I’m back from my CNY break, and will you look at the news on the wire:

Malaysia's December exports far above economists’ expectations

PETALING JAYA: Malaysia's exports for the month of December 2010 grew 4.6% from a year ago.

This was largely contributed by higher exports of palm oil, refined petroleum products, chemicals and chemical products, manufactures of metal, crude rubber, iron and steel products as well as optical and scientific equipment.

The figure was far above economists' expectations of a median 0.9% contraction in a Bloomberg survey while economists who spoke to StarBiz recently expected flat to very low single-digit exports growth.

Most economists expect exports for this year to be choppy as developed countries continue to be weighed by high unemployment and sovereign debt risks.

Month-on-month, December exports were up 8.5% mainly due to higher exports of electrical and electronic (E&E) products, refined petroleum products, chemicals and chemical products, machinery, appliances and parts as well as iron and steel products.

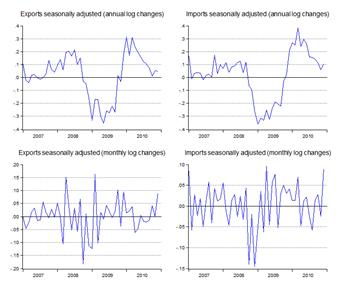

In my post last month, my seasonal difference model implied a 0.6% annual contraction in December exports, so I’m not too far off from my peers…though obviously well short of reality. But you can see from the following why most were caught flat-footed (log annual and monthly changes; seasonally adjusted):

The pace of December’s monthly export growth was met or exceeded just four previous times in the last four years (and just once in the case of imports). On the other hand, the December realisation was still within one standard deviation of my point forecast, so it wasn’t outside the realm of possibility.

So what happened? My opinion, for what it’s worth, is the runup in commodity prices:

That changes the terms of trade, and since these industries rely less on imported inputs, my models predictions break down a little (note that oil is lagging the rest). Breaking down the export numbers (log annual and monthly changes; seasonally adjusted):

…while there’s been an unseasonal increase in electronics and electricals exports, non-EE exports have been sustaining a high pace of headline growth. Tin and rubber production volumes increased in 2010, but production of other major commodities (oil, gas, timber, CPO) were mostly flat or declining – that supports a price-based interpretation of the data.

But even given that, December’s pace does not seem sustainable, so this January’s trade numbers should be flat to down…I think. December import growth was just as impressive as exports, so we could see higher production and trade numbers going into Chinese New Year, with the fall-off happening after that.

Next month’s tea leaves:

Seasonally adjusted model

Point forecast:RM56,533m, Range forecast:RM63,623m-49,444m

Seasonal difference model

Point forecast:RM53,600m, Range forecast:RM61,210m-45,990m

Technical Notes:

2010 External Trade Report from MATRADE.

No comments:

Post a Comment