I feel a little guilty because I’ve been planning this post for a while now but just haven’t got round to it. To make that up, I’m jumping straight into the 4th quarter numbers, even if they aren’t out yet. Nevertheless, government borrowing was minimal in December, so I’m fairly sure my estimates won’t be too far off reality when they’re released next month.

I’ve already touched on the raw figures for the federal government budget up to 3Q 2010 (seasonally adjusted, RM millions):

The important takeaway here is that both revenue and expenditure are pretty much back to their long term trends (2007-2008 numbers appear to be outliers), with the drop in revenue largely responsible for the outsized deficit of 2009. The absolute value of development spending has however been increasing since 2006, which largely explains the continuance of a larger than average deficit since then.

Revenue recovery since the end of the recession has contributed to the slower pace of borrowing for 2010:

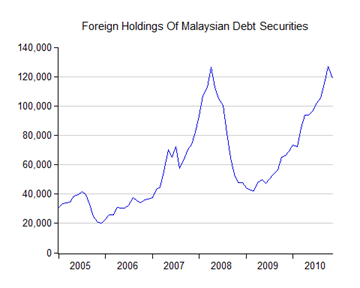

Net domestic Government borrowing for 2010 is running at a third less than it was in 2009. Combined with increasing foreign demand for Malaysian debt securities (RM millions):

…that helped keep a lid on government borrowing costs.

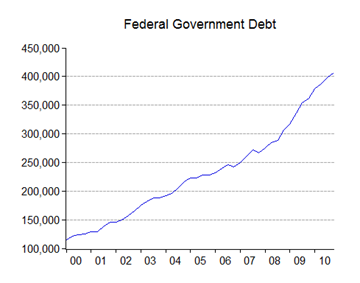

None of that means that debt is going down anytime soon (RM millions):

By my estimates, government debt breached the RM400 billion level sometime in October and ended the year at about RM406 billion. But growth has definitely slowed (log annual and monthly changes):

The figures that concern us the most are the ratios, particularly debt per capita…

…and debt to GDP…

…which suggests some stabilisation at least. Debt per capita (using pre-Census 2010 population estimates), show the debt load at just over RM14,070 per person. The figure should be a little higher, once the population estimates are revised to take into account the Census data. Adjusting for inflation, the debt load falls to about RM11,240 per person in 2000 Ringgit, which indicates a doubling of the debt burden over the past decade – that’s in contrast to the implied tripling of debt in the non-adjusted series.

The debt-to GDP ratio has more or less flatlined, though I’m disappointed that it hasn’t started falling substantially yet. That’s more a function of slowing GDP growth more than anything else, as I’m expecting GDP growth to continue to slow going into 4Q 2010.

Looking forward, I doubt the government will be able to maintain fiscal discipline in 2011 – again, this is par for the course. Take the 2011 budget estimates and add 10% to all the headline numbers, which ought to be closer to the government’s actual spending and revenue next year. But that suggests paradoxically that next year’s deficit will be pretty close to target – which means that the pace of debt accumulation should continue to slow.

Technical Notes:

- Federal Government revenue, expenditure and debt numbers from BNM’s November 2010 Monthly Statistical Bulletin.

- Additional debt issuance estimates culled from FAST.

No comments:

Post a Comment