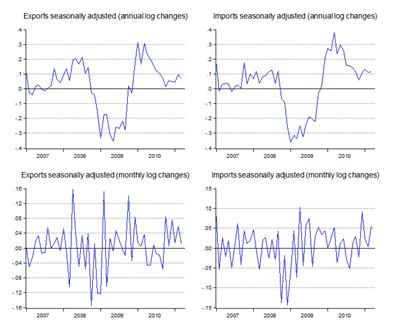

I missed last month’s trade post because of my trip to Korea, and it seems I missed a lot (log annual and monthly changes; seasonally adjusted):

Seasonally adjusted trade data for February and March have been really solid, which should give some support to my hypothesis that 1Q growth will be better than decent.

Most of the trade expansion has been coming from non-electronics exports (log annual and monthly changes; seasonally adjusted):

Higher commodity prices have certainly helped, though that also suggests a future source of trade volatility, not to mention the potential impact on the Ringgit. If commodity prices started retreating, then export receipts will take a hit as will the Ringgit.

Next month's forecasts suggest a slight retreat in export numbers, though I expect realisation would still be in the upper part of the range forecast:

Seasonally adjusted model

Point forecast:RM61,841m, Range forecast:RM69,656m-54,027m

Seasonal difference model

Point forecast:RM57,424m, Range forecast:RM65,589m-49,259m

Technical Notes:

March 2011 External Trade Report from MATRADE.

No comments:

Post a Comment