Last week’s inflation report showed price increases slowing down (log annual and monthly changes; 2000=100):

Headline inflation fell to 2.1% in log terms, while the pain index was down sharply to 2.3% (it was 3.6% in January).

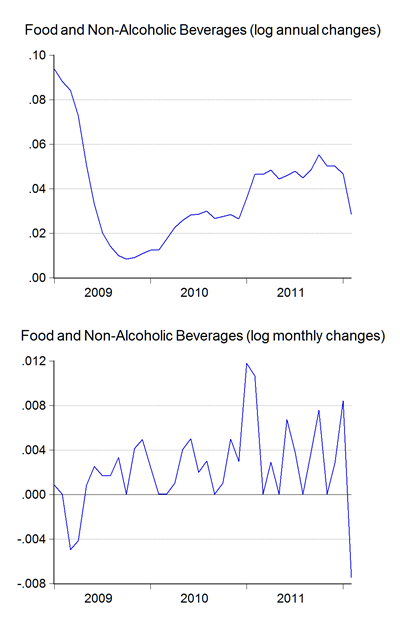

But looking at the monthly growth numbers, you can see that the seemingly slower rate of inflation is a function of sharply higher core prices and an equally sharp pullback in food prices (transportation costs were flat) (log annual and monthly changes; 2000=100):

That’s the slowest rate of increase since the end of 2010, and the drop is being driven by staples such as meat, fish and vegetables. Fish and seafood though, are still much higher on a yearly basis.

Going forward, I think the headline rate will probably slow further before stabilising between 1.5%-2.0%, as prices were already fairly high in the past year. I also think we’ll start seeing more demand-led inflation this year, rather than supply side factors prompting price increases i.e. I think the rate of change in the core measure will continue converging on that of the Pain index.

Technical Notes:

February 2012 Consumer Price Index report from the Department of Statistics

Lower inflation means real GNI growth needs to be higher if we are to attain the HIE target of RM48k.However USD weakening to RM3 makes the USD15k easier to achieve.Guess it really shows that ETP targets are really moving goalpost cos of the many variables at play.Wld ETP stand up and tell us wats is the real target?.1.7 trillion,RM48k,Usd 15k,6% real growth...and its not relevant just to point out thats it is benchmarked to WB thresh hold.Lets see a real n measurable end post n dispel the confusion.

ReplyDeleteJust to illustrate some of the problems with establishing a proper target:

ReplyDelete"Lower inflation means real GNI growth needs to be higher if we are to attain the HIE target of RM48k"

Lower CPI inflation doesn't necessarily translate into a lower GDP deflator, which is really what affects the GNI calculation.

You hv explained the GDP deflator i.e cost of widget in base year..very clear n valuable insight.But I reckon Pemandu simplifies by applying inflation rate of 2.8% to the real growth of 6 % to arrive at the RM 1.7 trillion in 2020.Of cos they then presented another set of numbers i.e RM 48k/capita as a backstop.

ReplyDeleteMy point is how do we measure progress when the end post is so fraught with uncertainties...how do you economist resolve that?

Sorry, we don't actually resolve those uncertainties, the best we can do is measure it. But I'll do a post to explain why. Might take some time though.

ReplyDelete