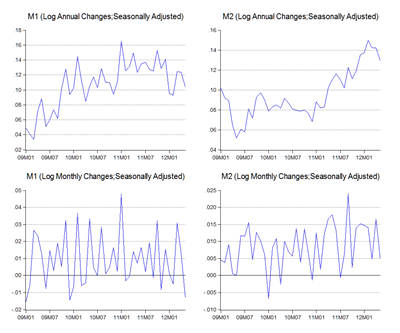

Local monetary conditions in May appeared to be a little tighter, though growth in M2 looks to be within a “normal” pace of activity (log annual and monthly changes; seasonally adjusted):

M1 growth crashed however on a monthly basis, largely from a drop-off in demand deposits. Broad money growth was better, but only due to higher savings deposits offsetting falls in other money substitutes, but particularly in forex deposits.

This isn’t necessarily an indication of money leaving the country however, as the amount was relatively small (-RM1.5b) and because official reserves went up by RM9 billion (RM millions):

The banking system’s net external position also looks pretty good (RM millions):

On the credit side, loans continue to hold up at a double digit pace (log annual and monthly changes):

…driven mainly by non-household borrowing (log annual and monthly changes):

After the scare that BNM put into banks and borrowers alike with the new lending guidelines put in place in January, loan demand and credit conditions appear to have returned to pre-January trends:

While credit standards are tighter than they were before the Great Recession, we’re looking at loan approvals back at the same pace as the past two years. This is more or less what the literature on macro-prudential measures suggests – at best, they act like temporary speed-bumps and no more. We’ll need to see some confirmation from June data to be sure however.

All this while lending margins are continuing to be squeezed, as average lending rates continue to bottom-feed:

With respect to other interest rates, MGS yields indicate there’s still demand coming in for government securities:

…and while the rate of pickup has fallen off, foreign buying is still respectable (log annual and monthly changes):

Higher prices and lower yields could also be a reflection of reduced supply, as issuance of government securities (ex-BNM bills) up to May is 9.8% lower than a year ago (RM billions):

Having said all that, an interesting thought struck me – is the rate of borrowing excessive? We’ve heard all about household borrowing getting above 70% of GDP, but what about overall borrowing?

Based on loans alone, it doesn’t look like it, at least relative to the 1990s (loans to nominal GDP; total financing to nominal GDP (includes PDS)):

That big spike you see started in 1996 and peaked in 1997 before coming off in 1998-99. By those standards, current debt levels aren’t nearly as big.

However, it’s not a completely accurate picture as it doesn’t include non-bank lending or non-bank holdings of private debt securities. These measures also doesn’t account for external corporate borrowings, which is significant – almost all of Malaysia’s external debt is private sector debt, amounting to an additional RM146.9 billion (ex-government, ex-banking sector).

Nevertheless, it looks as if having gone on a diet post-1998, Malaysian Inc is borrowing again. So far though, its at a pace that is only slightly faster than income growth which suggests the pace is sustainable. But I think I’ve found my research project for this month.

Technical Notes:

Monetary and interest rate data from the May 2012 Monthly Statistical Bulletin from Bank Negara Malaysia.

Thanks Hishamh Im into economics chart porn and this is as good as its gets. In America they talk about lack of 'velocity' of money in the system and how the drop in borrowing by business and individuals has kept inflation and economic growth down despite massive stimulus injections by the Fed. Do you see Inflation in Malaysia under control based on the fact we have typical private sector lending going on?

ReplyDelete