I’m settling in and having fun at my new workplace, so I should begin blogging a bit more regularly soon. To be honest though, I might not have as much time to do that as I might wish. It’s been a pretty hectic couple of days, even without dealing with the (non-existent) city traffic – which by the way means that January economic numbers aren’t going to look good, as very few people are actually working this last week and more.

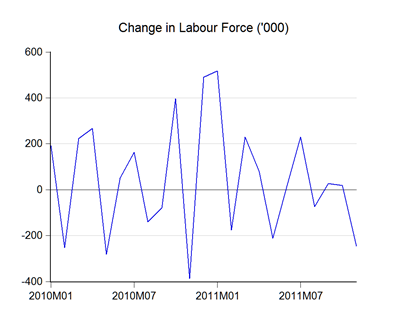

But back to business - quite unexpectedly (at least by me), the economy cut 250k jobs in November (’000):

Europe? Possibly, though after reading some of the literature on employment statistics (warning: pdf link), I’m starting to think this is just part of the “noisy” nature of the data. Take this for example (‘000):

Can you seriously believe that a quarter of a million people not only got fired, but are no longer looking for work? In just one month? Neither do I – looking at the chart, it looks mostly like random sampling noise.

It could also probably be seasonal variation, but there’s not enough data to check as Census X12 and Tramo/Seats methodologies require a minimum of three years worth of data, which we won’t have until next month.

In any case, the numbers generated result in – surprise! – a mild increase in the unemployment ratio to about 3.1%:

Again, it’s probably best to consider this as noise. It looks like there’s been little change in the unemployment ratio (and thus in the job creation rate) for the past year. And I’d bet that December’s numbers will come in between 3.0% and 3.2%.

Technical Notes:

November 2011 Employment Report from the Department of Statistics

Presume the "foreign labour" is not in these stats.Thus the 3.1% unemployed refers to locals and translates to about 400k ppl.And foreign labour is about 3 mil or so?

ReplyDeleteBased on above we hv scope to improve productivity,reduce public sector jobs and still be in a position to provide adequate employment opportunities to all Malaysians.

Issue is really how to make it attractive for people to work in certain sectors?Maybe pay n working condition should be starting point.But a lot of other considerations of cos i.e mobility,prospects,gender bias. ..

I believe Govt not doing enough to look at all levels of the employment profile.As such...dependence on foreign labour and bargaining power of lowest 40% of workforce remains weak.And wages growth moderated by easy availibility of foreign labour..reducing incentive to improve productivity n use local labor.Vicious circle thats affecting our long term competitiveness.

GOT to begin cracking the whip.

Whip can only be cracked if there is demand for value-added goods, local plants can make them, local workers have the skills to run the equipment or processes, and there is bismarckian will around.

ReplyDeleteWith the drone mentality in both public and private sectors, nein.

The economy in Malaysia cut 250K jobs, could that be right? It would be like the equivalent in America of losing several million jobs!

ReplyDeleteHi Hisham,

ReplyDeleteIn your opinion, is the household debt to annual household income ratio in Malaysia alarming/sustainable? Do you think it will start easing downwards or has that already started?

I ask 'cos I read an article here and started wondering how our country's graph pattern would look and what would it mean for us in the future: https://www.mckinseyquarterly.com/Economic_Studies/Country_Reports/Working_out_of_debt_2914

All the best in your new workplace!

@alt inv

ReplyDeleteAs I said, I think it's purely sampling error. Otherwise you're right, it would be a lot of jobs being cut!

@metalrage

It's hard to tell. Biggest issue is simply measurement, since a big portion of that debt doesn't come from the banking system and because the personal disposable income stats aren't broken out in the quarterly national accounts. Worse is that I think there's a big imbalance in who's borrowing and who's got the resources i.e. debt is being concentrated down the income scale. I honestly don't think that even BNM knows the exact situation - the existing databases don't exactly cover that sort of information.

My instinct says that right now it's probably sustainable, but we're heading in the wrong direction.

Ty for reply. For my education, can please comment:

ReplyDelete1) Can I say we don't really need the quarterly disposable income stats just annual? And to do that, can get the reported income from LHDN?

2) Wouldn't most of the loans come from the banking system? Or do Ah Longs and personal loans make up such a large portion of our debt that it's effect can't be disregarded?

3) On the concentration of debt further down the ladder, I think the Gross Disposable Household Income against the Debt Size doesn't intend to measure that. So need another way to measure if we are trying to find the breakdown of concentration of debt by personal networth.

Thanks in advance for your thoughts Hisham!

@Metalrage,

ReplyDelete1) Link (it's a pdf). It's only up to 2005 however.

2) Most but not all. I can't find hard numbers, but as at end-2010, total household debt was just under RM600 billion, of which only RM490 billion was sourced from the banking system (mortgages, credit cards etc) (source: Financial Stability and Payment Systems Report - you can also find the household debt to GDP ratio there).

Most of the rest came from DFIs and co-ops (e.g. about a third of that from Bank Rakyat alone), which do not fall under BNM's regulatory purview. Household borrowing from the banking system is growing at around 12%, which lags overall bank lending. But household borrowings from DFI's and Coops are growing at least twice as fast.

The FSMP also covers household financial assets, which more than covers total household debt (about 2.5x over). But...ownership of financial assets is concentrated in the top 10% of income earners, hence my suspicion that net household debt is concentrated at lower income levels.

Link is dead, but even up till 2005 isn't much use. More interested in the year that marked the boom in property prices till now (since it makes up the large part of household debt).

ReplyDeleteThanks again for weighing in.

Try this link instead. It's the last item on the first list.

ReplyDeleteNot sure how useful aggregate disposable income data would be for that purpose, even for 2009-2011. House price increases were not even across the country (try here- and yes I know the latest report is a dead link too - I've emailed them about it).