The Ringgit has continued to rise against the USD, despite some hiccoughs along the way (index numbers; 2000=100):

What’s apparent is that the pace of appreciation has slowed to something closer to the pre-crisis rate of around 0.3% per month, rather than the torrid 0.7% pace in the recovery phase.

Strength against the USD doesn’t however imply overall strength however (index numbers; 2000=100):

Both nominal and real effective (trade-weighted) exchange rates have been hanging around the same levels as they were in early 2010. That obviously conceals a lot of movement, of which the appreciation against the USD is but one component. Against our top 5 trading partners this past quarter, the MYR has only gained against the USD, stayed even with the SGD and CNY, but lost ground against the JPY and EUR (cumulative log difference since 2005m7; 2000=100):

Looking at the cross rates against our other trade partners, there’s been little movement since the last update, except some depreciation against the KRW (index numbers; 2000=100):

…but we’re not talking about a whole lot here.

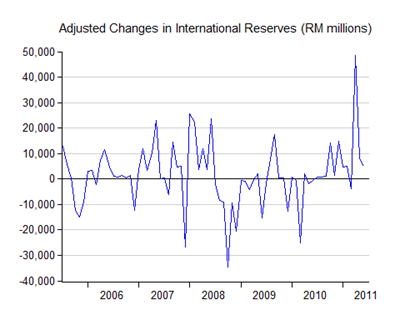

On the intervention front, there’s been little movement in international reserves either since April (RM millions, adjusted for forex revaluation):

So it looks like BNM’s move three months ago was mainly a reserve accumulation exercise, and less an attempt to influence the Ringgit per se.

One thing to note though – the Ringgit’s pace of appreciation against the USD, if it continues at the current pace, will add 50% to current GNI per capita in USD terms over the next ten years (the NEM assumes an average of RM3.00 to the USD throughout the decade). If we manage to also hit the government’s target of 6% real growth per annum, that would allow Malaysia to hit the high income bracket way, way before 2020.

No comments:

Post a Comment