Not something to be proud of – Global Financial Integrity released a report yesterday on capital outflows from developing countries, and Malaysia ranks in the top ten:

Illicit Financial Flows from Developing Countries: 2000-2009

Illicit outflows increased from $1.06 trillion in 2006 to approximately $1.26 trillion in 2008, with average annual illicit outflows from developing countries averaging $725 billion to $810 billion, per year, over the 2000-2008 time period measured…

….Top 10 countries with the highest measured cumulative illicit financial outflows between 2000 and 2008 were:

- China: $2.18 trillion

- Russia: $427 billion

- Mexico: $416 billon

- Saudi Arabia: $302 billion

- Malaysia: $291 billion

- United Arab Emirates: $276 billion

- Kuwait: $242 billion

- Venezuela: $157 billion

- Qatar: $138 billion

- Nigeria: $130 billion

I don’t doubt that capital has been leaving the country (see here) – that’s fairly obvious from the BOP data. But describing unidentified flows as intrinsically “illicit” is too strong. The authors don’t even pretend to track overtly illegal flows like smuggling.

More importantly, apart from banning offshore convertibility, Malaysia has almost no exchange controls to speak of. If you’re buying foreign assets with your own money, you don’t even have to report it no matter how much you shift outside. If you’re borrowing locally, the limit’s RM50 million a year – and that’s about it. If it’s not reported, then it’s not tracked and might not appear officially, even if the use of that money is completely legitimate.

Now, the report identifies two types of flows that are “illicit” – trade mispricing, and the differential between sources and uses of funds from Balance of Payments data. For Malaysia, the loss of capital is about equal from both sources.

For the BOP data, I think you could make a strong case that part of it is legitimate outward investment, however desirable or undesirable that circumstance might be for the domestic economy. The methodology used for this is a residual calculation, i.e. everything that’s not actually categorised, which makes value-laden labels such as “illicit” a bit of an overkill.

Also bear in mind that the BOP also records non-flows as well e.g. retained earnings from overseas investments which could inflate the flow data, without actually involving actual transfers of money.

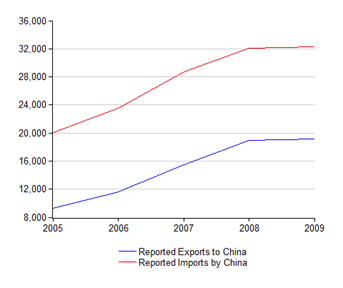

But the trade mispricing problem is real enough, though you might argue the quantum. For example, here’s Malaysia’s reported exports to China (FOB), and China’s reported imports from Malaysia (CIF) (US$ millions):

These should be almost the same except for CIF costs…but they aren’t even close. There’s a consistent US$10 billion missing here, which is far too much to be explained away by CIF costs (carriage, insurance and freight) or forex adjustment errors, and is fully one third of the annual average estimate made by GFI for trade mispricing.

If this is in fact illicit capital transfers, it represents a way for Malaysians to “smuggle” money into China, and elude two things – first, the requirement for repatriation to Malaysia of trade receipts by Malaysian resident exporters, and second China’s restrictions on capital inflows.

It’s also in my mind that some of this discrepancy might be from intercompany transfer pricing. MNCs dominate Malaysia’s export market and might be manipulating prices charged between country units for tax or other benefits. Obviously, I’ve no way to quantify that.

However that may be, I think the important lesson here is that the path we’re following right now is the right one – get people and companies interested in investing domestically. Knee-jerk reactions to shutting down these so-called “illicit” flows will either drive them further underground, inhibit legitimate outward investment, or make Malaysia even less desirable as an investment destination. If you can’t take your money out, why would you want to put it here in the first place?

Technical Note:

Malaysia-China trade data from the UN Commodity Trade Database

Thanks for the analysis Hisham.

ReplyDeleteWith respect to the China-Malaysia trade mis-pricing that you cited, I'm not sure I agree with your interpretation on the directionality of the fund flows as it looks more like the reverse to me. Basically, it appears like an intermediate entity was used to:

1. either extract funds from China or create a trade debt for future extraction; and

2. park profits in the intermediate entity which would likely be in a tax favourable jurisdiction.

Not all transfer pricing mechanisms contravene the tax authorities' rules and classifying this portion of fund flows as "illicit" probably results in an over-estimation at least from a Malaysian perspective. To my mind, the portion that is more likely to be truly "illicit" is the estimated fund flows drawn from the BOP data.

On the BOP portion, it is true that there has been an extensive relaxation of exchange controls which has done away with requirements to obtain prior BNM approval on many transactions. However, all remittances continue to be reported to BNM if done through financial institutions via the Forms P & R and presumably picked up in the various categories.

Given this, would I be correct to assume that GFI's methodology in identifying "illicit" flows relies on the "net errors and omissions"? If so, either cash was physically smuggled out (which given the amounts in the GFI report seems a little impractical) or more likely, the bulk of the funds were moved using the hawala system i.e. Indian money-changers network (note recent BNM enforcement action against money-changers) or similar systems that do not report remittances to BNM.

Thanks for the comments - I think there are a variety of factors involved with respect to the China trade. The scale of the underreporting suggests there's more than a few companies involved here. I like that second explanation you gave especially, given our tax rates.

ReplyDeleteOn the BOP data, net errors and omissions doesn't come close to explaining the differential - just half at best.

The methodology they used is a little different. It relies on enumerating gross sources (change in debt and net investment) and uses of funds (change in current account and reserves), and taking the difference.

I'm not sold that this is the best way to do it - if there's a net repayment of debt, and high outward investment relative to a stagnant use of funds (Malaysia's position over the past decade), then it will look like lots of "illicit" outflows. But as I said, this could be wholly legitimate outward investment.

I'm aware of the reporting requirements at FIs, and I think what GFI is actually capturing is the outward investment that Malaysian companies have been engaged in for the last decade. The official BOP stats do actually show considerable outward DI and other investment, and that figure is very close to the BOP portion of the GFI estimate (about RM50/USD16 billion a year).

Their position seems to be that if you're a developing country, it's a "crime" for anybody to take money out. But if we had excess capital, it'd be a crime not to put it to some use.

I'm still intrigued by trade data though, as that's completely new to me.

This comment has been removed by the author.

ReplyDeleteBased on your comments on the methodology, it would seem that it is not definitive in determining "illicit" fund flows and at best, it is merely indicative.

ReplyDeleteI was intrigued by the way to note that GFI does not appear to do a similar study for developed countries which lends credence to your comment that "Their position seems to be that if you're a developing country, it's a "crime" for anybody to take money out".

Thanks again for looking at this report.

Assalamu 'alaikum warahmatullahi wabarakatuh Brother Hisham.

ReplyDeleteYour blog is one of my favourite blog eventhough most of the time I feel completely baffled after reading your articles.

Nevertheless I still make a point to keep on reading your posts for knowledge sake and I believe you are one no-nonsense blogger.

For the benefit of layman understanding, like me, I humbly request if Brother Hisham can provide a brief note at the end of each articles in the future, summarising the key points. Better still, with Malay translation as well. I'm sure this can expand your group reader Brother Hisham.

Thank you for your consideration. May Allah bless you always. Keep on writing!

-Faisal

Wa'alaikum salam Faisal,

ReplyDeleteComments are always welcome. I'm not sure about a translation, as that's a lot of work for what is a personal blog - I spend too much time on this already! I find Google translates pretty well, though it might not quite capture all the technical terms. The Google Chrome browser can do it almost automatically.

But a short summary is something I can try to do.

we are at no.3 now? i'm proud to be malaysian *wink

ReplyDelete