The volatility of employment numbers continues to bemuse me. Maybe if I watch it long enough, the numbers will start to behave and make sense.

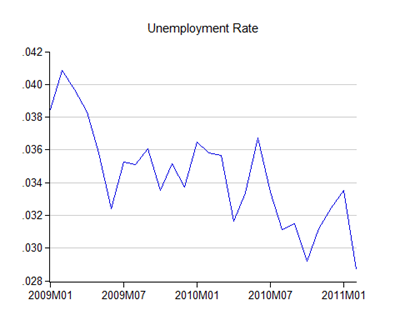

To wit: February employment and labour force numbers showed a drop (which I thought might happen), but it was much, much smaller than I expected. More confusingly, the net result was a crash in the unemployment rate:

The economy lost about 110k jobs in February, a consequence of the aftermath of CNY. But 176k left the labour force at the same time, thus producing the effect above. That means that the huge increase in employment in the last three months has reached semi-permanent status…I think.

I suspect I’ll probably be proved wrong next month.

On another note, here’s an interesting factoid – with the hike in employment numbers over the past three months, annualised monthly growth of the labour force reached 4.8%, or more than triple the overall population growth rate:

There’s little likelihood of this pace being sustained, but my belief is that one of the keys in Malaysia’s attempt at reaching high income status is a higher growth rate of the work force relative to the population, and the creation of jobs for these new workers. Now we’re seeing it happening right before our eyes, and I wonder how many people will grasp the significance?

Technical Notes:

February 2011 Employment Report from the Department of Statistics (warning: pdf link)

Dear HishamH,

ReplyDeleteThanks for the note. I too noticed the crash in unemployment figures, but surprisingly the average wages in the manufacturing industry continued to trend lower for that period.

By the way, I have a theory that I hope you can help explain. It goes like this

If there is a higher growth in the workforce without the corresponding gains in productivity, wouldn't that lead to the labour supply curve shifting outwards, and thus putting downward pressure on wages. If that is true, wouldn't it make it harder to achieve high income status?

Would be grateful if you could clarify this.

Ex Rembau Times Reader

Interesting thought.

ReplyDeleteUnder the assumption of autarky then an increase in the work force, ceterus paribus, should lead to lower wages.

But that doesn't describe Malaysia. We have essentially two labour markets, not one. We have a labour force that works under a large export sector, and a labour force that works in the domestic sector.

For the former, because you're actually looking at part of a global work force, an increase in productivity actually leads to lower labour demand and/or downward pressure on the exchange rate - increases in the local labour force are too small to shift the global labour supply curve. I think that's what you're seeing here. A higher exchange rate (as we've been seeing) is leading to job losses or downward pressure on wages in the export (i.e. manufacturing) sector.

The domestic market would act more normally, where increases in the supply of labour would put downward pressure on wages.

But the thrust of the reforms under the ETP and the NEM is to reduce the role of the external sector and increase the size of the domestic sector, while increasing value added in the external sector (i.e. structural shift to markets where global wages are higher).

What we're really talking about here is trying to create enough domestic demand to be able to absorb the inevitable faster pace of new entrants into the job market. In some ways, this is automatic - new workers are a source of demand on their own.

And you also have to consider that high income status does not necessarily require high average wages.

I don't quite understand that last bit"high income not necessarily high wages."

ReplyDeleteI believe PM wants everyone to enjoy a better life thus his focus on high income.And by 2020 everyone shld enjoy 6% compounded increase in income.Thus if graduates earn RM1800 now,come 2020 the same post will be valued at RM3600.

If its any less,life will be no better cos chicken will surely be 16/kilo.

I hope I am making sense.

The 6% target is based on a set of assumptions embedded in the NEM - change the assumptions, and you change the target.

ReplyDeleteMore importantly, the benchmark we have to reach is defined as nominal (non-inflation adjusted) Gross National Income per capita in USD terms, per the World Bank's definition.

Breaking that down:

1. Because the USD15k-17k target is defined in nominal terms, higher inflation means we'll get to the target faster. It also means that the target we need to achieve is really an average of around 9% (increase in real output, plus increase in prices).

2. GNI includes net corporate earnings from abroad, which means higher GNI does not necessarily imply higher domestic economic activity.

3. Per capita is defined as the average over the total population. If work force growth is higher than population growth (as will be the case for Malaysia over the next two decades), that means increases in total income can be achieved without higher wage growth as there are more workers relative to the total population.

4. Because the target is defined in USD terms, a strengthening Ringgit will also mean we can get to the target faster.

Put all that together, and it's more than possible that high income status can be achieved without real wage growth. And nothing says that increased GNI will filter down into higher household income - it appears based on current policies that the main beneficiaries will be owners of capital, not labour i.e. the distribution of higher income may be uneven.

I worry that unless we have remedial policies in place (considerably more investment in education, retraining, and a social support system), we'll just be creating greater income and wealth disparities.

salaries is about 33% of current GNI and will be eroded to 26% in 2020.Assumption is 3.5 % wage rate increase per annum.There will be an increase in the higher value jobs.But if one is in the bottom group,2020 is going to be a high cost economy.And for the rest of the middle income salary man life sure ain't going to be sweeter.So thats about 80% of us taken care of.

ReplyDeleteOwners of capital,land,assets and foreign capitalists will be the big winners.But can't complain cos we choose our leaders and they decide whats best; for them.

@anon 9.05

ReplyDeleteThanks for the assist! Yes, that's what I'm afraid is going to happen. And 3.5% wage growth is a full 1% higher than the average over the last decade. Based on that there will be some increases in nominal wages, but not enough to compensate for the higher price level.