On July 2 1997, the Bank of Thailand gave up the struggle to maintain their currency peg and let the Thai Baht devalue against the US dollar. Thus began one of the worst regional crises in the post-WWII era.

The reasons were complex and continue to be the subject of controversy, but the popular and official notion that the AFC was the result of foreign currency speculators alone is in my view very far off the mark. While hedge funds are known for taking risky bets, in this case it was a virtually no-risk bet. Pegged currencies that were over valued, current account deficits, unsustainable real estate bubbles (both residential and commercial), out-of-control bank lending, runaway money supply growth, and high external corporate borrowing provided ample grounds for a sell-down of Asian currencies.

It was a once-in-a-lifetime opportunity.

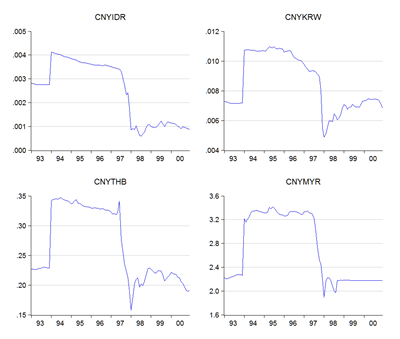

I’d also like to point out that with the exception of the Indonesian Rupiah, the three major currencies affected by the crisis – the Malaysian Ringgit, the Korean Won and the Thai Baht – all ended up post-crisis at close to the same levels against the Yuan as they had been before China’s 1993 devaluation. Now isn’t that suggestive (cross rates against the Yuan; higher values indicate appreciation):

But whether you believe the crisis was a result of a foreign conspiracy, external pressures and hot money flows, or the cumulative results of policy mistakes, this was a seminal event in the economic and financial development of East Asia.

May we never forget that it happened or the lessons that we’ve from it.

No comments:

Post a Comment