the domestic financial system. While the liquidity in the financial system has been manageable, going forward, additional policy tools such as the statutory reserve requirement and macroprudential lending measures may be considered to avoid the risks of macroeconomic and financial imbalances.

What that says to me is that BNM won’t consider using a sledge hammer to whack a fly – unless there’s evidence of a systemic change in aggregate price picture. I think the SRR will be used as a signalling measure, telling the markets that BNM is considering tightening further. It’s pretty much a paper tiger at the moment, given the current SRR level (1%) and the banking system’s actual reserve ratio (15%).