The consensus appears to have expected more IPI growth from yesterday’s IPI report, but it’s really not that bad. Growth numbers on their own don’t appear to be too encouraging (log annual and monthly changes; seasonally adjusted; 2000=100):

The jump in growth on the month is pretty good, but on an annual basis, IPI growth fell to 2.3% from 5.0% in February (log terms).

On the whole though, it’s a pretty decent performance if you look at the levels:

Manufacturing has been trending up since the downturn in 3Q 2010, and there’s no indication yet of a pullback. Growth in the IPI’s been held back by the falloff in mining and electricity output.

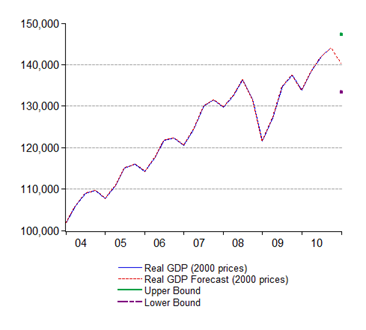

Now that we’ve got a full quarter’s worth of IPI numbers, what’s the prognosis for 1Q 2011 GDP?

Again, a decent performance – the IPI implies real GDP growth of about 4.8% which is just a fraction below 4Q 2010 GDP growth. Seasonally adjusted annualised growth on the quarter should reach about 7.7%, compared to the 4Q 2010 number of 8.2%. There’s still strength in the economy, though activity has moderated somewhat.

The GDP numbers are due out next Wednesday, which and we’ll see if these forecasts are confirmed.

Technical Notes:

March 2011 Industrial Production Index Report from the Department of Statistics

No comments:

Post a Comment