Just a quick post to a question posed by Wenger J Khairy in my post on SRR:

Why is the bank sitting pretty on a pile of cash?

I think the answer has to be the huge almost titanic differential between cost of funds (deposit rate) vs. the BLR. I think the spread is like 400 bps, something which makes it very easy to be a banker and very crappy to be a consumer. So banks don't have to stretch to be profitable, just lend to the consumers and earn the differential

This is a fair concern, especially in light of the charges levelled at the Federal Reserve during this past crisis – by keeping interest rates at near 0% and inviting banks to borrow against all sorts of collateral, coupled with record issuance of US Treasury Bills, meant that US banks had an almost risk free way to gain profits. 30 year Treasuries were yielding over 3% in 2009, and over 4.7% currently. Nice business if you can get it.

But the Malaysian market is a little tougher (percentage points; spread between MGS and interbank overnight rate):

During the latter half of 2009, 10 Year MGS yielded over 2.0% above KLIBOR, but that profit opportunity has fallen sharply with BNM’s interest rate hikes in the first half of 2010.

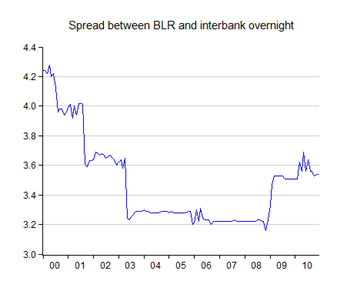

Obviously it makes more sense to lend money to businesses and consumers, right, especially with the Base Lending Rate (BLR) generally over 5.0%? (percentage points; spread between BLR and interbank overnight rates):

You’d get a minimum net yield of 3.2%, assuming our putative banker was mainly borrowing from the interbank market. In practice, with demand deposits and low paying consumer savings deposits, a bank’s cost of funds (COF) would be lower.

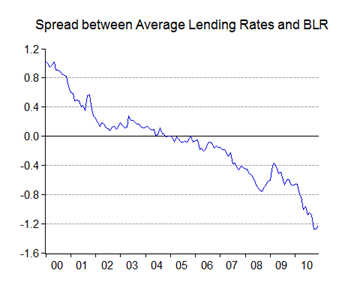

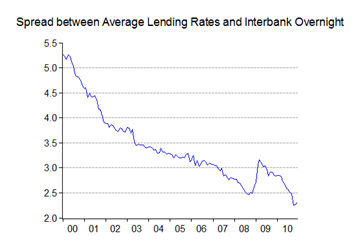

But here’s the problem: BLR as an indicator is becoming as anachronistic as the SRR has become. Here’s what has happened to commercial banks lending rates over the past decade (percentage points):

…and relative to average BLR (percentage points; spread between BLR and Average Lending Rates):

Which yields this picture (percentage points; average lending margin):

Malaysian banks are actually operating in a pretty tough environment – net interest margins are actually plumbing historical lows. That ties in with a report today from the Star (excerpt; note especially the graphic detailing major banks’ interest margins):

Interest margins under pressure

PETALING JAYA: Stiff competition in banks' lending business will add pressure to interest margins although this will likely be mitigated upon upward revision of the overnight policy rate (OPR) in the second half of the year.

The OPR, which determines the lending rate, is expected to be increased by another 50 basis points by year end…

…While competition is intense on the lending side, banks are fighting for a bigger portion of low-cost deposits through strategies that will drive up the cost of funds in the immediate term.

Apart from aggressive deposit campaigns, banks are reverting to the policy of accumulating longer fixed deposits of at least a year, against expectations of rising interest rates…

…“Going forward, product pricing will depend very much on respective banks' market strategies and risk appetite,” said HwangDBS banking analyst Lim Sue Lin.

“We understand that most banks are stepping up competition especially in mortgages and new non-national car loans. Banks are also offering competitive deposit rates to attract low cost deposits as well as structured deposits. With pressure at both ends, NIMs in Malaysia will be on a downtrend,” she said.

Mortgage rates have stabilised around base lending rate (BLR) -2.2% to BLR 2.3% levels, which is similar to levels seen in August 2010. This was when banks started to dismantle the informal arrangement put in place in November 2009 to limit mortgage rates to BLR 1.8%.

Moving forward, Lim expects earnings growth for Malaysian banks to mainly come from non-interest income sources, thanks to an active capital market.

I’d actually be more concerned about this than if banks are making too much money; if their basic business is profitable, we don’t have to worry too much about systemic risk. They aren’t tempted to go off the reservation, so to speak.

It’s when traditional sources of interest income gets squeezed that things get complicated. That’s when pressure for increasing non-interest sources (read: fees, proprietary trading) and financial engineering starts coming into play, not to mention lending rates that don’t bear much relation to actual credit risk (BLR –2.2%!!).

And we know where that leads – lower credit standards, asset bubbles, bigger risk of loan defaults, and higher risk of bank failure.

Maybe it’s time to consign BLR to the dustbin of history. It no longer serves much purpose, except as an administrative device.

No comments:

Post a Comment