With the next Monetary Policy Committee meeting due exactly one week from today, it’s nice timing to have January 2012 data on hand to give us an idea of what likely moves are in store for monetary policy.

The bottom-line: nowhere fast. I don’t see anything that would prompt BNM to either cut rates or raise them. If anything, I’m starting to think the bias will be towards a rate hike going into the end of the year.

But that’s getting ahead of myself.

Reviewing the money supply situation, we see the usual seasonal impact of CNY (log annual and monthly changes; seasonally adjusted):

Broad money climbs, while the monetary base crashes – happens almost every time (the weakness of the seasonal adjustment methodology I use is that it can’t quite strip out seasonal effects from moving holidays such as CNY and Eid, but I’ll keep using it as I think it’s still a better alternative to no seasonal adjustment at all).

Somewhat unusually though, the source of the broad money climb in January didn’t coming from personal deposits, but from forex deposits and the catch-all “other” deposits. January seems to have been a turning point of sorts – we saw the near resolution of (this round of) the Greek crisis, better numbers coming out of the US, and a return to yield chasing. So foreign capital inflows are back and pretty soon we’ll be reading editorials on capital controls again.

But January 1st also saw the enforcement of new prudential guidelines on consumer borrowing. Are they having an effect? Oh my, yes they are (RM millions; seasonally adjusted; except for the approval ratio)

Applications and approvals are down for both residential property and car loans. But note that while credit has tightened for residential property, it hasn’t for cars (despite what the car vendors think). Also note that banks have been effectively tightening credit for both categories since at least 2009 (and much longer for residential loans).

For personal loans, the tap is definitely being shut off (RM millions; seasonally adjusted; except for the approval ratio):

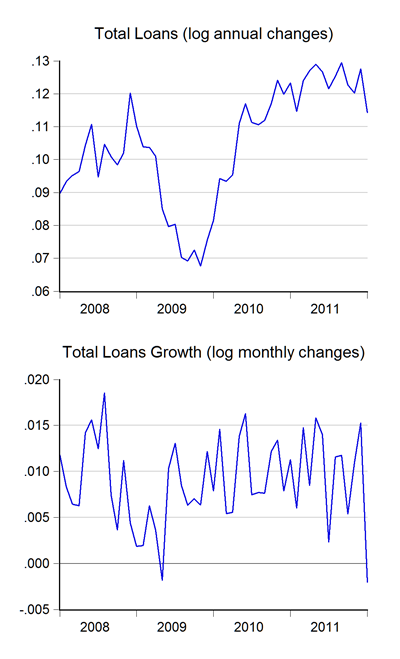

With all that going on, overall loan growth posted the first month-on-month contraction since the recession (log annual and monthly changes):

One thing to note is that loan applications by businesses have zoomed, though not enough to offset the pullback by consumers. Also I’m not sure that we’re not seeing a stronger than usual CNY effect on consumer loans. So I’d be wary of making too many predictions over the pace of loan growth this year until we’ve seen a couple more months of data.

And since this slowdown was largely induced by BNM, I don’t think they’ll factor the drop in credit expansion too much into their rate decision next week. Another reason is that long term interest rates have been trending down for over a year:

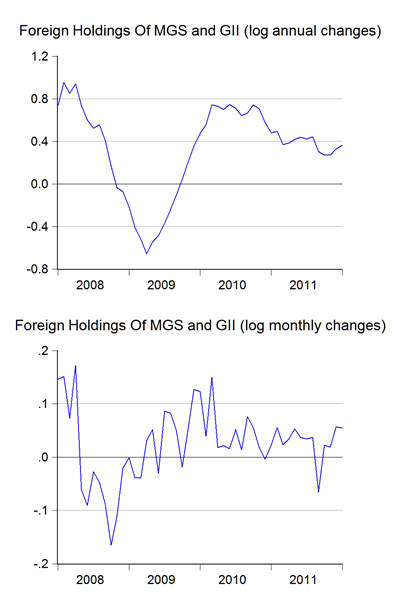

The difficulty here is that we could be looking at artificially depressed borrowing costs, as foreign demand for MGS and GII has continued to increase (log annual and monthly changes):

That’s a 36% increase y-o-y and 5.5% up in January alone – lot’s of foreign interest in local debt. That’s a future point of vulnerability that may have to be addressed soon if it continues – in a sudden stop capital flight scenario, yields could suddenly jump and international reserves run down. We’ve got the “insurance”, but its better if we avoid having to “claim”.

Another point to note about yields – the MGS yield curve has more or less kept its slope over the past year; since yields have more or less dropped in tandem, the shape of the yield curve has stayed more or less the same. That implies that bond traders haven’t really changed their views over the pace of growth and inflation, or of the government’s borrowing needs (there was just one tranche of MGS issued in January, for RM3.5 billion). No doomsday scenarios here just yet.

So what I think we’re seeing here is really status quo ante. The external situation is looking somewhat better, even if Greece remains a timebomb waiting to explode. The latest numbers coming out – weaker US industrial production, but better numbers from Korea and Japan – is typical of what we’ve been seeing since the Great Recession, two step forwards, one step back and then sideways.

So despite the cautious language of the last MPC statement, I’m betting that the OPR will stay at 3.00% for now.

Technical Notes:

All data from the January 2012 Monthly Statistical Bulletin from Bank Negara Malaysia

Yeah, I do think the seasonal adjustments is not really taking care of the CNY effect very well. Last year, CNY was in Feb, while this year, CNY was in Jan, so this could significantly distort the seasonal adjustment.

ReplyDeleteWell if you take x12 to seasonalise, it will adjust the moving seasonality (i think). But not perfectly though.

ReplyDelete@jayD,

ReplyDeleteX12 is precisely what I'm using. But X12 only takes into account Easter, and doesn't adjust for other moving holidays such as CNY or Hari Raya. There's a way to do it, but involves manually adding additional ARIMA functions (I think) to account for each moving holiday. I'm not quite up to that level yet.